from Lars Syll The other day, on my way home on the train after having attended an economics conference, yours truly tried to beguile the way by listening to a podcast of EconTalk where Garett Jones of George Mason University talked with EconTalk host Russ Roberts about the ideas of Irving Fisher on debt and deflation. Jones’s thoughts on Fisher were thought-provoking and interesting, but in the middle of the discussion Roberts started to ask questions on the relation between Fisher’s...

Read More »Values and ideology in economics and other social sciences

from Peter Soderbaum There is a tendency in mainstream neoclassical economics to claim value-neutrality. Economics is believed to be close to natural sciences where the scholar is standing outside observing what goes on in the economy. It is believed that experiments can meaningfully be carried out to arrive at “evidence-based” results. There is a focus on markets and markets are understood in terms of supply and demand as mechanistic forces. While reference to more than one perspective...

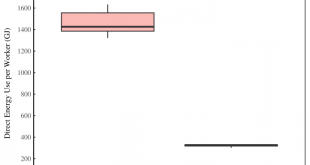

Read More »Can a service transition save the planet?

from Blair Fix Let’s talk sustainability. Unless you’re an anti-science crank, you probably agree that we’ve got a problem with carbon emissions. We need to drastically cut emissions to avoid catastrophic climate change. On this we should all agree. The question that’s open for debate is how to cut emissions. I think we actually know very little about how do to this. But even worse than knowing little is thinking we know a lot when we don’t. As the old saying goes, “It ain’t what you...

Read More »Maurice Allais on empirics and theory

from Lars Syll Submission to observed or experimental data is the golden rule which dominates any scientific discipline. Any theory whatever, if it is not verified by empirical evidence, has no scientific value and should be rejected. Maurice Allais Formalistic deductive “Glasperlenspiel” can be very impressive and seductive. But in the realm of science, it ought to be considered of little or no value to simply make claims about the model and lose sight of reality. Mainstream —...

Read More »Digitalization and the transnational corporations. Rethinking economics

from Grazia Ietto-Gillies Digitalization has been with us for a couple of decades and is now all pervasive. It affects every sphere of economic activity: from production to consumption to the interaction between the State and its citizens. The latter interaction is in terms of: the delivery of public services; the collection of revenue; and the development and implementation of public policies. The transnational companies (TNCs) have been with us for much longer. Steven Hymer (1976...

Read More »What is (wrong with) mainstream economics?

from Lars Syll If you want to know what is neoclassical economics — or mainstream economics as we call it nowadays — and turn to Wikipedia you are told that neoclassical economics is a term variously used for approaches to economics focusing on the determination of prices, outputs, and income distributions in markets through supply and demand, often mediated through a hypothesized maximization of utility by income-constrained individuals and of profits by cost-constrained firms employing...

Read More »Dying too young

from David Ruccio If there ever was an argument in support of Medicare for All it’s this: despite spending more on health care than any other country, the United States has seen increasing mortality and falling life expectancy for people ages 25 to 64, who should be in the prime of their lives. A new report published in the Journal of the American Medical Association paints a bleak picture: overall life expectancy in the United States, which had increased for most of the past 60 years,...

Read More »Macroeconomic uncertainty

from Lars Syll The financial crisis of 2007-08 hit most laymen and economists with surprise. What was it that went wrong with our macroeconomic models, since they obviously did not foresee the collapse or even make it conceivable? There are many who have ventured to answer this question. And they have come up with a variety of answers, ranging from the exaggerated mathematization of economics to irrational and corrupt politicians. But the root of our problem goes much deeper. It...

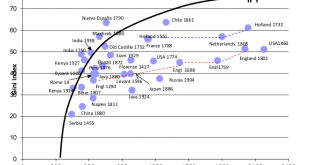

Read More »Graphics from 4 empirical muckrakers – 4. Branko Milanović — Ancient Inequality

from Blair Fix Branko Milanović is the oracle of ancient inequality. He has muckraked to compile inequality data for many pre-industrial societies. Here’s a chart of inequality versus GDP per capita for ancient societies: Ancient Inequality Data from Branko Milanović. (Source) The curved line is the ‘inequality possibility frontier’. This is the maximum inequality that is achievable at the given level of production. I have my own ideas about what creates an inequality frontier — I think...

Read More »Randomised controlled trials — a retreat from the bigger questions

from Lars Syll Nobel prizes are usually given in recognition of ideas that are already more or less guaranteed a legacy. But occasionally they prompt as much debate as admiration. This year’s economics award, given to Abhijit Banerjee, Esther Duflo and Michael Kremer … recognised the laureates’ efforts to use randomised controlled trials (RCTs) to answer social-science questions … RCT evangelists sometimes argue that their technique is the “gold standard”, better able than other...

Read More » Real-World Economics Review

Real-World Economics Review