“The Treasury must explain the reasons for any departure from the previous mandate and/or supplementary targets.“ From the current Charter for Budget Responsibility’s fiscal rules“The Treasury may from time to time modify the Charter… When the Charter is modified the Treasury must lay the modified Charter before Parliament.”From the 2011 Budget Responsibility and National Audit Act 2011—————-There’s no getting away from it – in the manner in which it has put forward today’s...

Read More »A farewell to ‘fiscal rules’?

Image: latest version of Charter including fiscal rules, put before Parliament January 2017 Dirty secrets? Yesterday (5 March) the Financial Times published an article by its economics editor Chris Giles, under the title “The Treasury has two dirty secrets on its fiscal rules”. Underneath that, the...

Read More »100 years ago: the dignity of labour affirmed in the Royal Courts of Justice

“I say that if captains of industry cannot organise their concerns so as to give Labour a living wage, then they should resign from their captaincy of industry” - Ernest Bevin, February 1920One hundred years ago this month, a public inquiry held at the Royal Courts of Justice in London marked a significant change in industrial relations and...

Read More »Feeble UK productivity – it’s still down to austerity and lack of demand

Image with acknowledgment to https://www.flickr.com/photos/birminghammag/6798098618/in/photostream/ In his FT article yesterday (30 January), “The UK’s employment and productivity puzzle”, Martin Wolf says“The most important point is that the aggregate productivity performance of the UK economy since...

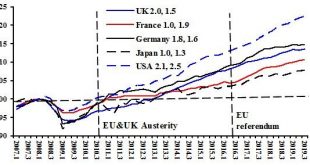

Read More »EU and UK economic prospects post-Brexit – the impact of investment

Analytical Considerations As Brexit is finalized we find considerable speculation about the likely consequences for the UK and EU economies after the end of January. Because this event has no clear precedent, much of the speculation derives from political predilections and opinion without an analytical anchor. Since private investment plays a major role in both growth and diversification of economies, beginning with the motivation to invest might provide that anchor. As...

Read More »Who Pays the Corporate Income Tax? Don’t believe the IFS

The AssertionEven before Corbyn launched the Labour Manifesto, the Institute of Fiscal Studies launched its critique of Labour tax policies, asserting that Labour’s proposed tax increases were not limited to the richest,:"The truth is of course that in the end corporation tax is paid by workers, customers or shareholders so would affect many in the population". On the BBC Shadow Chancellor John McDonnell politely rejected the IFS critique, which in essence asserts that the...

Read More »Dealing with the overhang of non-financial private debt

Building on the International Monetary Fund (IMF) Global Debt Database (GDD) comprising debts of the public and private non-financial sectors for 190 countries dating back to 1950, Mbaye et al (2018) identify a recurring pattern where households and firms are forced to deleverage in the face of a debt overhang, dampening...

Read More »Rethinking Britain: the fundamental choice we face on December 12th

At stake in December’s General Election in December is much more than just Brexit, though Brexit in the form proposed would be damaging enough. It is a fundamental choice of the kind of society we want to develop. In September, “Rethinking Britain: Policy Ideas for the Many”, was published, of which I was co-editor. The book brings together the...

Read More »Universal Basic Income and Universal Basic Services: a synthesis for the Election

Complements or substitutes?Over the summer in OurEconomy my PEF colleague Guy Standing argued that proposals for Universal Public Services (UBS) are not substitutes for the Universal Basic Income (UBI) that he has advocated so cogently. I strongly agree. The two are overwhelmingly complementary. As we approach a UK general election on 12 December and the parties prepare their manifestos, revisiting the UBS and UBI becomes quite relevant. Review of two public policy...

Read More »Its new report blocked – so is the Office for Budget Responsibility really independent?

Cabinet Secretary Mark Sedwill has in our view acted unlawfully in ‘advising’ or ‘ordering’ the Office for Budget Responsibility not to publish its report on technical changes in relation to its March 2019 fiscal and economic forecast, due out today. By giving way, the OBR has helped to undermine its own independence. The only winner is the...

Read More » Prime, Policy Research in Macroeconomics

Prime, Policy Research in Macroeconomics