from Blair Fix Have you ever wondered what it takes to become a billionaire? Do you need rare genius? Exceptional acumen? Miraculous foresight? An uncompromising work ethic? On all four counts, the answer is no. It turns out that to become a billionaire, what you really need is the right social setting. You need to live in a society that is suitably rich and appropriately unequal. Without those things, your chances of wearing the billionaire badge are low. In this post, I’ll do the math....

Read More »Crypto and finance are waste and a drag on the economy

from Dean Baker As everyone learns in Econ 101, and immediately forgets, the purpose of the financial sector is to facilitate transactions and allocate capital. This seems like a simple and obvious point, but you would never know it in most discussions of the financial sector. The point here is that we need finance for these purposes. We don’t need finance to develop elaborate betting games and complex financial instruments. Financial instruments are only useful when they serve the...

Read More »Economics education needs a revolution

from Lars Syll You ask me what all idiosyncrasy is in philosophers? … For instance their lack of the historical sense, their hatred even of the idea of Becoming, their Egyptianism. They imagine that they do honour to a thing by divorcing it from history sub specie æterni—when they make a mummy of it. Friedrich Nietzsche Nowadays there is almost no place whatsoever in economics education for courses in the history of economic thought and economic methodology. This is deeply worrying....

Read More »Degrowth

from Jason Hickel and RWER As the climate crisis worsens and the carbon budgets set out by the Paris Agreement shrink, climate scientists and ecologists have increasingly come to highlight economic growth as a matter of concern. Growth drives energy demand up and makes it significantly more difficult – and likely infeasible – for nations to transition to clean energy quickly enough to prevent potentially catastrophic levels of global warming. In recent years, IPCC scientists have argued...

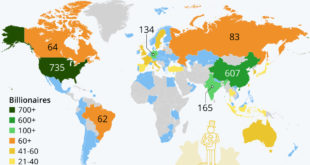

Read More »Billionaire world map

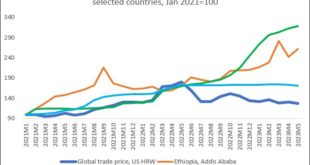

Global food prices in “The rest of the world”

from C. P. Chandrasekhar and Jayati Ghosh The dramatic increase in global oil and food prices from the start of the Ukraine War did not reflect real global supply shortages or demand-supply imbalances. Rather, it reflected the impact of market concentration and financial activity in commodity futures markets, which enabled some large private players particularly global agribusinesses and financial companies to make a killing. This is now so evident from the data that it is more widely...

Read More »The economic consequences of tax cuts for the rich

from Lars Syll Given the lack of consensus in existing empirical analyzes and the difficulties of making causal inferences from macro-level panel data analyzes, it remains an open empirical question how cutting taxes on the rich affects economic outcomes. We believe the question is best answered by looking at the effects of major tax cuts packages, as the story of taxing the rich in the advanced democracies over the past 50 years is one of discrete and stark changes in policy … Our...

Read More »Job loss from going green is nothing like the loss of manufacturing jobs due to trade

from Dean Baker The United States suffered from a massive loss of manufacturing jobs in the 00s. This has come to be known as the “China Shock,” since it was associated with a flood of imports, especially from China, and a rapid rise in the U.S. trade deficit. In the decade from December of 1999 to December of 2009, the economy lost more than 5.8 million manufacturing jobs, or more than one in three of the manufacturing jobs at the start of the decade. The vast majority of this job loss...

Read More »“So what has gone wrong?”

from this Nature editorial . . . income inequality within countries is rising, as measured by the Gini index, a measure of income distribution across a population. Globally, in the 15 years to 2019, economic output in terms of gross domestic product (GDP) roughly doubled, but the share of economic output earned by the workers producing the goods and services behind the increase fell from 54.1% in 2004 to 52.6% in 2019. So what has gone wrong? Between 2019 and 2020, the COVID-19 pandemic...

Read More »Core prices? More prices! Understanding inflation means looking at numerous sets of prices.

Producer prices in the UK are declining. Does this mean inflation is over? Hmmm… Many economists have difficulties understanding the present aftermath of an inflationary episode (which might be followed by new episodes…). Which is, considering their theoretical framework, understandable. They look at only one set of prices: consumer prices (or, in the case of derivatives ‘core prices’ and many others‘, even only at a subset of this set). Instead, they should expand their frame of...

Read More » Real-World Economics Review

Real-World Economics Review