from Lars Syll Little in the discipline has changed in the wake of the crisis. Mirowski thinks that this is at least in part a result of the impotence of the loyal opposition — those economists such as Joseph Stiglitz or Paul Krugman who attempt to oppose the more viciously neoliberal articulations of economic theory from within the camp of neoclassical economics. Though Krugman and Stiglitz have attacked concepts like the efficient markets hypothesis … Mirowski argues that their attempt...

Read More »In Thrall to the Infallible Hand

from Duncan Austin While Adam Smith’s Invisible Hand has many beneficial attributes, somewhere along the way the Invisible Hand was recast as the Infallible Hand, seeding today’s widespread faith that markets can solve large-scale social and ecological problems they are ill matched for. In the formidable shadow of the Infallible Hand, non-market solutions – policy, regulatory, cultural, behavioural – are often deemed ‘impractical’, so remain under-utilized. ‘Green growth’, ‘sustainable...

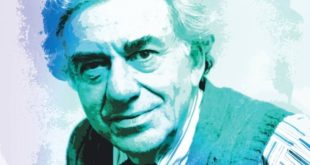

Read More »Irrational Exuberance — Robert Shiller’s modern classic

Lars Syll At the beginning of the year 2000, a book titled Irrational Exuberance was published. The American economics professor and Nobel laureate Robert Shiller warned that the extensive deregulation in the financial market that had taken place since the Thatcher-Reagan era had led to a rapid credit expansion. Banks and financial institutions saw a skyrocketing increase in lending, and the pursuit of gaining larger market shares led to neglecting creditworthiness checks and accepting...

Read More »The Religion of Economics

from Asad Zaman Maeshiro (2016) in “The Capitalist Religion and the Production of Idols“, writes that Capital is the God, and Capitalism is the religion of modern society. Gauthier’s review of Nelson’s Economics As Religion states that “economics became the modern theology that replaced traditional theology as the set of doctrines that give meaning to our social reality and hope to our endeavors to improving our lives … (Nelson analyses) the works of the major twentieth century American...

Read More »Economic methodology — Lawson, Mäki, and Syll

from Lars Syll We are all realists and we all — Mäki, Cartwright, and I — self-consciously present ourselves as such. The most obvious research-guiding commonality, perhaps, is that we do all look at the ontological presuppositions of economics or economists. Where we part company, I believe, is that I want to go much further. I guess I would see their work as primarily analytical and my own as more critically constructive or dialectical. My goal is less the clarification of what...

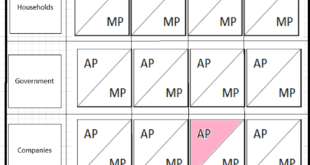

Read More »Something about prices II. The introduction of Multi Component Pricing for milk…

I’m tinkering with the idea of a kind of periodic table for prices. Below, a very rough sketch of what I have in mind relating to administered prices and market prices as well as the sectors of the national accounts (cost prices, shadow prices etcetera have to be added). Gardiner Means defined the difference between market and administered prices (quoted in Gu (2012) on p. 13): “In an engineering economy prices are fixed by...

Read More »We can do better with a thousand years

Review of Power and Progress, by Daron Acemoglu and Simon Johnson from Dean Baker When I saw that two of the country’s most prominent economists wrote a book on “our 1000-year struggle over technology and prosperity,” I expected a lot. I was disappointed. To be clear, there is much here to like and I’m sure that most readers will get much from it, as I did. But, the book fails to follow through adequately on the key point in its analysis, which is that the gains from technology are a...

Read More »Robert Lucas (1937-2023)

from Lars Syll Economic theory, like anthropology, ‘works’ by studying societies which are in some relevant sense simpler or more primitive than our own, in the hope either that relations that are important but hidden in our society will be laid bare in simpler ones, or that concrete evidence can be discovered for possibilities which are open to us which are without precedent in our own history. Unlike anthropologists, however, economists simply invent the primitive societies we study, a...

Read More »A student among the econ: Seeing through mathemagics

from Asad Zaman In my article on “Education of an Economist”, I have explained how I gradually came to realize that all I had learnt during my Ph.D. training at Stanford University was false. I would like to make this more specific and concrete, by providing some examples. A leading example is a paper on Power and Taxes which I studied as a graduate student. But, let me start from the beginning. Leijonhufvud, in his classic “Life Among the Econ” explains how the priestly caste of the...

Read More »Weekend read – Minsky and Keynes show the way out of the crisis

from Lars Syll American economist Hyman Minsky described capitalism as a “two price” system. On one side are asset prices—both financial, like government or corporate bonds, and physical like residential or commercial property. On the other, there are consumer prices—goods and services that determine current output and consumer price inflation. In the contemporary global economy, asset prices are much more sensitive to interest rate adjustments than consumer prices. The present value of...

Read More » Real-World Economics Review

Real-World Economics Review