from Lars Syll Because I was there when the economics department of my university got an IBM 360, I was very much caught up in the excitement of combining powerful computers with economic research. Unfortunately, I lost interest in econometrics almost as soon as I understood how it was done. My thinking went through four stages: 1. Holy shit! Do you see what you can do with a computer’s help. 2. Learning computer modeling puts you in a small class where only other members of the caste...

Read More »Scientist qua scientist, scientist qua citizen: Part I

from Malgorzata Dereniowska That economics is a value-laden science is not a new idea. Most of the prominent economic thinkers were also philosophers, wary of moral and philosophical content of scientific assumptions, models, and theories. That economics needs philosophy, and the separation between these two cannot be maintained any longer, is gaining recognition, and has become a subject of debates in the field of philosophy of economics that brings together (to various extends)...

Read More »WEA Commentaries – new issue

WEA Commentaries Formerly the World Economics Association NewsletterVolume 8, Issue No. 1 Download the issue as a PDF In this issue How to Inspire and Motivate Students Asad Zaman Redefining Governance in Cooperative BanksMitja Stefancic, Silvio Goglio, and Ivana Catturani The Biophysical Basis of Production and the Public Economy June Sekera Tesla, Amazon, Bitcoin, Efficient Markets and FTT Dean Baker Keynes and Econometrics Maria Alejandra Madi Corrupted Economic Research—two...

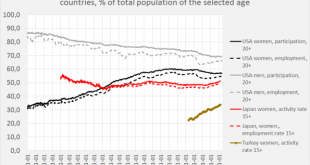

Read More »Female and male participation and employment

According to the accepted narrative after about 1950 female participation rates started to rise thanks to inventions like the washing machine and kept rising forever after. Reality is more confusing. According to a recent book by Julia Sophie Wörsdorfer, washing machines were, contrary to the ideas of Ha-Joon Chang, not that important. Neither cross sectional data nor time series analysis yields a strong correlation between ownership of a washing machine and high female labour force...

Read More »What austerity preachers do not get

from Lars Syll We are not going to get out of the economic doldrums as long as we continue to be obsessed with the unreasoned ideological goal of reducing the so-called deficit. The “deficit” is not an economic sin but an economic necessity … idle all around us. Alexan The administration is trying to bring the Titanic into harbor with a canoe paddle, while Congress is arguing over whether to use an oar or a paddle, and the Perot’s and budget balancers seem eager to lash the helm...

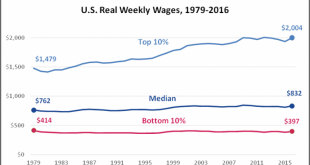

Read More »“If poor people knew how rich rich people are, there would be riots in the streets”

from David Ruccio Chris Rock may be right. Still, Americans are well aware that economic inequality in their country is obscene, even though they often underestimate the growing gap between the poor and the rich. But it’s Frank Rich, who conducted the interview with the American comedian, who made the more perceptive observation: For all the current conversation about income inequality, class is still sort of the elephant in the room. All the experts agree—from Thomas Piketty and the...

Read More »U.S. real weekly wages, 1979-2016

Source: Bureau of Labor Statistics.

Read More »Wren-Lewis and the dangerous MMT

from Lars Syll Professor Simon Wren-Lewis recently wrote: “The dangers of pluralism in economics: the case of MMT” … Wren-Lewis argues that MMT concepts can be explained using mainstream terminology. Since I tend to use fairly standard terminology, I cannot disagree with that argument. However, I would phrase it differently. Mainstream discussion of fiscal policy is almost invariably clouded with theoretical junk (“fiscal sustainability”, “budget constraints”, “intergenerational...

Read More »The void in neoclassical orthodoxy

from Julie Nelson Since the 1990s, I and some other feminist economists have been pointing out that the mainstream discipline of economics has a profoundly masculinist bias. That is, aspects of human nature, experience, and behavior that fit a culturally “macho” mold have been emphasized and elevated, while those that are culturally associated with a lesser-valued femininity have been ignored. The neoclassical orthodoxy focuses on markets and perhaps the public sphere, but categorizes...

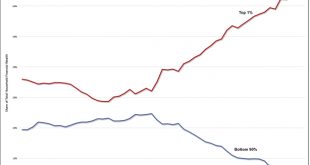

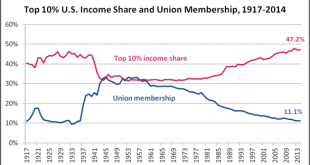

Read More »U.S. union membership and top 10% income share 1917-2014

Source: Economic Policy Institute

Read More » Real-World Economics Review

Real-World Economics Review