The "Rebuilding Macroeconomics" project established by the UK's Economic and Social Research Council (ESRC) has funded me to work with Tim Garrett and Matheus Grasselli to derive models of production that are consistent with the Laws of Thermodynamics. This seminar brought together the projects on the macroeconomics of sustainability, and it was my first opportunity to present what Tim, Matheus and I have achieved thus far. This focuses mainly on my approach, since Tim's is...

Read More »Keen Amsterdam Rethinking Economics 01

This is a critique of the truly appallingly bad work done by Neoclassical economists on climate change.

Read More »Keen Amsterdam Rethinking Economics 01

This is a critique of the truly appallingly bad work done by Neoclassical economists on climate change.

Read More »Keen 2019 Rethinking Economics Amsterdam 02

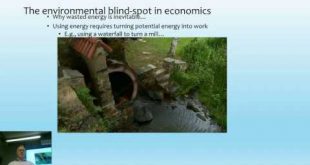

This part of my talks shows how Energy can be introduced into economic modelling properly, as the essential input without which no output is possible, and whose use necessarily generates waste.

Read More »Keen Workshop Climate Change Energy Minsky 03

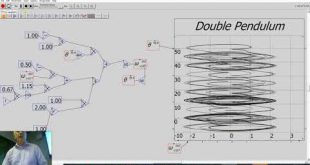

This is a quick demonstration of how to build a basic monetary model in Minsky, which you can download from https://sourceforge.net/projects/minsky/. Also consider signing up for as little as $1/month to the Minsky Patreon campaign at https://www.patreon.com/hpcoder/. This provides some development funds for Minsky, and lets you communicate with other Minsky users.

Read More »The Macrofoundations of Macroeconomics

The Neoclassical desire for sound foundations for macroeconomics was a laudable objective, but their attempt to base macroeconomics on microeconomics was fatally flawed. You can't derive a higher level analysis from a lower level one, and Neoclassical micro itself is a series of myths. Instead, macroeconomics can be derived directly and easily from macroeconomic definitions. The resulting model is Minsky's "Financial Instability Hypothesis", and it explains many facets of the real world...

Read More »Durham Macrofoundations For Macroeconomics Q&A Session

This is the discussion following on from my talk to the Durham Society for Economic Pluralism (https://durhampluralism.com/).

Read More »Durham Pluralism Macrofoundations For Macroeconomics Talk

Microfoundations for macroeconomics are not merely unnecessary, they are a positive hindrance to developing a realistic macroeconomics. I explain how macroeconomic definitions provide a incontestable macrofoundations for macroeconomics. A simple model derived by differentiating macroeconomic definitions with respect to time, and using the simplest possible assumed relationships between system states, generates the stylized facts of the last thirty years: a rising private debt to GDP ratio,...

Read More »Keen at Aberdeen Shifting Paradigms 2019

The incredible inertness of paradigms in economics I gave this talk to the “Shifting Paradigms” conference run by the Aberdeen Political Economy Group in November 2019. It was a good opportunity to not only comment on the theme of the conference itself—how one might displace Neoclassical Economics, the long-dominant paradigm in economics—but also to sketch out what I believe that alternative paradigm could be. In a sentence, I believe that the main reason for the persistence of the...

Read More »Loanable Funds versus Bank Originated Money & Debt

This video is to support Rethinking Economics' campaign to reform the teaching of banking and money in macroeconomics. See https://www.smartsurvey.co.uk/s/RE_RROB_OpenLetter/ for the campaign.

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch