The first ever Not the Nobel Prize in Economics was awarded to Mariana Mazzucato, who has specialised in analysing the actual role of governments in sponsoring and enabling innovation, in contrast to Neoclassical economics which simply assumes that governments have no role--or even a negative one--in innovation. I'll write a lengthier blog post on the event, and Mariana's work, on my Patreon site https://www.patreon.com/ProfSteveKeen, but for now I simply want to make available this video...

Read More »Not the Nobel Prize in Economics Event

Minsky Bug Fix

This short video shows a bug in a beta version of Minsky that made Godley Tables unusable, and its fix in the subsequent version. For more, go to www.patreon.com/profstevekeen

Read More »Workshop 05 Post Keynesian Dynamics using Minsky

Continuing on from Workshop 4, this workshop: Explains how to build a monetary model of capitalism in Minsky, using its Godley Tables; Explains the role of credit in aggregate demand and aggregate income; Shows how the data overwhelmingly confirms the Post Keynesian "Endogenous Money"/"Bank Originated Money and Debt" approach to macroeconomics and contradicts the Neoclassical "Loanable Funds", moneyless-macroeconomics; Explains that Minsky's Financial Instability Hypothesis was inspired by...

Read More »Workhop 06 Post Keynesian Dynamics using Minsky

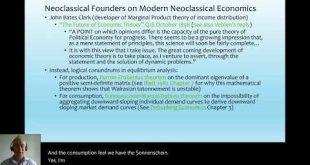

Following on from Workshop 5, this workshop: Includes a presentation of a Minsky model of the shadow banking sector by Nick Jackson, who built the model while doing his Masters degree with me at Kingston University London, and who is now working on shadow banking at the Bank of England; Introduces Pedro Pratas's Minsky model of the Portuguese economy, which he developed initially while doing a Masters degree in Portugal, and is now developing further for his PhD; Shows how Neoclassicals have...

Read More »Workshop 04 Post Keynesian Dynamics using Minsky

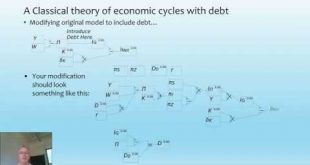

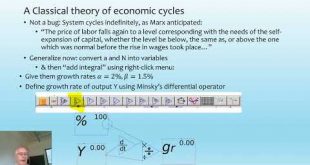

Building a model of Minsky's Financial Instability Hypothesis on the foundations of Goodwin's model; The emergent properties of this model: (1) A cyclically rising debt level (predicted by Minsky) (2) Rising inequality (probably expected by Minsky, but not predicted) and (3) Diminishing cycles in employment, economic growth, and inflation, before a crisis (totally unexpected); The pathetic reaction of Neoclassical economists to the Bank of England's paper rejecting Loanable Funds and...

Read More »Workshop 03 Post Keynesian Dynamics using Minsky

Building the basic Goodwin model in Minsky; Deriving the same model from macroeconomic definitions; Analysing its (in-)stability using its Jacobian matrix; Empirical test of the Goodwin model by Grasselli and Maheshwari; The red-herring of the current Neoclassical debate on the Phillips Curve; What Phillips actually said and was doing in the 1950s--building engineering-style nonequilibrium models of the economy;

Read More »Workshop 02 Post Keynesian Dynamics using Minsky

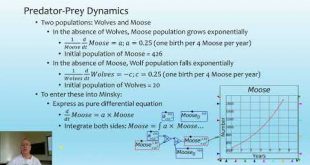

Following on from the first workshop, this video covers (1) The design of a basic predator-prey model in Minsky; (2) The first computer-simulated model of complex systems, Lorenz's model of turbulent fluid dynamics that gave the world "the butterfly effect""; (3) The basic logic of Goodwin's Growth Cycle model, which was based on Marx's verbal model of economic cycles in Capital I Chapter 25.

Read More »Workshop 01 Post Keynesian Dynamics using Minsky

This is the first in a set of six lectures/workshops I gave to students at the "Summer Academy for Pluralist Economics 2019: Economics in Transformation" held in Thuringia, Germany on August 9-16, 2019. It follows a set of five lectures on the history of Post Keynesian economics by Elisabeth Springler of the Technical College of the BFI in Vienna. This introduction covers the (non-)history of dynamic analysis in economics, and the basics of designing a model in Minsky, the Open Source...

Read More »Gisellian demurrage currency

Dr. Keen, I am wondering if you have ever seriously considered issuance of Gisellian currency for countries facing unplayable debt (all of them, as far as I know). The scheme I am imagining would have these govts paying off bonds due with G-currency. Bondholders would then, ASAP, spend it on real items in the economy, where it would eventually end up as wages, where workers would spend it, ASAP, on taxes and consumer goods. The demurrage, say 12%/year (= 12 x...

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch