My presentation to the "MOSES" seminar in Linkoping, Sweden, on Minsky as a way to include modeling of financial dynamics in a revised and updated model of the "Limits to Growth"

Read More »CERN Discovers New Particle Called The FERIR

CERN has just announced the discovery of a new particle, called the “FERIR”. This is not a fundamental particle of matter like the Higgs Boson, but an invention of economists. CERN in this instance stands not for the famous particle accelerator straddling the French and Swiss borders, but for an economic research lab at MIT—whose initials are coincidentally the same as those of its far more famous cousin. Despite its relative anonymity, MIT’s CERN is far more important than its physical...

Read More »Zombies-To-Be and the Walking Dead of Debt

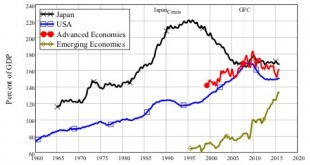

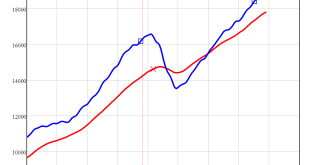

Using the dynamics of credit–which most other economists ignore–I explain why Japan, the USA and UK are among the “Walking Dead of Debt” and why China, Canada, Australia and South Korea are on their way to joining the Debt Zombies. This presentation is based on work I’m doing for a new 25000 word book for Polity Press entitled “Can we avoid another financial crisis?”, which should be published later this year. [embedded content]

Read More »Zombies-To-Be and the Walking Dead of Debt

Using credit--which most other economists ignore--to explain why Japan, the USA and UK are among the "Walking Dead of Debt" and why China, Canada, Australia and South Korea are on their way to joining the Debt Zombies. This presentation is based on work I'm doing for a new 25000 word book for Polity Press entitled "Can we avoid another financial crisis?"

Read More »Transcending the Lucas Critique & simple dynamic modelling with Minsky

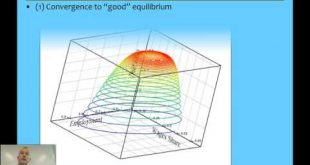

The Lucas Critique has ruled economics for the last 40 years, and led it into a dead-end as well. In this talk to the Economics for Everyone conference run by the Post Crash Economics Society in Manchester, I argue that micro-founded models fail because of the emergent properties that characterise complex systems. An alternative approach that transcends Lucas’s well-founded objection to ad-hoc model-building is to build models from strictly true macroeconomic identities. I show that three...

Read More »Transcending the Lucas Critique with Minsky. My talk in Manchester Economics For Everyone

I show that working from strictly true macroeconomic identities leads to Minsky's model of financial instability. I also build a Minsky model from scratch, showing the various features in the Open Source system dynamics program Minsky https://sourceforge.net/projects/minsky/). My talk in Manchester Economics For Everyone

Read More »Talk to Bristol University Rethinking Economics Society

This is the same talk that I gave in my inaugural lecture at Kingston, spiced by some exchanges with some of the Bristol University economics staff. I cover a realist alternative to the "Lucas Critique" argument that macro models must be developed from microfoundations, explain my model of Minsky, and show that it is empirically supported by the qualitative data of capitalism's two big booms and busts--1920-1940 and 1990 till today.

Read More »Are we facing a global “Lost Decade”?

This is an invited paper by the Private Debt Project, an initiative of the philanthropic organization the Governor’s Woods Foundation to raise awareness about the economic importance and dangers of private debt. The era of low growth known as Japan’s “Lost Decade” commenced in 1990, and persists to this day. While most authors acknowledge that the seeds for the Lost Decade were sown by excessive credit growth in the preceding Bubble Economy years, only Richard Koo (Koo, 2009, Koo, 2011,...

Read More »The Seven Countries Most Vulnerable To A Debt Crisis

For decades, some of the most important data about market economies was simply unavailable: the level of private debt. You could get government debt data easily, but (with the outstanding exception of the USA—and also Australia) it was hard to come by. That has been remedied by the Bank of International Settlements, which now publishes a quarterly series on debt—government & private—for over 40 countries. This data lets me identify the seven countries that, on my analysis, are most...

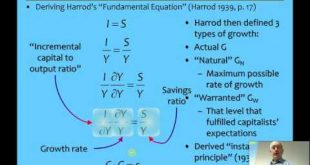

Read More »Introduction to mathematics of analyzing nonlinear dynamic models

Economists have done dynamics very badly, from the bastardisation of the original Harrod unstable growth model by Hicks, through to today's DSGE models which pretend that a saddle node equilibrium can be an attractor. This lecture uses basic mathematical techniques to show that "multiplier-accelerator trade cycle models" aren't models at all, and explains the basics of working out the dynamical properties of low-order (3 or below) systems of nonlinear differential equations, using the...

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch