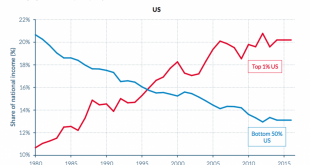

In 1980 the bottom 50% of the population in the US received 20% of the national income and 23% in Western Europe. By 2016 the share of the bottom 50% of the US population received declined to 13% while in Western Europe the bottom 50% held on to 22% of the national income. The top 1% in Western Europe increased their share to 12% in 2016. Meanwhile in the US the top 1%increased their share of the national income from 10% in 1980 to 20% in 2016. A key question is what policies and forces...

Read More »Confusing statistics and research

from Lars Syll Coupled with downright incompetence in statistics, we often find the syndrome that I have come to call statisticism: the notion that computing is synonymous with doing research, the naïve faith that statistics is a complete or sufficient basis for scientific methodology, the superstition that statistical formulas exist for evaluating such things as the relative merits of different substantive theories or the “importance” of the causes of a “dependent variable”; and the...

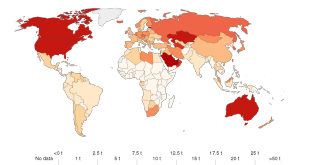

Read More »Map of CO2 emissions per capita by country

https://en.wikipedia.org/wiki/File:CO2_emissions_per_capita,_2017_(Our_World_in_Data).svg

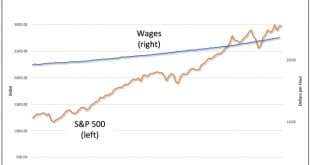

Read More »“It doesn’t feel like a boom yet”

from David Ruccio Across American universities, corporations, and financial institutions, researchers are honing computer models designed to predict the winner in the November 2020 presidential election in which Donald Trump will face a Democratic candidate still to be determined. One such set of models, developed by Moody’s Analytics, which focuses on the electoral college (and not the national popular vote), predicts a convincing victory for Trump. Moody’s based its projections on...

Read More »Game theory — a scientific cul-de-sac

from Lars Syll Back in 1991, when yours truly earned his first PhD with a dissertation on decision-making and rationality in social choice theory and game theory, I concluded that “repeatedly it seems as though mathematical tractability and elegance — rather than realism and relevance — have been the most applied guidelines for the behavioural assumptions being made. On a political and social level, it is doubtful if the methodological individualism, ahistoricity and formalism those...

Read More »CO2 emissions per capita by country

Kindle $5.96 US UK DE FR ES IT NL JP BR CA MX AU IN paperback (567 pages) $20 US UK DE FR ES IT JP CA

Read More »World – CO2 emissions per capita 1960 to 2014

The experimental dilemma

from Lars Syll We can either let theory guide us in our attempt to estimate causal relationships from data … or we don’t let theory guide us. If we let theory guide us, our causal inferences will be ‘incredible’ because our theoretical knowledge is itself not certain … If we do not let theory guide us, we have no good reason to believe that our causal conclusions are true either of the experimental population or of other populations because we have no understanding of the mechanisms that...

Read More »Mark Zuckerberg is a rich jerk

from Dean Baker Last week, New York Times columnist Timothy Egan had a piece headlined “Why Doesn’t Mark Zuckerberg Get It?” The piece then goes on to document how Facebook has become a medium for spreading lies and nonsense all over the world, that many ill-informed users have come to believe. This is what Egan wants Zuckerberg to “get.” While it would be nice if Zuckerberg understood the problems created by Facebook, and took effective measures to address them, the problem with Egan’s...

Read More »Economist validates Elizabeth Warren’s M4A tax questions

Support the show at http://PoliticsDoneRight.com/Join Or Donate Directly at http://PayPal.Me/politicsdoneright ‘Join’ on YouTube: https://www.youtube.com/channel/UCcgg5oVHV3ktWzbkbc52urQ?sub_confirmation=1 --- Description: Economist Dr. Dean Baker details why Senator Elizabeth Warren is correct in the manner in which she addresses the question about tax increases with Medicare for All. Hashtags: #PoliticsDoneRight #DeanBaker #ElizabethWarren #MedicareForAll #Taxes --- **Follow...

Read More » Real-World Economics Review

Real-World Economics Review