from Asad Zaman I am in process of creating an online course on the history of Central Banking. The era of online courses has been forced upon us by the Corona Virus, though I have been meaning to do this for a long time. The WEA Pedagogy Blog seems like a great place to do a beta-test. I would like to start by inviting the audience to read through Charles Goodhart’s book on the Evolution of Central Banking. We would plan to read one chapter a week and discuss it on posts and/or comments...

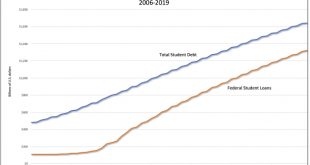

Read More »US student debt jubilee—pandemic edition

from David Ruccio The coronavirus outbreak is serving as a mind-expansion exercise, making hitherto unthinkable solutions thinkable. Debts that can’t be paid won’t be. A debt jubilee may be the best way out. — Michael Hudson The United States is currently experiencing a dystopian orgy of death and destruction. In the midst of the novel coronavirus pandemic, hundreds of thousands of Americans are falling ill, tens of thousands are dying, and everyone else is living in fear they’ll...

Read More »A debt jubilee is the only way to avoid a depression

from Michael Hudson Even before the novel coronavirus appeared, many American families were falling behind on student loans, auto loans, credit cards and other payments. America’s debt overhead was pricing its labor and industry out of world markets. A debt crisis was inevitable eventually, but covid-19 has made it immediate. Massive social distancing, with its accompanying job losses, stock dives and huge bailouts to corporations, raises the threat of a depression. But it doesn’t have...

Read More »The ‘laws of economics’

from Lars Syll What we discover is that the cash value of these laws lies beneath the surface — in the extent to which they approximate the behaviour of real gases or substances, since such substances do not exist in the world … Notice that we are here regarding it as grounds for complaint that such claims are ‘reduced to the status of definitions’ … Their truth is obtained at a price, namely that they cease to tell us about this particular world and start telling us about the meaning of...

Read More »Jalāl ad-Dīn Muhammad Rūmī

from Lars Syll [embedded content] O day, arise! The atoms are dancing. Thanks to Him the universe is dancing. The souls are dancing, overcome with ecstasy. I’ll whisper in your ear where their dance is taking them. All the atoms in the air and in the desert know well, they seem insane. Every single atom, happy or miserable, Becomes enamoured of the sun, of which nothing can be said. Jalāl ad-Dīn Muhammad Rūmī (1207-1273)

Read More »Modern monetary theory—pandemic edition

from David Ruccio Modern Monetary Theorists are having a moment, as governments (many of them run by conservative regimes, such as Donald Trump and the Republicans in the United States) are running gigantic fiscal deficits in order to combat the economic crisis occasioned by the coronavirus pandemic.* This time, with the $2 trillion CARES Act, the U.S. federal government has taken an additional step down the road of Modern Monetary Theory, by having the Federal Reserve buy an unlimited...

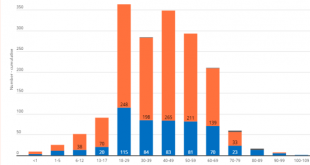

Read More »Can we reopen primary schools? Iceland data suggest: yes (they didn’t close them in the first place)

Mortality and prevalence of Corona. Iceland tests a lot and has some of the best, most complete and representative, data on Corona infections (graph above, which is consistent with comparable data for Iceland from surveys, h/t Jesse Frederik) and seems to have come to grips with Corona, for the moment. What do these data tell us about the prevalence and mortality rate of Corona? They show that young people (18-, below another definition will be used) seem to be relatively immune to...

Read More »The totalitarian dystopia of the World Economic Forum is becoming reality

from Norbert Häring In January 2018, a pilot project for the surveillance of air travelers, commissioned by the World Economic Forum, was agreed upon in Davos. At the time, I presented the Known Traveller Digital Identity (KTDI) project as a “totalitarian dystopa”. A follow-up report shows that the multinational corporations are successfully involving governments and the EU in their plans. Covid-19 is speeding up implementation tremdendously and Bill Gates inadvertently lets us know...

Read More »What’s the use of economic models?

from Lars Syll Getting it right about the causal structure of a real system in front of us is often a matter of great importance. It is not appropriate to offer the authority of formalism over serious consideration of what are the best assumptions to make about the structure at hand … Where we don’t know, we don’t know. When we have to proceed with little information we should make the best evaluation we can for the case at hand — and hedge our bets heavily; we should not proceed with...

Read More »Back to normal?!

from David Ruccio We can’t stay this way forever—with physical distancing (now that all 50 states have finally issued some kind of Stay at Home order), schools closed (and operating with a semblance of education through online teaching), businesses shuttered (even while the stock market soars). The question that seems to be on everyone’s lips is, when are things going to go back to normal? But who wants to return to normalcy? The novel coronavirus pandemic has revealed, if nothing else,...

Read More » Real-World Economics Review

Real-World Economics Review