The Council on Economic Policies and the Bank of England are organising a workshop on this topic to be held at the Bank on November 14-15 2016. A call for papers has just been put out, with a deadline of June 30th. Background Climate change and other environmental challenges are moving up policy agendas worldwide. Nonetheless, the potential implications of environmental risks and scarcities for central banking as well as the linkages between financial regulation, monetary policy and...

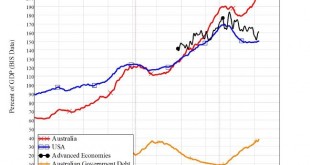

Read More »Get ready for an Australian recession by 2017

For the last 25 years, Australian politicians of both Liberal and Labor hue have been able to brag that, under their stewardship, Australia has avoided a recession. Those bragging rights are about to come to an end. During the life of the next Parliament — and probably by 2017 — Australia will fall into a prolonged recession. Click here to read the rest of this post, and here to download the Excel file showing the link between a slowdown in the rate of growth of debt and a recession....

Read More »Spanish translation of Debunking Economics

I was recently informed that a Spanish translation of Debunking Economics is now available via Amazon Spain, under the title “La Economía Desenmascarada“ There’s one review so far: Hay que agradecer que se haya traducido al español, dicho sea en primer lugar. Podría considerarse este libro como un ‘antimanual’ de los textos que se enseñan en la mayor parte de las facultades del mundo; es, por tanto, atendiendo a las patrañas con las que se ‘intoxica’ las mentes de los estudiantes, un...

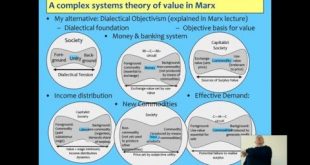

Read More »Modelling Financial Instability using Minsky

I start with a discussion of how economic models should be developed--rejecting the microfoundations approach of Neoclassical economics & instead arguing that we should start from undeniably true economic identities. I develop Goodwin's model of cyclical growth in Minsky (https://sourceforge.net/projects/minsky/), extend this to include debt and show that this simple model generates both a "Great Moderation" and a debt crisis. I then show that this same model is the simplest possible...

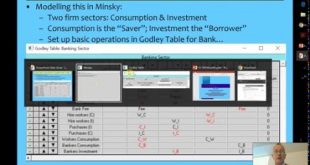

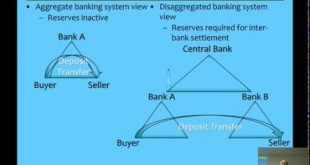

Read More »Macroeconomics of Loanable Funds & Endogenous Money compared using Minsky

The mainstream economic idea that banks are just intermediaries between savers and investors is a fantasy, but given that fantasy, their argument that the level and rate of change of private debt are not macroeconomically significant (except at the “Zero Lower Bound”) is correct. But in the real world, the role of the level and rate of change of private debt is crucial. I illustrate this by building a Minsky model of Loanable Funds and converting it to the real world of Endogenous Money....

Read More »Macroeconomics of Loanable Funds & Endogenous Money compared using Minsky

The mainstream economic idea that banks are just intermediaries between savers and investors is a fantasy, but given that fantasy, their argument that the level and rate of change of private debt are not macroceonomically significant (except at the "Zero Lower Bound" is correct. But in the real world, the role of the level and rate of change of private debt is crucial. I illustrate this by building a Minsky model of Loanable Funds and converting it to the real world of Endogenous Money. Then...

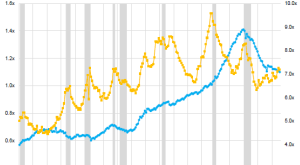

Read More »Laughter–the Worst Medicine

Like many commentators, I regard August 9 2007 as the start of the “Global Financial Crisis“. On that day, BNP Paribas declared that several of its funds were being closed because liquidity in those markets had completely evaporated: So I was particularly amused–in a sick sort of way–to see this brilliant info-graphic on The Fed on Twitter today: it plots the amount of laughter in FOMC meetings between 2000 and 2012. “Peak Laughter” occurred literally days before the crisis began:...

Read More »Kingston Uni releases monetarily sound forecast model of US Economy

PERG economists are developing a macroeconometric model to track the evolution of the US economy over the medium term, which is 3-5 years: KFBM Macroeconomic Outlook Issue 1 February 2016 The model belongs to the family of “financial balances models”, an approach pioneered by Wynne Godley and collaborators at Cambridge University (UK) and then successfully developed by the macroeconomics team of the Levy Institute – led by Godley himself. At its heart, the KFBM (Kingston Financial Balances...

Read More »Tilting At Windmills: The Faustian Folly Of Quantitative Easing

As I explained in my last post, banks can’t “lend out reserves” under any circumstances, which undermines a major rationale that Central Bank economists gave for undertaking Quantitative Easing in the first place. Consequently, the hope that Bernanke expressed in 2009 is “To Dream The Impossible Dream”: To dream the impossible dream To fight the unbeatable foe To bear with unbearable sorrow To run where the brave dare not go Former Chair of the Federal Reserve Ben Bernanke listens while...

Read More »Modelling Graziani’s insights on money & proving that banks can’t lend Reserves

I am a huge fan of Augusto Graziani, because I could never have developed my own monetary technology without his logical insights into the true nature of money. But he and the Circuitist School in general went wrong when they tried to move from philosophy to the mathematics of endogenous money, because they made numerous stock-flow confusions because (a) having been taught by Neoclassical economists, they fell back into inappropriate equilibrium thinking; (b) with only basic training in...

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch