from Peter Radford I suspect economic theorists are not alone in shunting to the side issues or phenomena that might upset the applecart. But they appear to do it with a determination that other disciplines mind find somewhat alarming. This is why I relentlessly and repeatedly mention Cause and his 1937 question about the existence of the firm. It isn’t because I imagine that theories of the firm began in 1937, or that they are somehow restricted to a peculiar Anglo-Saxon view — Coase...

Read More »Financing drug development: What the pandemic has taught us

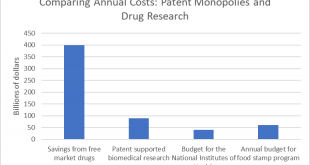

from Dean Baker We are still very much in the middle of the pandemic, with the U.S. seeing tens of thousands of new infections daily, and the world experiencing hundreds of thousands of new infections. However, it is not too early to look at areas where we need to reevaluate public policy, most importantly in financing the research and development of new drugs and vaccines. The accepted wisdom in policy circles has been, that while the government can finance basic research, we need to...

Read More »Whither global capitalism?

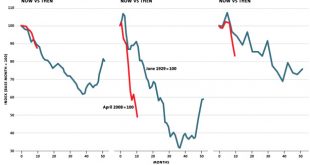

from David Ruccio Mainstream economists and commentators, it seems, are worried that the global economy is going to come crashing down as a result of the COVID crisis. That’s why they’re willing now to consider the possibility that the current crisis is more than a normal recession, more serious even than the so-called Great Recession; in their view, it’s an economic depression. That, at least, is the argument they present up front. But there’s something else going on, which haunts their...

Read More »Macroeconomics and reality

from Lars Syll Why would an academic profession sanction the use of theories based on crassly unrealistic assumptions? It is not an intuitively attractive idea. One suspects that the underlying reason is: economists are, in the main, committed to the defense of propositions that cannot be generated by models based on realistic assumptions. For example, a long string of unrealistic assumptions are necessary to generate the desired conclusion that unregulated financial markets perform...

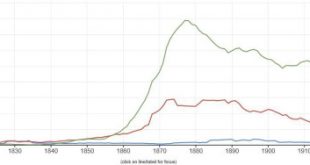

Read More »Paul Samuelson and the Cold War rebirth of David Ricardo

from Erik Reinert and issue 92 of RWER In complete contradiction to the ruling practice of the Marshall Plan at the time, Paul Samuelson started building what was to become Cold War economic theory with two articles in The Economic Journal in 1948 and 1949. Communism advanced under the utopian slogan “from each according to his ability, to each according to his needs”. With his renewed interpretation of David Ricardo, Paul Samuelson produced a counter-utopia: under the standard...

Read More »Inequality and morbid symptoms of a financialised system

from Ann Pettifor and issue 92 of RWER Today as the world endures the crisis of a global pandemic, “an old order is ending in convulsions”. So writes Rebecca Spang, historian of the French revolution in The Atlantic (Spang, 2020). In the 1790s, money, debt and the non-payment of taxes by France’s rentiers, played a critical role in revolutionizing France. Today purveyors of money and debt – creditors, investors and speculators – both avoid taxes and prey on a global economy radically...

Read More »In the middle of a pandemic, the World Bank wants slum dwellers to lose their water supply

from Norbert Häring Developing countries are trying to contain the corona pandemic under the most adverse conditions. In the middle of this, the World Bank is proposing that the water supply of slum dwellers be cut off, if their landlords do not pay the water bill. It is an inhumane philosophy of development that is behind such monstrosities. For about two decades, the World Bank’s philosophy has been “sustainable development”; “sustainable” in the sense of profitable in the long run....

Read More »More thoughts on the post-pandemic economy

from Dean Baker I have written before on the post-pandemic economy and how it should actually provide enormous opportunities, but it is worth clarifying a few points. First and most importantly, there is an important measurement issue with GDP that people will need to appreciate. It is often said that GDP is not a good measure of well-being, we see this in a very big way in the post-pandemic period. It is likely that many of the changes in behavior forced by the pandemic, first and...

Read More »The missing middle?

from Peter Radford A couple of things before we get started: when I say that economics is not history, I mean exactly that. Geology is not history either. That is not the same as saying that economics ought pay no heed to history. Let’s not get confused over that. Economics is its own discipline with rules and territory that its exponents determine. That might frustrate or annoy some of us who would like to think of it more broadly, but it’s up to us to find doors to open to help in...

Read More »Housing Bubble Week: Can We Predict Housing Bubbles? — Dean Baker [Audio]

I speak with Dean Baker, US economist and co-founder of the Center for Economic and Policy Research based in Washington, D.C. Dean is widely regarded as one of the first economists to have discovered the existence of the US housing bubble. I learn what indicators led him to make that call and what lessons his experience holds for future bubble-seers. Topics discussed - What problem is Dean working at the moment that excites him the most? [3:20] - The story of Dean selling his house in...

Read More » Real-World Economics Review

Real-World Economics Review