This interview, which was just recorded today, will go to air tomorrow. The broadcast details are: BBC News Channel: 02.30 BST, 04.30 BST and 20.30 BST Tuesday 16th August 2016, and 00.30 BST Wednesday 17th August 2016 And from the 04.30 TX it will then be available within the UK on BBC iPlayer for one year. BBC World News Channel: 03.30 GMT; 08.30 GMT; 14.30 GMT and 19.30 GMT Tuesday 16th August 2016 It will also go out at numerous timeslots on Friday on the BBC World Service....

Read More »The Big Idea about Private Debt

This is a talk I gave to the Northern Ireland Big Ideas Event organised by NICVA: the "Northern Ireland Council for Voluntary Action" (http://www.nicva.org/event/big-ideas-festival-of-economics). Unfortunately I ran out of time to finish my presentation on why a "Modern Debt Jubilee" is needed to escape from the current economic state of credit stagnation, but I covered why it is this--and not "secular stagnation" that explains the prevalence of low rates of economic growth globally.

Read More »The need for pluralism in economics

For decades, mainstream economists have reacted to criticism of their methodology mainly by dismissing it, rather than engaging with it. And the customary form that dismissal has taken is to argue that critics and purveyors of alternative approaches to economics simply aren’t capable of understanding the mathematics the mainstream uses. The latest instalment of this slant on non-mainstream economic theory appeared in Noah Smith’s column in Bloomberg View: “Economics Without Math...

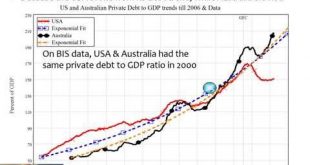

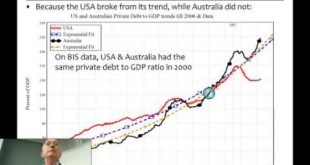

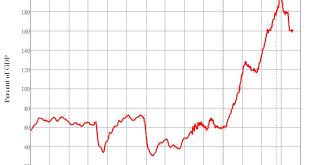

Read More »Why Australia (& Canada, Korea, China and others) can’t avoid a recession

Australia and South Korea were the only OECD nations to avoid a recession at the time of the Global Financial Crisis in 2008. I argue that they and several other countries--including China and Canada--face a recession in the near future, because the way they avoided the GFC was by continuing to borrow their way to prosperity.

Read More »Inequality, Debt and Credit Stagnation

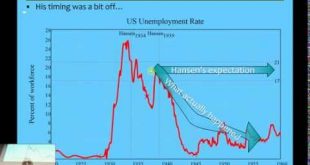

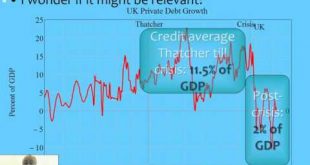

This was my keynote speech at the French Association for Political Economy (AFEP) annual conference in Mulhouse, France (the other keynote was given–in French–by my good friend Marc Lavoie, who is now based at the University de Paris 13). In this presentation, I: Disparage the “secular stagnation” explanation that Larry Summers has regurgitated for the tepid level of economic growth today. As did Hansen in the 1930s, Summers ponders “why growth would remain anaemic in the absence...

Read More »Inequality, Debt and Credit Stagnation

What Larry Summers calls "secular stagnation"--which blames the limp economy on slower population growth and technical change--is actually "credit stagnation" due to too high a level of private debt. I explain the logic behind credit being an essential component of aggregate demand and income; the empirical consequences--including stagnation in the "Walking Dead of Debt" countries and coming crises in the "Future Zombies" countries; and a complex systems approach to economic modeling which...

Read More »What next after Brexit?

A cliché—“Expect the Unexpected”—has happened. As I noted in “The Divisive Brexit Vote”, though I favoured Brexit, I took the opinion polls at face value, and expected that Britain as a whole would vote to remain in the EU. Instead, in the largest electoral turnout in twenty years, the UK voted 52:48 in favour of leaving the EU. I’ll leave a post-mortem of the vote itself for later; the main interest now is what will happen because of it. Many pundits from the Center, Left and...

Read More »The Divisive Vote Over Brexit

Andrew Watt has written a passionate critique of my support for Brexit (“Progressive economists should support Remain not Brexit – a response to Steve Keen”), and it highlights a key feature of this peculiar referendum: people who normally find themselves on the same side in most economic and political debates have been divided by this referendum. Andrew comments that he broadly agrees with my economic analysis on most issues, but vehemently opposes me here. Likewise, good friends...

Read More »There has to be a better way

Note: This was published as my last column on Business Spectator on April 6th, but it’s now gone missing after News Ltd merged BS with its own in-house stable and changed all the URLs. Given the election and Elizabeth Farrelly’s excellent thought piece in the Sydney Morning Herald “The great tragedy of Malcolm Turnbull“, I thought it was a good time to revive it. One of the disadvantages of growing up is finding in your old age that people you never took seriously in your youth...

Read More »Talk to Momentum at Bedford

Ann Pettifor and I amongst others warmed up for a talk by the Deputy Leader of the Labour Party, John McDonnell. This gave me a chance to put my major theme--that economic crises are caused by private debt bubbles--directly to a potential Chancellor of the Exchequer

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch