from Lars Syll Many American undergraduates in Economics interested in doing a Ph.D. are surprised to learn that the first year of an Econ Ph.D. feels much more like entering a Ph.D. in solving mathematical models by hand than it does with learning economics. Typically, there is very little reading or writing involved, but loads and loads of fast algebra is required. Why is it like this? … One reason to use math is that it is easy to use math to trick people. Often, if you make your...

Read More »The big three’s CEOs are ripping off their companies

from Dean Baker Robert Reich posted a table that tells us a huge amount about the U.S. economy. CEO pay of the largest carmakers in the world Honda: $2.3M Nissan $4.5M Toyota: $6.7M BMW: $5.6M Mercedes: $7.5M Porsche: $7.9M Ford: $21M Stellantis: $25M GM: $29M The reason this table is so informative is that the performance of these foreign automakers would certainly stand up well in comparison to the U.S. Big Three. (In fairness, Stellantis is largely a European company, headquartered in...

Read More »But critical thinking is not always appreciated

from Peter Soderbaum Economists, like other people, are political economic persons guided by their ideological orientation. We are eager to become accepted in some social groups. Just as political parties often are afraid of departing too much from one another, an economist may prefer a comfortable life by positioning herself close to other economists with respect to conceptual framework and ideology. Accepting the norms and standards of neoclassical economics is rewarding and constitutes...

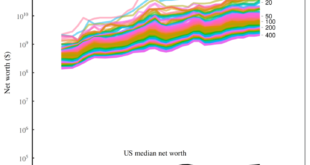

Read More »Weekend read – How the rich get richer

from Blair Fix The rich get richer. It’s a phrase that packs a lot of punch. It’s potent rhetoric, yet surprisingly accurate at describing how rising inequality plays out. Of course, there’s nothing inevitable about the rich getting richer. We just happen to live in an age of growing corporate despotism. And our friends at Forbes have been there to document the disease. Forbes. Forbes who loves the free market. Forbes who loves obscene wealth. Forbes … the unwitting social scientist?...

Read More »The ultimate methodological issue in economics

from Lars Syll If scientific progress in economics — as Robert Lucas and other latter-day followers of Milton Friedman seem to think — lies in our ability to tell ‘better and better stories’ one would of course expect economics journals to be filled with articles supporting the stories with empirical evidence. However, the journals still show a striking and embarrassing paucity of empirical studies that (try to) substantiate these stories and their predictive claims. Equally amazing is...

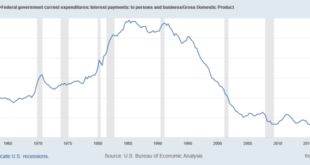

Read More »A high national debt can be bad news, sort of like a high stock market

from Dean Baker The media have been giving considerable attention to the national debt in the last year or so. They have some cause, it has been rising rapidly, and more importantly, the interest burden of the debt has increased sharply since the Fed began raising rates last year. But, if we want to be serious, rather than just write scary headlines, we have to ask why the debt is a problem. The first concern to dispel is the idea that the country somehow has to pay off its debt. Our...

Read More »The difference between a philosopher and a common street porter

from Adam Smith The difference of natural talents in different men is, in reality, much less than we are aware of; and the very different genius which appears to distinguish men of different professions, when grown up to maturity, is not upon many occasions so much the cause as the effect of the division of labour. The difference between the most dissimilar characters, between a philosopher [economist] and a common street porter, for example, seems to arise not so much from nature as...

Read More »Risk vs. Uncertainty

from Steve Keen The key concept in Keynes’s summary was the impact of expectations upon investment, when those expectations were about what might happen in an uncertain future. Investment is undertaken to augment wealth, and yet the outcome of any investment depends upon economic circumstances in the relatively distant future. Since the future cannot be known, investment is necessarily undertaken on the basis of expectations formed under uncertainty. Keynes was at pains to distinguish...

Read More »The causal revolution in econometrics has gone too far

from Lars Syll Kevin Lewis points us to this recent paper, “Can invasive species lead to sedentary behavior? The time use and obesity impacts of a forest-attacking pest,” published in Elsevier’s Journal of Environmental Economics and Management, which has the following abstract: “Invasive species can significantly disrupt environmental quality and flows of ecosystem services and we are still learning about their multidimensional impacts to economic outcomes of interest. In this work, I...

Read More »Inflation: bumps, potholes, the government and a 3D analysis

At this moment, there’s quite some ‘graphology’ when it comes to inflation. Here, an example by Paul Krugman. Here, Larry Summers. And an example by a younger chap, Joey Politano. (Caveat: ‘X’ kicked out some links when I was writing this blog (or at least they disappeared), it might happen again)). All of these economists are really ahead of the pack when it comes to knowledge of economic statistics (methodology as well as results). They also know a thing or two about economic theory....

Read More » Real-World Economics Review

Real-World Economics Review