from Dean Baker It seems more than a bit bizarre, but in a discussion of alternative to patents for financing the development of new drugs and vaccines, publicly funded open-source research is not mentioned. This is peculiar since so much of the research into treatments and vaccines for the coronavirus are in effect being open-sourced, with researchers posting results as soon as they are available. Advance, open-sourced funding would mean that any new drugs or vaccines that are developed...

Read More »What’s the problem with economic models?

from Lars Syll Some critics of economics appear to believe that the root of the alleged problems lies in models, or the method of modelling in general. On this view, modelling just is not an appropriate way of acquiring knowledge about the social world. No (simple) model can do epistemic justice to the (complex) world, so there cannot be a proper use of models that would make the method of modelling justified. Models are the problem. Models distort the world, not people using them. This...

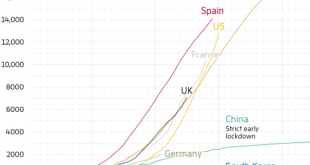

Read More »C deaths as of 8 April 5 pm BST

“The economy”—pandemic edition

from David Ruccio We’re back at it again: “the economy” has broken down and we’re all being enlisted into the effort to get it back up and working again. As soon as possible. The Congressional Budget Office has announced that it expects the U.S. economy will contract sharply during the second quarter of 2020: Gross domestic product is expected to decline by more than 7 percent during the second quarter. If that happened, the decline in the annualized growth rate reported by the Bureau of...

Read More »Mäki Rules on Rodrik’s Rules

from Asad Zaman Mäki, Uskali. “Rights and wrongs of economic modelling: refining Rodrik.” Journal of Economic Methodology 25.3 (2018): 218-236. Introduction: I must confess to having admired Dani Rodrik. His research was iconoclastic, fearlessly going after many sacred cows of economics. So, I was saddened and disappointed by his defense of Economics: Rodrik, Dani (2015) Economics Rules. Why Economics Works, When It Fails, and How to Tell the Difference. Oxford UP. Rodrik uses “rules” in...

Read More »WEA online conference: Trade Wars after Coronavirus

from Maria Alejandra Madi The United States declared an economic war on China in early 2018. Economic warfare is a unilateral action that questions the existence of multilateralism and places the question of what regime we are about to enter after the weakening of the existing multilateral trade agencies. US trade policy opens the door for new relationships between emerging market economies and international financial institutions on issues of liberalisation but mostly it ends a period...

Read More »As GDPs crumble…

As GDPs crumble… With the pause button pressed on nearly half of economic activity in the US and the EU for what is likely to be at least a period of three months, consumption, investment and trade have all collapsed. A contraction of as much as 10-20% of GDP or worse is possible. Pervasive uncertainty about the timing of the development of a viable treatment and/or vaccine means there is no light at the end of the tunnel yet. Even when we get there, the trauma of the COVID-19 meltdown...

Read More »Isolation Waltz

from The Guardian Move over Mozart, here comes Stelios Kerasidis. A seven-year-old Greek prodigy has penned an “isolation waltz” inspired by the pandemic. The hypnotic, fugue-like melody has picked up more than 43,000 hits on YouTube since its launch last week. “Hi guys! I’m Stelios. Let’s be just a teeny bit more patient and we will soon be out swimming in the sea,” he beams, perched on his piano stool, feet barely touching the floor. “I’m dedicating to you a piece of my own.” The work,...

Read More »Highest U.S. unemployment rates in history and tomorrow

Health care MUST be in public provision and accessible to all in order to . . .

from Grazia Ietto Gillies The expenditure given [in the chart] include both private and public expenditure as far as I know. That the US have a VERY inefficient health care system is well known but it can only be made clear by looking also at outcomes such as Infant mortality rate or life expectancy alla available from OECD health statistics. Why such inefficiency. Well then you have to look at the organization of health systems not just the stats. In countries with high private provision...

Read More » Real-World Economics Review

Real-World Economics Review