This talk at an Association for Heterodox Economists workshop for PhD students. I explain the concept of system dynamics, and Minsky's unique feature of Godley Tables that generate financial flow equations using double entry bookkeeping. Download Minsky from https://sourceforge.net/projects/minsky/.

Read More »Keen 2016/7 Financialisation 02 Value And Dialectics

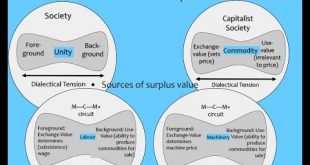

Most of my lectures annoy Neoclassicals; this one is going to annoy Marxists. Using the energy-aware production function derived in the previous lecture, I argue that the "Labour Theory of Value" asserts that production is entirely a function of the energy input to unskilled labour--which is absurd. I then explain the dialectical interpretation of Marx, which thankfully contradicts the "Labour Theory of Value" and is also compatible with an energy-based model production. It also provides a...

Read More »Infrastructure conference in Westminster Tuesday 24th

A new organisation called NEKS (for “New Economic Knowledge Services”, see www.neks.ltd) is holding its inaugural conference on the economics of infrastructure In Westminster on Tuesday January 24th, and you should attend. Why NEKS, and why Infrastructure? The economic importance of infrastructure is obvious, but the actual performance of infrastructure often differs radically from what is predicted when it is being planned. Three forms of delusion make many infrastructure...

Read More »Keen 2016/7 Financialisation01 Value And Thermodynamics

What is "value"? I take the question back to the basics of how is it that we can produce a net output? The answer has to be consistent with the Laws of Thermodynamics, and on that basis, every school of thought from the Neoclassicals to the Marxists, is wrong. I introduce a new production function in which energy plays an essential role. I've previously posted a video on this topic, but this is my first presentation of the concepts to a group of students.

Read More »Teaching Economics the Pluralist Way: no more airbrushed economics from any school

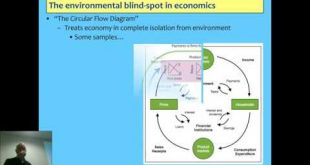

This is a speech I gave to the Amsterdam Rethinking Economics students when they launched their survey on the state of economics teaching in The Netherlands, laving out key principles for teaching economics the pluralist way: 1 Teach Honestly: Give a “Warts and All” treatment of every school 2 Read the original sources—journals & books—not textbooks 3 Let experts teach maths & computing, not economists 4 Facts exist & are not theory-neutral 4.1 Rules of accounting versus Money Multiplier...

Read More »Teaching Economics the Pluralist Way

This is a talk I gave in Amsterdam to launch the Amsterdam Rethinking Economics critique of the current state of economics “education” in the Netherlands. The text of my slides is reproduced below. [embedded content] Teaching Economics the Pluralist Way Steve Keen Kingston University London IDEAeconomics Minsky Open Source System Dynamicswww.debtdeflation.com/blogs General Principles Teach Honestly: “Warts and All” treatment of every school –Read the original sources—journals...

Read More »Prof. Steve Keen on private debt and his solution people’s QE

I’ve had some tough interviews over the years (such as the BBC HARDtalk! interview earlier this year with Stephen Sackur), but I’d have to credit the student interviewers at the University of Amsterdam’s Room for Discussion event with giving me the toughest, well-informed grilling my ideas have had in public. I’m following up later today with a keynote speech at the Dutch Rethinking Economics event tonight, and I’ll post that here later this week. [embedded content]...

Read More »The Role of Energy in Production. Explaining “Solow Residual” as energy’s contribution to output

Economic theory has failed to incorporate the role of energy in production for two centuries since the Physiocrats. In this video I derive a production function that includes energy in an essential manner. It implies that economic growth has been driven by the increase in the energy throughput capabilities of machinery. NOTE: As a viewer pointed out, I should set alpha to 0.3 rather than 0.7 here. I swapped usual treatment of which input was raised to alpha but forgot to swap the values as...

Read More »My Speech at Occupy Sydney Five Years Ago

Apparently it’s the fifth anniversary of the day I gave this talk, to the Occupy movement in Sydney, in Martin Place, right outside the offices of the Reserve Bank of Australia. The day after, the site was shut down by the police. It seems I was jinxed, because the same thing happened in New York, the day after I simply dropped off a couple of copies of my book Debunking Economics. The speech holds up pretty well, though I’ve developed my technical arguments a lot since then....

Read More »Real Vision interview excerpts. Finance sector as a good servant but lousy master of capitalism

I was interviewed by the Raoul Pal Real Vision online investor TV program recently. This five minute excerpts covers some of the main points, including the cause of the 2008 crisis, and why mainstream economists missed it; why the economy is moribund today; how a "modern debt jubilee" could reduce private debt and enable a recovery in credit-based demand to occur; and the need to reform the finance sector so that it is profitable for it to finance entrepreneurs rather than asset bubbles....

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch