In 1921 King, Macaulay and Mitchell published their milestone ‘Income in the United States: Its Amount and Distribution, 1909-1919’ which estimated time series of nominal and real income in the USA. Why did they measure this? The last sentence of their introduction reads: “Last but most interesting of all, we shall consider the way in which the National Income is distributed among individuals”. Distribution was paramount. The authors were also well aware of the limited nature of their...

Read More »Some suggestions for reorienting economics and philosophy of economics

from Gustavo Marqués If it is assumed that (a) both agents and theorists are aware they are facing an uncertain context, and (b) they hold epistemic and ontological beliefs consistent with this state of affairs, the proper way to approach economic phenomena should be very different from those that guide current modeling practice. Particularly, instead of mechanisms or economic regularities that keep running independently of agents’ expectations, the decisive role of lobbyists within...

Read More »Tesla, Amazon, and Bitcoin

from Dean Baker The soaring price of Bitcoin is a useful lesson about markets for people who seem to very quickly forget the last lesson. Bitcoin, a digital algorithm, backed by absolutely nothing, has been selling for more than $16,000. Perhaps Bitcoin’s price will double or triple again. After all, who knows how badly people need digital currencies that are not really currencies? But more likely the market will run out of people who are willing to trade real money for nothing. At that...

Read More »Is economics becoming an evolutionary science? Veblen at the 2018 ASSA conference

In 1898 Thorstein Veblen asked ‘Why isn’t economics an evolutionary science?’. At the ASSA 2018 conference Avsar, Duroy and Scorsone mused about this. Below, the abstracts of their papers. Here, Mark Thomas about this. Avsar’s article is, with its link to neurology, truly Veblenian in spirit. An interesting question is: it seems that the behavior of hunter-gatherers, who have little property as they can’t carry it with them, have behavior that is more economic rational than the behavior...

Read More »The truth about the minimum wage

from Lars Syll It has been more than eight years since many of the United States’ cashiers, dishwashers, janitors, lifeguards, baggage handlers, baristas, manicurists, retail employees, housekeepers, construction laborers, home health aides, security guards, and other minimum-wage workers last got a raise. The federal minimum wage now stands at just $7.25. In real terms, these workers’ earnings have declined by nearly 13 percent since the last hike, in 2009—and have fallen by over...

Read More »The ASSA conference: some institutional papers

Some (institutional) stuff from the ASSA conference, the first one with nice definitions of trust and control (but there might be more empirical stuff). The second one on the role of the ideology of judges in economic cases when there are no clear legal rules. More tomorrow. Claudius Gräbner, Johannes Kepler University-Linz Wolfram Elsner. To trust or to control: Informal value transfer systems and computational analysis in institutional economics Here, the PPT This paper illustrates the...

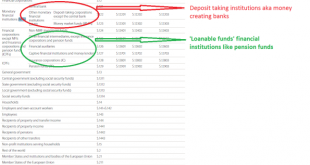

Read More »In praise of the Institutional Nature of the National Accounts

A variable like GDP (Gross domestic Product) receives a lot of flack from economists. Much of this is misguided. The economists should not look at GDP but at the national accounts (of which GDP is one, but only one, variable). And they should not criticize the accounts but praise them. A 2016 ECB working paper about the flagship ECB ‘EAGLE-FLI’ neoclassical macro-model (Bokan e.a. (2016)) shows why: neoclassical have no idea about how and what to measure. National account statisticians...

Read More »Modern economics — an intellectual game without practical relevance

from Lars Syll Modern economics is sick. Economics has increasingly become an intellectual game played for its own sake and not for its practical consequences for understanding the economic world. Economists have converted the subject into a sort of social mathematics in which analytical rigour is everything and practical relevance is nothing. To pick up a copy of The American Economic Review or The Economic Journal these days is to wonder whether one has landed on a strange planet in...

Read More »WEA Commentaries – new issue

Volume 7, Issue No. 6 Download the issue as a PDF In this issueA Philosophical Framework for Rethinking Theoretical Economics and Philosophy of EconomicsGustavo Marqués Interview on The Fascist Nature of NeoliberalismFlavia Di Mario Doomed to RepeatPeter Radford The Invisible Hand in Context Global Rentier CapitalismDavid F Ruccio Perfect Competition and CounterfactualsStuart Birks Keynes was right about Quantitative EasingMerijn Knibbe How UBER Money Dominates and Distorts Economic...

Read More »Making merry on Bitcoin

from C.P. Chandrasekhar Bitcoin has left the world of finance gasping. Though the total market value of all of that cryptocurrency in circulation is only a fraction of the value of the world’s financial assets, the rapid rise in the value of the currency has made it the most wanted of those assets. On January 1, 2017, the currency was trading at between $972 to $990 a unit. By December 7 that range had risen to $14,063 to $17,363. According to a calculation by Reuters, an investment of...

Read More » Real-World Economics Review

Real-World Economics Review