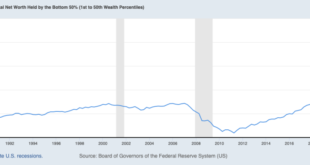

from David Ruccio In a recent article in The Intercept, Jon Schwarz [ht: db] arrives at a perfectly reasonable conclusion—but, unfortunately, he makes a real hash of the data concerning changes in wealth ownership in the United States. Schwarz starts with the fact that the total amount of wealth owned by the bottom 50 percent of the U.S. population has doubled since the first quarter of 2020 (in other words, during the pandemic). He then takes issue with the idea that economic growth...

Read More »Macroeconomic aspirations

from Lars Syll Some economists seem to be überjoyed by the fact that they are using the same ‘language’ as real business cycles macroeconomists and that they therefore somehow can learn something from them. James Tobin obviously did not find any need to speak the RBC ‘language’: They try to explain business cycles solely as problems of information, such as asymmetries and imperfections in the information agents have. Those assumptions are just as arbitrary as the institutional rigidities...

Read More »Dean Baker on Inflation Myths

Subscribe to The Zero Hour with RJ Eskow for more: https://www.patreon.com/thezerohour If you liked this clip of The Zero Hour with RJ Eskow, please share it with your friends... and hit that "like" button! Some of the music bumpers featuring Lettuce, http://lettucefunk.com.

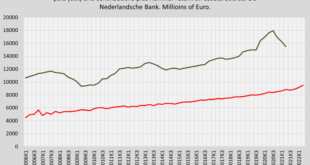

Read More »Neoclassical induced financial fragility. Central bank pension fund regulation edition.

Financial wizardry recently caused massive problems for UK pension funds and the Bank of England. The Bank of England forces pension funds to take part in ‘LDI’ contracts which aim to insure possible future liquidity problems. These contracts however lead to real liquidity problems, which forced the Bank of England to intervene to prevent a market melt down. The solution became the problem. Deputy Governor John Cunliff of the Bank of England stated: ...

Read More »Weekend read – Can university education in economics contribute to strengthened democracy and peace?

from Peter Söderbaum and WEA Commentaries current issue Introduction In all societies there is a tension between democracy and dictatorship. In some countries democracy is well institutionalized and the threat of dictatorship is successfully kept at a distance. In other societies, a system close to dictatorship is quite established and democracy is regarded as a threat. Today, we witness a confrontation between Russia, a nation close to dictatorship and Ukraine which appears to move...

Read More »The Nobel prize in economics — awarding popular misconceptions

from Lars Syll This year’s Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel honours Ben Bernanke, Douglas Diamond and Philip Dybvig. In the view of the Royal Swedish Academy of Sciences, the laureates ‘have significantly improved our understanding of the role of banks in the economy’. But what is the role of banks in the economy? The academy describes it this way: ‘To understand why a banking crisis can have such enormous consequences for society, we need to know...

Read More »What is money?

from Tony Lawson and real-world economics review issue no. 101 What is money? Two sorts of answer to this question can be found in the modern literature. One locates money’s nature in the organising structure of human communities, the other in intrinsic properties of particular (money) items (like commodities, debts, precious metals and so on). If accounts of money that draw on social positioning theory are instances of the former, a currently very popular and seemingly increasingly...

Read More »Neoliberalism as an enabler of the spread of coronavirus

from Imad A. Moosa and real-world economics review issue no. 101 The spread of the Coronavirus was aided by unpreparedness, the fact that the private sector cannot deal with a pandemic, neoliberal policy makers who could not care less about ordinary people, and years of dismantling public health systems through privatisation. Since the 1980s, belief in the power of the market has led to a status quo where governments take a back seat, allowing the private sector to steer the economy for...

Read More »On the validity of econometric inferences

from Lars Syll The impossibility of proper specification is true generally in regression analyses across the social sciences, whether we are looking at the factors affecting occupational status, voting behavior, etc. The problem is that as implied by the three conditions for regression analyses to yield accurate, unbiased estimates, you need to investigate a phenomenon that has underlying mathematical regularities – and, moreover, you need to know what they are. Neither seems true. I have...

Read More »Weekend read – Four flaws in foundations of statistics

from Asad Zaman and the WEA Pedagogy Blog Rejecting Arbitrary Distributional Assumptions In the early 20th Century, Sir Ronald Fisher initiated an approach to statistics that he characterized as follows:: “… the object of statistical methods is the reduction of data. A quantity of data, which usually by its mere bulk is incapable of entering the mind, is to be replaced by relatively few quantities which shall adequately represent the whole …” As he clearly...

Read More » Real-World Economics Review

Real-World Economics Review