from Peter Radford As we tumble from one degrading political spectacle to another it is worth remembering that things that mattered were actually addressed periodically, even if the result was tumult. For reasons not worth mentioning here I am taking good look at English history between 1909 and 1911. In this case the tumult was triggered by a budget which was resisted by landowners and the House of Lords, and ended with a radical reorientation of power that left the House of Lords...

Read More »Trump’s trade wars threaten US foreign investment

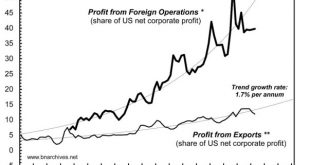

from Shimshon Bichler and Jonathan Nitzan There is a lot of buzz about Trump’s recently launched trade wars, but much of this buzz misses the point. The key issue here is not foreign trade, but foreign investment. Foreign trade contributes relatively little to US corporate profit. The disaggregate data here are patchy, but if we can assume that profit rates on exports and domestic sales are roughly the same, we can use the share of exports in GDP as a proxy for the share of export...

Read More »Keynes and econometrics

from Lars Syll After the 1920s, the theoretical and methodological approach to economics deeply changed … A new generation of American and European economists developed Walras’ and Pareto’s mathematical economics. As a result of this trend, the Econometric Society was founded in 1930 … In the late 1930s, John Maynard Keynes and other economists objected to this recent “mathematizing” approach … At the core of Keynes’ concern laid the question of methodology. Maria Alejandra Madi Keynes’...

Read More »Whose sweet spot?

from David Ruccio Economic journalists, like Neil Irwin, are falling all over themselves celebrating the strength of the current economic recovery. According to the latest data from the Bureau of Labor Statistics, 313 thousand new jobs were added in February. The official unemployment rate remained at a relatively low 4.1 percent. Hourly wages grew at an annual rate of 2.6 percent. And so on. Here’s Irwin: This is not the kind of data you expect in an expansion that is nine years old,...

Read More »“Let’s pretend that people are like molecules”

“Social researchers of the 19th century were impressed by the success of this branch of science [thermodynamics], and also by its similarity to economics. A gas is a macroscopic thing, characterized by macroscopic properties — temperature, pressure, volume. But it consists of many microscopic constituents (molecules) whose interactions collectively create the macroscopic state. The study of macroscopic properties arising from microscopic interactions is called statistical mechanics. That...

Read More »Friedman’s methodology: a stake through the heart of reason

from Asad Zaman Romer writes that macro-economists casually dismiss facts, and the profession as a whole has gone backwards over the past few decades, losing precious and hard-won knowledge. He does not consider WHY this happened. What are the methodological flaws that create the possibility of moving backwards, losing knowledge, affirming theories known to be in conflict with facts. How is it that leading economists can confidently assert theories which border on lunacy, and receive...

Read More »Steel tariffs and doctors: a teachable moment?

from Dean Baker Donald Trump’s tariffs on steel have elicited near universal condemnation. In addition to issuing warnings from retaliation by our trading partners, the media have also been giving us economics lessons on how steel tariffs will mean higher prices for consumers. If we pay 10 percent more for our steel, then the price of cars and other items that use large amounts of steel can be expected to rise. This will reduce demand for these products and might cause consumers to buy...

Read More »How money is created

from Lars Syll Everything we know is not just wrong – it’s backwards. When banks make loans, they create money. This is because money is really just an IOU. The role of the central bank is to preside over a legal order that effectively grants banks the exclusive right to create IOUs of a certain kind, ones that the government will recognise as legal tender by its willingness to accept them in payment of taxes. There’s really no limit on how much banks could create, provided they can find...

Read More »U.S. Average Household Income, 2015

Source: Emmanuel Saez, UC Berkeley

Read More »Utopia and healthcare—1

from David Ruccio This is the first in a series of blog posts on the utopian dimensions of healthcare. I’ve written quite a bit about the U.S. healthcare dystopia over the years—including a seven-part series back in 2016.* But I haven’t yet addressed the utopian dimensions of healthcare reform. The appearance of the new issue of Jacobin Magazine, titled “The Health of Nations,” is a good occasion to start that discussion. Adam Gaffney starts with much the same question that provoked my...

Read More » Real-World Economics Review

Real-World Economics Review