This short video illustrates why banks, debt and credit matter in macroeconomics, by starting from the Neoclassical vision of the world in which it's OK to ignore those issues. I model the Neoclassical "Loanable Funds" model in my system dynamics program Minsky, and it's easy to see why they ignore banks, debt and money in their macroeconomics. If they were right about banks merely being intermediaries, then private debt wouldn't matter to the macroeconomy. However, it takes about 30...

Read More »Can We Avoid Another Financial Crisis? My New City Agenda talk at House of Commons

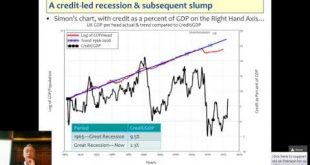

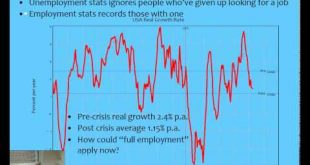

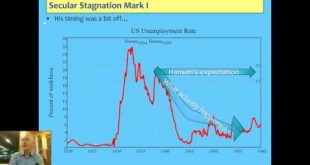

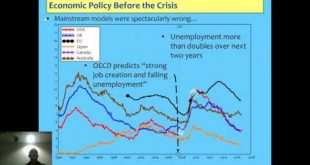

This talk on whether we can avoid another financial crisis, and what caused the last one, was arranged by New City Agenda (http://www.newcityagenda.co.uk/keen) and held in a committee room of the House of Commons. I cover what caused the crisis (credit), why mainstream economics erroneously ignores credit, and the empirical data showing which countries face continued stagnation, and which countries face a future private debt crisis.

Read More »Support me at https://www.patreon.com/ProfSteveKeen. Share widely.

Support my work on Patreon. Help keep pluralist economics alive, for as little as $1 a month: https://www.patreon.com/ProfSteveKeen The teaching of pluralist economics at Universities will die thanks to the "marketisation" of Higher Education in the UK. So I'm going to the public to get funding to continue getting the pluralist message out, and to continue developing a realistic economics for the post-Crash economy.

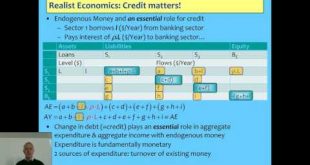

Read More »How Endogenous Money changes Macroeconomics because credit is part of aggregate demand & income

This lecture to my Kingston Globalisation & Financialisation class elaborates on the role of credit in macroeconomics, which is only apparent if you realise that money is created (and destroyed) by lending by (and debt repayment to) the banking sector. This is ignored by Neoclassical economists, who continue to believe in the fantasy model of Loanable Funds, despite the Bank of England saying emphatically in 2014 that the endogenous money model is correct and the loanable funds model is...

Read More »Credit & Crisis (with Spanish translation)

I gave this talk at UNAM in Mexico City. I cover why credit matters in macroeconomics, why the crisis occurred, and why many countries (not including Mexico!) face a financial crisis in the next 1-3 years. The content is the same as my previously placed talk in Mexico; this one just has a Spanish translation as well (apologies for the poor sound!) The content is also almost identical to my talk last week in Norway, with brief closing remarks on Mexico taking the place of the same on Norway.

Read More »Presentation at UDLAP Mexico City on why Trump happened, credit and economic crises

I gave this talk at the excellent Masters program facilities of UDLAP (http://www.udlap.mx/inicio.aspx) in Mexico City. I cover why credit matters in macroeconomics, why the crisis occurred, and why many countries (not including Mexico!) face a financial crisis in the next 1-3 years. I will post another version of this talk, given at UNAM, which also has a Spanish translation of my remarks. The content is almost identical to my talk last week in Norway, with brief closing remarks on Mexico...

Read More »Banking, Credit & Norway

This was an invited talk during Oslo University's "Week of Current Affairs", so though my talk covered the global issues of credit and economic cycles, I paid particular attention to Norway, which is one of the 9 countries I have identified as very likely to experience a credit crunch in the next few years.

Read More »Kingston Becoming an Economist L10: Why the money multiplier model is false 2/2

This completes the lecture; I had to make the screen resolution lower so that the Godley Table could be read by students. Of course I'd rather be able to magnify the Table within the program, but that takes money for software development which at the moment I don't have. You may be able to help on this front though, in a few month's time, when I launch an appeal on Patreon: https://www.patreon.com/. My videos will no longer be freely available, but as little as $1 a month to see them will...

Read More »Kingston Becoming an Economist L10: Why the money multiplier model is false 1/2

The actual focus of this lecture was monetary policy after the crisis, and in particular unconventional monetary policy or QE. But to explain why it has given far less bang for the buck than economic theory expected, I had to explain why the money multiplier model of money creation is nonsense.

Read More »The Role of Energy In Production (with discussion)

This is a slightly expanded presentation on developing a model of production in which energy plays an essential role, and it includes a recording of the very useful discussion that followed with my Kingston colleagues and students. I critique the Labor Theory of Value as well as the Neoclassical model of production and distribution in this talk.

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch