This video completes the quick demo of Minsky, and explains why "time constants" are such a useful concept for modelling monetary flows.

Read More »Quick demo of Minsky: dynamic modeling software, especially but not only of monetary economics 1/2

This is a very impromptu demonstration of building a simple monetary model in Minsky. It shows how to use "Godley Tables" to build and extend a model of monetary transactions

Read More »Quick demo of Minsky: dynamic modeling software, especially but not only of monetary economics 1/2

This is a very impromptu demonstration of building a simple monetary model in Minsky. It shows how to use "Godley Tables" to build and extend a model of monetary transactions

Read More »Coronavirus growth rates compared for Australia, Netherlands, Thailand, UK

This brief video shows the number of confirmed cases each day in these four countries, using a pre-release version of my new data analysis program Ravel. I hope to release an online accessible Dashboard of the Coronavirus using Ravel in the next two weeks. For more details, please see my Patreon page www.patreon.com/profstevekeen. I will make this pre-release version of Ravel free for anyone to download. If you would like to support its development, you can signup to my Patreon page, but...

Read More »Coronavirus growth rates compared for Australia, Netherlands, Thailand, UK

This brief video shows the number of confirmed cases each day in these four countries, using a pre-release version of my new data analysis program Ravel. I hope to release an online accessible Dashboard of the Coronavirus using Ravel in the next two weeks. For more details, please see my Patreon page www.patreon.com/profstevekeen. I will make this pre-release version of Ravel free for anyone to download. If you would like to support its development, you can signup to my Patreon page, but...

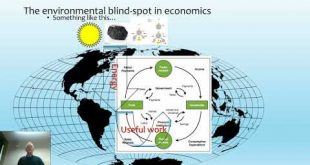

Read More »Climate Change Economics the right way and the fraudulent way

This is a talk I gave to students at Vrije Universiteit in Amsterdam yesterday--where Richard Tol has a fractional appointment. It's probably the most impassioned speech I have given on this topic to date. The more I delve into mainstream climate change economics, the more ludicrous attempts I find to reach a pre-ordained view that climate change is no big deal. One of my patrons put this very well: "Tol and Nordhaus, in my view, quite obviously reasoned backwards from a minimalist...

Read More »Climate Change Economics the right way and the fraudulent way

This is a talk I gave to students at Vrije Universiteit in Amsterdam yesterday--where Richard Tol has a fractional appointment. It's probably the most impassioned speech I have given on this topic to date. The more I delve into mainstream climate change economics, the more ludicrous attempts I find to reach a pre-ordained view that climate change is no big deal. One of my patrons put this very well: "Tol and Nordhaus, in my view, quite obviously reasoned backwards from a minimalist...

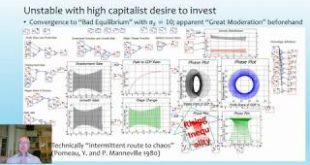

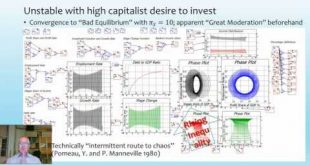

Read More »Minsky At 100. Deriving and validating the "Financial Instability Hypothesis"

For full details on this video, including the presentation slides and the Minsky models, please go to my Patreon site www.patreon.com/profstevekeen. This and most other posts there are freely available, though of course I would be pleased if you would sign up to support my work to reform economics by becoming a Patron for as little as $1 a month.

Read More »Minsky At 100. Deriving and validating the “Financial Instability Hypothesis”

For full details on this video, including the presentation slides and the Minsky models, please go to my Patreon site www.patreon.com/profstevekeen. This and most other posts there are freely available, though of course I would be pleased if you would sign up to support my work to reform economics by becoming a Patron for as little as $1 a month.

Read More »NIESR Macroeconomics of Sustainability Presentation

The "Rebuilding Macroeconomics" project established by the UK's Economic and Social Research Council (ESRC) has funded me to work with Tim Garrett and Matheus Grasselli to derive models of production that are consistent with the Laws of Thermodynamics. This seminar brought together the projects on the macroeconomics of sustainability, and it was my first opportunity to present what Tim, Matheus and I have achieved thus far. This focuses mainly on my approach, since Tim's is...

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch