Massimo Amato is Professor of Economics, Bocconi University, Milan. The full paper, whose key points this post seeks to summarise, can be downloaded here in pdf format. ForewordThis post sums up the results of a collective research [1] and aims at providing the fundamental elements of a feasible European Debt Agency (DA). The DA is meant to be charged with financing sovereign debts with advantages both for the Eurozone Member States (MS) and for the system as a whole. The...

Read More »Globalisation, a pandemic and the US dollar

As published on Progressive International on Monday, 11 May, 2020 She said, "My name's Flo, and you're on the right trackBut look here, daddy, I wear furs on my backSo if you want to have fun in this man's landLet Lincoln and Jackson start shaking handsI reached in my pocket, and to her big surpriseThere was Lincoln staring her dead in the eyeOn a greenback, greenback dollar billJust a little piece of paper, coated with chlorophyllRay Charles, 1957. Things are falling...

Read More »Top economists warn against post Covid-19 austerity.

This brief piece by Ann Pettifor appeared in the New Statesman on 4 May, 2020. Top economists warn the UK not to repeat austerity after the Covid-19 crisis. Mariana Mazzucato, Robert Skidelsky, Ann Pettifor, David Blanchflower and others on why the UK must not impose spending cuts in response to higher debt.It is clear that some commentators and think-tanks have not woken up to the severity of the debt-deflationary depression we are heading into. Delusional Tory austerity...

Read More »The future of money – for El Pais

This note was published by Spain’s El Pais on 4 May, 2020 Central banks have adopted extraordinary, historically unprecedented measures to prevent this pandemic collapsing the globalised financial system. Trillions of dollars, euros and yen have been created ‘out of thin air’. As a result there is a fear of inflation – the erosion of the value of...

Read More »Our ‘scenario’ for UK GDP in 2020 (a 14% annual fall)

source: ONS with our own estimation for 2020 The Wall Street Journal reported over the weekend (but not as a great surprise) that US GDP is likely to fall in the first Quarter – before the main impact of the coronavirus hit – at the fastest rate since the global financial crisis: “This is just the beginning,” said Beth Ann Bovino,...

Read More »Debt, wealth and climate: globally coordinated Climate Authorities for green financing

By T.Sabri Öncü & Ahmet Öncü This article first appeared in the Indian journal, Economic and Political Weekly on 18 April 2020. The authors’ contact details are at he foot of this article.Abstract Based on the German Currency Reform of 1948 and the “Modern Debt Jubilee” of Steve Keen, a globally coordinated orderly debt deleveraging mechanism is proposed to address the global debt overhang problem. Since the global debt overhang and lack of sufficient climate finance...

Read More »Confronting twin perils of pandemic and austerity – some lessons from 1920 & 2020

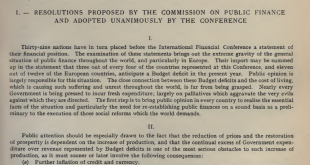

Extract from Resolutions of Brussels International Financial Conference 1920 SummaryThe UK is experiencing, as a result of the COVID 19 crisis and response, its most severe economic downturn on record; the largest in the last century was in 1921, when annual GDP fell by 9.7%. In assessing the likely level of the fall, the Office for...

Read More »Here’s a Three-Step Plan to Take Back Control

The following article appeared on The Correspondent’s website on 17 April, 2020 With acknowledgement to HiltonT for the image of the President Steyn Gold Mine in Welkom, Orange Free State. I was born and grew up in a dusty, sparsely populated gold mining town on the bare and vast ‘veld’ of the Orange Free State, South Africa. As a child, my town’s dependence on the extraction of gold at a price fixed in Washington, opened my eyes to the architecture of the international...

Read More »“The economic mechanism of Europe is jammed”

“The economic mechanism of Europe is jammed.” - J M Keynes [1] The Dutch finance minister Wopka Hoekstra is somewhat brazen. Like his German counterpart, he caused consternation across the Union by rejecting a ‘Coronabond’ – a scheme for raising finance for EU countries tackling the coronavirus crisis; a scheme that would have lowered the cost of debt for many countries. A conservative German economist, who had earlier rejected the concept of shared liability, predicted...

Read More »Our 10th anniversary survey of readers – to help us improve PRIME’s web service

This year marks Prime's 10th anniversary, a decade in which we have opposed the politics and economics of austerity, and argued for a new international financial system and transition to the post-carbon society. To mark our anniversary, we decided – before the current COVID 19 lockdown – to revamp our website, and (we hope) provide a better web experience and more quality content for our readers. We would be very grateful if you could take just a few minutes to answer our...

Read More » Prime, Policy Research in Macroeconomics

Prime, Policy Research in Macroeconomics