from Lars Syll Again and again, Oxford professor Simon Wren-Lewis rides out to defend orthodox macroeconomic theory against attacks from heterodox critics. In his latest attack on heterodox economics and students demanding pluralist economics education he writes: The danger in encouraging plurality is that you make it much easier for politicians to select the advice they like, because there is almost certain to be a school of thought that gives the ‘right’ answers from the politicians...

Read More »Former AIG director Martin Feldstein warns of stock and housing bubbles

from Dean Baker That’s one of the things we learn from reading Robert Samuelson’s Washington Post columntoday, although Samuelson identifies Feldstein only by his professorship at Harvard, not his moonlighting work on AIG’s board. (In addition to requiring a massive government bailout during Feldstein’s tenure as a director, AIG was also rocked by an accounting scandal that forced the resignation of its Maurice Greenberg, its longtime CEO.) I’m one of those old-fashioned types who think...

Read More »Prosperity as human development, not wealth

from Asad Zaman The main thesis of our lecture is that our quest for prosperity has failed to deliver the sought-after goals because we have misunderstood the meaning of prosperity , and looked for it where it cannot be found. We base our economic policies on modern economic theory, which is based on the amazing assumption that human beings act to maximize lifetime consumption, since this is the sole source of human welfare. Human beings are far more generous and cooperative than the...

Read More »Trump trashes the United States while Xi tries to build a “sustainable China”

from Richard Smith and issue 82 of the RWER As Trump walked away from the Paris climate accord, Xi announced his intention to “take the driver’s seat in international cooperation to respond to climate change”. Not only that but Xi’s government has also pledged to wipe out the last vestiges of poverty in China by 2030 and turn China into a “moderately prosperous society” where the basic needs of all including jobs, housing, and healthcare, are met. Trump, as we know, has different...

Read More »Dani Rodrik’s Ten Commandments

from Lars Syll Dani Rodrik is not satisfied with the critique of mainstream economics put forward by yours truly and other mostly non-orthodox economists. So he has put up a list of ten commandments for economists, hoping thereby to somehow ‘save’ mainstream ‘the model is the message’ economics from the critique. The two central commandments are 3. Make your model simple enough to isolate specific causes and how they work, but not so simple that it leaves out key interactions among...

Read More »On the real-world irrelevance of game theory

from Lars Syll It has been argued that some ascription of rationality plays a crucial role in particular in game theoretic modeling from a participant’s point of view. However, ascribing some kind of ideal reasoning process symmetrically to all players in the game, it becomes very unclear whether we as analysts can truly adopt a participant’s attitude to such an idealized interaction. After all, we are as a matter of fact only boundedly rational and not perfectly rational beings ourselves...

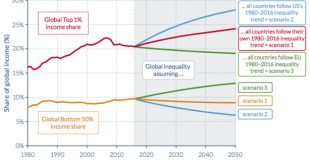

Read More »The elephant in the world

from David Ruccio One of the most important stories I read, but did not write about, while I was away was the launch of the World Inequality Report 2018.* The authors of the report confirm what Branko Milanovic and others had previously discovered: that a representation of the unequal gains in world economic growth in recent decades looks like an elephant. Thus, the real incomes of the bottom 50 percent of the world’s population (except the poorest, at the very bottom) have increased,...

Read More »Disruptive technologies and sustaintech investments

from Mari Alejandra Madi On a global level, to achieve the 2˚C agreed upon during the Paris Agreement, a decrease in emissions of 40-70 percent (relative to 2010) should be obtained by 2050. According to Bloomberg New Energy Finance, 2017 global green investments exceeded 2016´s total of $287.5 billion. With strong government policy support, China has experienced a rapid increase in sustainable investments over the past several years and nowadays this country is the leader of global...

Read More »Time for another crash?

from Lars Syll On Black Friday 1929 market fundamentalist wet dreams of eternal growth took a serious hit. The stock market bubble exploded and crashed. Today we have a stock market situation much reminding of that in 1929. The Shiller P/E ratio is now even higher than that year. Those of us who know our Keynes-Fisher-Kindleberger-Minsky and have not completely forgotten all about economic history are starting to worry …

Read More »Why does it cost so much to read heterodox economics?

from Edward Fullbrook The current issue (January 8, 2018) of the Heterodox Economics Newsletter lists the current issues of 16 English language journals, with each linked to the newsletter’s website where there is a link for each article in these new issues. For each journal, I picked one article to try to read. Here is what I found. Research in the History of Economic Thought and Methodology, 35B Lucia Morra: Friendship and Intellectual Intercourse Between Sraffa and Wittgenstein: A...

Read More » Real-World Economics Review

Real-World Economics Review