Thomas Piketty's Capital has rightly focused attention on economic inequality, but his explanation of why it occurs is not compelling. I explain the simple "network" effect behind inequality in phenomena from earthquakes to income and then outline work by myself, Matheus Grasselli and Gael Giraud that argues that rising inequality is a sign of impending economic breakdown.

Read More »Lecture10: Not Learning From the History of Money

The world has failed to learn from previous financial crises because a naive model of money--the "Fractional Reserve Banking" model--dominates how we interpret them, despite this model being wildly at odds with the actual mechanics of banking and with history itself.

Read More »Keen Grasselli Giraud on Debt, Inequality, Crisis & Piketty

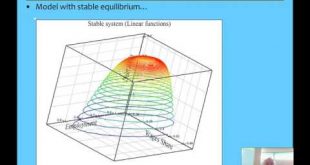

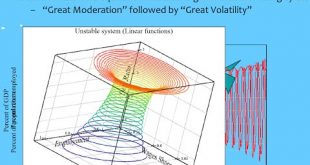

I explain the genesis of my model of Minsky's Financial Instability Hypothesis, and provide an extension of it which includes price dynamics. The mathematicians Matheus Grasselli and Gael Giraud follow with a variation of the model that approaches debt dynamics from the household perspective. Together they provide an analytic perspective on Piketty's claims about the causes of rising inequality.

Read More »The Economic Crisis And The Crisis In Economics

The economic crisis in 2008 was an anomaly for economic theory, but par for the course for the economy itself, since, as Hyman Minsky asserted, "capitalism is inherently flawed, being prone to booms, crises and depressions. This instability is due to characteristics the financial system must possess if it is to be consistent with full-blown capitalism. Such a financial system will be capable of both generating signals that induce an accelerating desire to invest and of financing that...

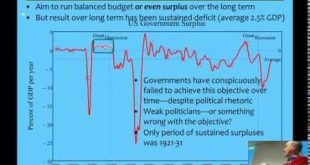

Read More »Lecture 09: Austerity, Budget Surpluses and “Sound Finance”

How sound is "Sound Finance"? The logic behind running a budget surplus. The arguments for and against "Expansionary Fiscal Austerity" and "Functional Finance".

Read More »Lecture 08 Unconventional Monetary Policy: The Fallacies underlying Quantitative Easing

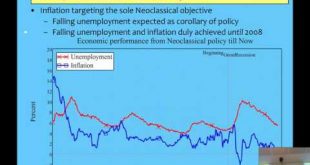

Conventional and unconventional monetary policy both suffer from the same flaw: they are based on unrealistic models of how a market economy operates. I give a very fast overview of the (de-)evolution of macroeconomic policy from the Post-War "Keynesian" period through to the Neoclassical ascendancy, before the Global Financial Crisis ushered in both zero reserve interest rates and Quantitative Easing.

Read More »Keen 2015 Betty Sinclair Talk: complexity economics as the alternative to Neoliberalism & Marxism

This was my first talk at this annual event for community and union activists, which is organized by Trademark Belfast (http://www.trademarkbelfast.com/). I gave a rather free-form presentation covering my own period as a conference organizer for trade unions, the reasons the Left comprehensively lost the intellectual battle with the Right in the 1970s, and the need for progressive thinkers to develop a realistic analysis of capitalism, rooted neither in the barren "Labor Theory of Value"...

Read More »The Power And The Impotence Of The ECB

I’ve attended two conferences in two days where both the power and the impotence of the European Central Bank (EBC) have been on vivid display. Its political power is considerable, both in form and in substance. At both seminars, the ECB speaker—ECB Board member Peter Praet at the first, and ECB President Mario Draghi at the second—spoke first, and then left. In form, the ECB has no need to defend its policies because it is unimpeachable in its execution of them. In substance, it does not...

Read More »Lecture 07: Why the Euro is destroying Europe

The Euro was intended to unite Europe, and it has abjectly failed to do so. However ironically it has helped unite the economics profession, since one thing that economists from most walks of life can agree on is that the Euro was and is a bad idea. This lecture explains the critiques of the Euro and why the Euro has turned the economic crisis of 2008 into a localized Great Depression.

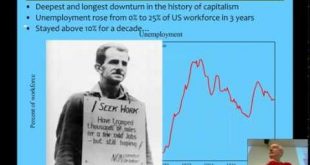

Read More »Lecture 6 on Minsky, Financial Instability, the Great Depression & the Global Financial Crisis

I explain Minsky's Financial Instability Hypothesis--why he developed it, what were his inspirations, how well it fits the empirical record, and how it can be modeled easily using system dynamics methods. For some reason my webcam froze for the 1st half of the lecture; I start moving in the second half...

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch