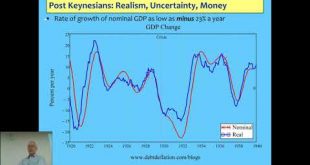

The defining question for Post Keynesians was put by Hyman Minsky in 1982: "Can "It"-a Great Depression-happen again? And if "It" can happen, why didn't "It" occur in the years since World War II? These are questions that naturally follow from both the historical record and the comparative success of the past thirty-five years. To answer these questions it is necessary to have an economic the ory which makes great depressions one of the possible states in which our type of capitalist...

Read More »Kingston University Becoming an Economist Lecture 03: The Austrians

The core question posed by Austrian economists (beginning with Menger) was "how does innovation and change occur in a market economy?". Though they shared many of the same concepts as the mainstream--supply and demand analysis, and the belief that "value" was subjective rather than objective--they diverged on many others, especially on how much knowledge could be had about the economy. Neoclassicals began with attempting to analyse the economy as if it were in equilibrium, because their...

Read More »Kingston University Becoming an Economist Lecture 02: The Mainstream

Mainstream "Neoclassical" Economics began with the legitimate question, first posed by Leon Walras in the 1870s, of "can a set of interdependent markets reach equilibrium where supply equals demand in every market, without any central coordination?" He invented the model of "tatonnement": he imagined that all traders for all markets met in a room with an auctioneer who starting from a random set of prices, kept adjusting prices to try to have demand equal supply for all commodities, and only...

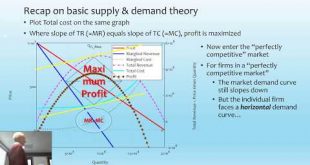

Read More »Kingston Masters Political Economy Lecture 02: Fallacies in the theory of demand

This second lecture covers the standard exposition of supply and demand theory, and then explains how the individual demand curve is derived, which obeys the so-called "Law of Demand", that demand necessarily falls for a product when its relative price rises. I then cover the Sonnenschein-Mantel-Debreu theorem, which shows that this "Law" does not survive aggregation: when you consider more than one consumer in isolation, the "income" and "substitition" effects of a relative price change...

Read More »Kingston Masters Political Economy Lecture 01: Methodology and the Supply Curve

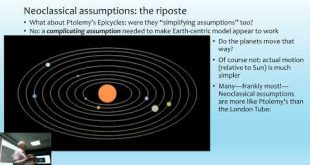

This first lecture introduces my section of this subject: five lectures on Neoclassical economics, three on Post Keynesian, and two on Marxian. I start this lecture with the criticisms of Neoclassical economics by The Guardian's Economics Editor Larry Elliott, and the response of several IFS (Institute for Fiscal Studies) economists arguing that Elliott misunderstood the role of simplifying assumptions in economics. They draw an analogy between simplifying assumptions in economics and the...

Read More »Becoming An Economist 2018-19 Lecture 01: Paradigms and Anomalies

This is the first of ten lectures for the Kingston University Economics Undergraduate course Becoming an Economist (EC4001). It starts with the fact that economists disagree with each other because they follow different "paradigms" about what economics is. I compare the state of economics today to the state of astronomy half a millenium ago, when the empirically accurate but completely wrong Ptolemaic Earth-centric model of the Universe was challenged by the initially less empirically...

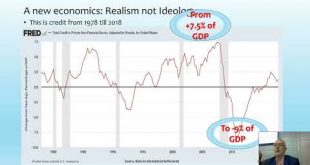

Read More »Keen OECD NAEC 2018 Realism Not Ideology

The OECD established NAEC ("New Approaches to Economic Challenges"; see http://www.oecd.org/naec/) in response to its failure to warn of the economic crisis that began in August 2007, and which led, a year later, to the collapse of Lehman Brothers. This is my ten minute talk to NAEC's conference "10 Years after the failure of Lehman Brothers: What have we learned?" (see http://www.oecd.org/naec/10-years-after-the-crisis/). I cover the simple reason why mainstream economists didn't see the...

Read More »Tenth Anniversary Lehman Brothers at the European Parliament

I took part in a forum entitled "R.I.P. Lehman Brothers! Have we learned any lessons?". [If you like my work, then consider supporting me on Patreon for as little as $1 a month: https://www.patreon.com/ProfSteveKeen] I argued of course not: equipped with a dominant economic theory in which such crises were impossible, and with a financial sector holding politicians in its thrawl, the emphasis has been on learning as little as possible. I begin with a paper from 2010 by Lee Ohanian, once a...

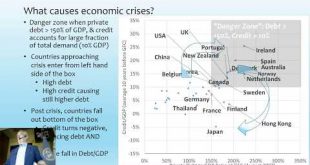

Read More »How private debt and credit cause financial crises

It should be obvious: financial crises are caused by the financial sector, and its primary product is debt, which is necessarily created when credit-money is created. And borrowers only commit to additional debt because they wish to spend, so there is an intimate link between private debt, credit, and demand. But it's not obvious to economists, because they convinced themselves, as long ago as the early 1800s, that money didn't matter: the economy was really a barter system, obscured by the...

Read More »Banking and “The Money Multiplier”

"Fractional Reserve Banking" and "The Money Multiplier" are two of the most reviled aspects of the current monetary system for libertarian and Austrian inclined thinkers. Post Keynesian thinkers like myself and leading Central Banks argue that these things don't exist: they're economic textbook models that are in fact fundamentally wrong, and people railing against them like my good mate Mish Shedlock are in fact "tilting at windmills" (see...

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch