from Peter Radford I have been reminded by Tyler Cowen of Bryan Caplan’s simplistic theory of left and right. It’s short and to the point. Leftists are, he says, “anti-market”. He is wrong. Leftists are anti-market obsession. They are anti-market fanaticism. They are anti-market worship. Specifically, they are opposed to the form of idealization used to articulate “the market” in economics. There’s a difference. And I assume Bryan Caplan knows as much. There has been a recent...

Read More »David Brooks’ celebration of American capitalism

from Dean Baker Last week, David Brooks had a column that was quite literally a celebration of American capitalism. He makes a number of points showing the U.S. doing better than other wealthy countries over the last three decades. While his numbers are not exactly wrong, they are somewhat misleading. (I see Paul Krugman beat me to the punch, so I’ll try not to be completely redundant.) Brooks points to the faster GDP growth in the United States than in other wealthy countries. As Krugman...

Read More »Exploiting the South: power & knowledge

from Asad Zaman This is the first of a sequence of posts on the current economic crisis in Pakistan. Although the discussion is in the context of Pakistan, all the poor countries in grips of the modern neo-colonial global system face essentially the same problems. The financial basis of the system is outlined by Jason Hickel in Aid-in-Reverse: How the Poor Countries Develop the Rich. He describes how the poor countries receive 1.3 Trillion USD in financial inflows, aid, etc. from the...

Read More »Mainstream economics — slipping from the model of reality to the reality of the model

from Lars Syll A couple of years ago, Paul Krugman had a piece up on his blog arguing that the ‘discipline of modelling’ is a sine qua non for tackling politically and emotionally charged economic issues: In my experience, modeling is a helpful tool (among others) in avoiding that trap, in being self-aware when you’re starting to let your desired conclusions dictate your analysis. Why? Because when you try to write down a model, it often seems to lead some place you weren’t expecting or...

Read More »China is bigger, get over it

from Dean Baker It is standard for politicians, reporters, and columnists to refer to the United States as the world’s largest economy and China as the second largest. I suppose this assertion is good for these people’s egos, but it happens not to be true. Measuring by purchasing power parity, China’s economy passed the U.S. in 2014, and it is now roughly 25 percent larger.[1] The I.M.F. projects that China’s economy will be nearly 40 percent larger by 2028, the last year in its...

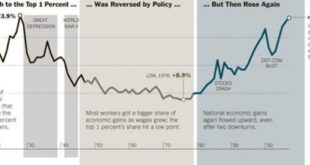

Read More »The Keynesian revolution and the monetarist counter-revolution

from Asad Zaman and RWER current issue The intimate connection between economic theory and political power is clearly illustrated by the rise and fall of Keynesian Economics in the 20th Century. Confidence generated by theories glorifying the workings of a market economy led leading economists to predict permanent prosperity, just prior to the Great Depression of 1929. After the crash, Keynes set out to resolve the most glaring contradiction between economic theory and reality. While...

Read More »Quick thoughts on AI and intellectual property

from Dean Baker There has been a lot of concern in recent days about the impact of AI on people’s intellectual property. The latest AI programs screen millions of documents, songs, pictures, and videos posted to the web and freely grab any portion that seems to fit the commands given the program. As it stands, the creators of the material are not compensated, even if a large portion of their work appears in the AI product. This raises serious questions about how AI will affect the future...

Read More »Weekend read – Bayes theorem — what’s the big deal?

from Lars Syll There’s nothing magical about Bayes’ theorem. It boils down to the truism that your belief is only as valid as its evidence. If you have good evidence, Bayes’ theorem can yield good results. If your evidence is flimsy, Bayes’ theorem won’t be of much use. Garbage in, garbage out. The potential for Bayes abuse begins with your initial estimate of the probability of your belief, often called the “prior” … In many cases, estimating the prior is just guesswork, allowing...

Read More »The fossil-fuel business should be actively dismantled

from Blair Fix and RWER current issue From the moment the first veins of coal were opened (thousands of years ago), one thing has been certain: the fossil-fuel business would eventually die. But what’s always been uncertain is the when and the how. That’s because there is no law of nature that tells us how much of a non-renewable resource humans will exploit. One possibility is that we will harvest fossil fuels to the point of utter exhaustion. Of course, there will always be some scraps...

Read More »Copyrights: What to do?

from Spencer Graves and RWER current issue To the extent that copyrights and paywalls on academic journals are obstacles to “the progress of science and the useful arts”, there are things that individual researchers, academic administrators, and the public can do to help overcome these obstacles: Researchers can submit their work only to open-access journals and refuse to submit their work to journals that will put their work behind a paywall. (No one who wants to be cited wants their...

Read More » Real-World Economics Review

Real-World Economics Review