The 2008 financial crisis, the rise of Trumpism and the other populist movements which have followed in their wake have grown out of the frustrations of those hurt by the economic policies advocated by conventional economists for generations. Despite this, textbooks continue to praise conventional policies such as deregulation and hyperglobalization. This textbook demonstrates how misleading it can be to apply oversimplified models of perfect competition to the real world. The math works...

Read More »August 24, 2020

August 24, 2020

Funny

Billionaires—pandemic edition

from David Ruccio 2019 was a very good year for the world’s wealthiest individuals. The normal workings of global capitalism created both more billionaires and more combined wealth owned by those billionaires. According to Wealth-X, which claims to “have developed the world’s most extensive collection of records on wealthy individuals and produce unparalleled data analysis to help our clients uncover, understand, and engage their target audience, as well as mitigate risk,” the size of...

Read More »Why do we need to Transform Economics, and how do we do it?

from Jayati Ghosh It’s truly a delight for me to be able to address the UNCTAD-YSI Summer School. This is not only because these are two groups that I have huge respect for and sympathy with. It’s also because the theme of this Summer School is something very close to my heart, something I and some of my colleagues have been grappling with for decades. It’s really quite energising to realise that there are so many young people willing to engage in this project. So I am going to treat this...

Read More »MMT — debunking the deficit myth

from Lars Syll We have already shown that deficit spending increases our collective savings. But what happens if Uncle Sam borrows when he runs a deficit? Is that wht eats up savings and forces interest rates higher? The answer is no. The financial crowding-out story asks us to imagine that there’s a fixed supply of savings from which anyone can attempt to borrow … MMT rejects the loanable funds story, which is rooted in the idea that borrowing is limited by access to scarce financial...

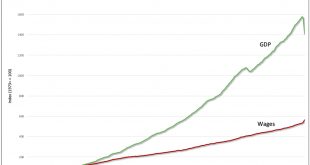

Read More »To the victor belong the spoils

from David Ruccio The phrase, which was used in the early nineteenth century to describe the the spoils system of appointing government workers, accurately describes the American economy today.* And it’s pretty clear who the victor is, and it’s not the working-class. Instead, a small group at the top have come out as the victor—and that’s been true for decades now. How do we know? Well, all we have to do is look at the growing gap between the amount produced by American workers and...

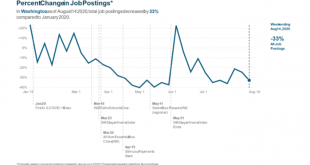

Read More »Should we be more worried about the economy?

from Dean Baker We are really in an unprecedented period where the economy is trying to recover from the shutdowns of April and May while being faced with partial shutdowns due to the resurgence of the pandemic in large parts of the country. We are struggling to make sense of data, which often has a substantial lag. We are still getting data from July even as we are in the last weeks of August. Furthermore, when we have large monthly changes, the picture at the end of July could have been...

Read More »How to use models in economics

from Lars Syll The reason you study an issue at all is usually that you care about it, that there’s something you want to achieve or see happen. Motivation is always there; the trick is to do all you can to avoid motivated reasoning that validates what you want to hear. In my experience, modeling is a helpful tool (among others) in avoiding that trap, in being self-aware when you’re starting to let your desired conclusions dictate your analysis. Why? Because when you try to write down a...

Read More » Real-World Economics Review

Real-World Economics Review