Second of twelve videos showing the construction of models of the monetary aspects of Modern Monetary Theory in Minsky. Download Minsky from https://sourceforge.net/projects/minsky/files/beta%20builds/ and support Minsky's development at https://www.patreon.com/hpcoder/ for as little as $1 a month

Read More »Introduction to The Minsky Models of Modern Monetary Theory #TMMOMMT #MMT

This playlist shows the development of a model of the strictly monetary dimensions of Modern Monetary Theory. To use the models yourself, download the latest beta of Minsky from https://sourceforge.net/projects/minsky/files/beta%20builds/ (the demonstration uses features of Minsky that are not in the current release version). The models will be posted to my Patreon site https://sourceforge.net/projects/minsky/files/beta%20builds/ shortly. This post will be freely available--no paywall. This...

Read More »Introduction to The Minsky Models of Modern Monetary Theory #TMMOMMT #MMT

This playlist shows the development of a model of the strictly monetary dimensions of Modern Monetary Theory. To use the models yourself, download the latest beta of Minsky from https://sourceforge.net/projects/minsky/files/beta%20builds/ (the demonstration uses features of Minsky that are not in the current release version). The models will be posted to my Patreon site https://sourceforge.net/projects/minsky/files/beta%20builds/ shortly. This post will be freely available--no paywall. This...

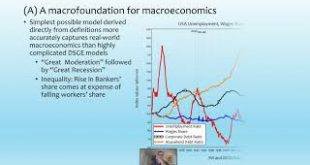

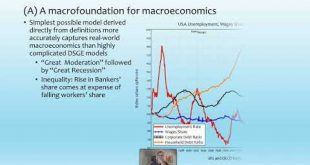

Read More »Thermodynamics 2.0 keynote: Macroeconomics, Minsky, & fraud in Neoclassical climate change economics

Thermodynamics 2.0 was the "bisociation of thermodynamics with other academic disciplines such as physics, biology, sociology, economics... It is about merging two cultures, not just bridging the gap." I argue proper scientific methods should take economics over, not merge with what is currently there. I show macroeconomics doesn't need microeconomics, illustrate modeling using the Minsky system dynamics software, & expose the appallingly bad work of Neoclassical climate...

Read More »Thermodynamics 2.0 keynote: Macroeconomics, Minsky, & fraud in Neoclassical climate change economics

Thermodynamics 2.0 was the "bisociation of thermodynamics with other academic disciplines such as physics, biology, sociology, economics... It is about merging two cultures, not just bridging the gap." I argue proper scientific methods should take economics over, not merge with what is currently there. I show macroeconomics doesn't need microeconomics, illustrate modeling using the Minsky system dynamics software, & expose the appallingly bad work of Neoclassical climate change economists

Read More »Introduction to Monetary Post Keynesian Economics

This is a talk I've prepared for the University of Basel, which has established on online plural economics lecture series as part of the official curriculum--a move that I congratulate the University for. I give a very brief overview of the content and history of Post Keynesian economics, and then focus on Hyman Minsky's Financial Instability Hypothesis, and my work on both modelling Minsky and explaining the role of credit in aggregate demand and income. This includes a very brief...

Read More »Introduction to Monetary Post Keynesian Economics

This is a talk I've prepared for the University of Basel, which has established on online plural economics lecture series as part of the official curriculum--a move that I congratulate the University for. I give a very brief overview of the content and history of Post Keynesian economics, and then focus on Hyman Minsky's Financial Instability Hypothesis, and my work on both modelling Minsky and explaining the role of credit in aggregate demand and income. This includes a very brief...

Read More »Building a SEIRD (Susceptible/Exposed/Infected/Recovered/Dead) model of the #Coronavirus in Minsky

For a complete explanation of this model and how it was developed, please check my @Patreon page https://www.patreon.com/posts/36379285. Like most of my posts there, this is free access, with no paywall.

Read More »Building a SEIRD (Susceptible/Exposed/Infected/Recovered/Dead) model of the #Coronavirus in Minsky

For a complete explanation of this model and how it was developed, please check my @Patreon page https://www.patreon.com/posts/36379285. Like most of my posts there, this is free access, with no paywall.

Read More »Quick demo of Minsky: dynamic modeling software, especially but not only of monetary economics 2/2

This video completes the quick demo of Minsky, and explains why "time constants" are such a useful concept for modelling monetary flows.

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch