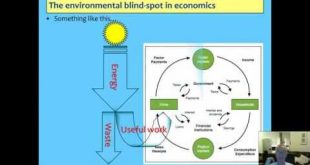

The position of the economy in the environment is a shared blindspot in economics: no existing school handles the topic well, and yet this is the key issue we need to understand. I explain the Laws of Thermodynamics–as well as I could in an introductory class without using mathematics–and provide some links to important topics that students wouldn’t normally hear about in an economics degree. [embedded content] Click here for the Powerpoint slides....

Read More »Lecture05 Why Economists Disagree: The common blindspot on the Environment,

The position of the economy in the environment is a shared blindspot in economics: no existing school handles the topic well, and yet this is the key issue we need to understand. I explain the Laws of Thermodynamics--as well as I could in an introductory class without using mathematics--and provide some links to important topics that students wouldn't normally hear about in an economics degree.

Read More »Becoming An Economist Lecture 4: Post Keynesians

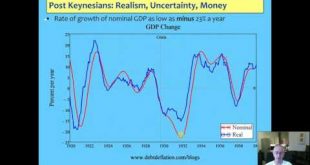

This lecture covers the Post Keynesian school of thought in economics, focusing mainly on its modern emphasis upon endogenous money, sectoral balances, and Minsky’s Financial Instability Hypothesis. I also show how to do non-equilibrium modeling (using my Open Source modeling program Minsky of course). [embedded content] Click here to download the Powerpoint slides.

Read More »The Unnatural Rate Of Interest (Ultra-Wonkish)

Paul Krugman’s latest column—“Check Out Our Low, Low (Natural) Rates” (which he didn’t flag as “Wonkish”, even though it is so in spades—noted that the “natural real rate of interest” was falling, and that this justified the low interest rate set by the Federal Reserve. And this made me think about Karl Marx. Click here to read the rest of this post.

Read More »Economists Prove That Capitalism Is Unnecessary

Actually they’ve done no such thing. But they do effectively assume that it’s unnecessary all the time. This transcendental truth became apparent to me in the reactions I have had from mainstream economists to a lecture I gave to my Kingston students this month (which is posted on my YouTube channel and blog). Click here to read the rest of this post.

Read More »Lecture 4 The Post Keynesians: Realism Uncertainty, Endogenous Money & Financial Instability

Post Keynesians diverged from the mainstream when Hicks re-imagined Keynes as a marginalist. Defining features include an emphasis upon realism in modeling, behavior uncertainty, and an empirical and inductive approach to developing theory. In this brief lecture I cover the three modern strands of Endogenous Money, Stock-Flow Consistent Modeling, and Minsky's Financial Instability Hypothesis

Read More »Lecture 3 in Becoming an Economist at Kingston University

This lecture introduce the Austrian school of thought, which is closely related to the Neoclassical mainstream–in that it shares its utilitarian theory of value, accepts basic supply and demand analysis, and sees capitalism as generally tending towards equilibrium. But it is also highly critical of the mainstream for the absurd assumptions about individual knowledge that it is willing to make to preserve its equilibrium-oriented mathematical approach. It...

Read More »Lecture 3 Why Economists Disagree: The Austrians. Real knowledge, Disequilibrium & Credit

The Austrian school of thought is closely related to the Neoclassical mainstream--in that it shares its utilitarian theory of value, accepts basic supply and demand analysis, and sees capitalism as generally tending towards equilibrium. But it is also highly critical of the mainstream for the absurd assumptions about individual knowledge that it is willing to make to preserve its equilibrium-oriented mathematical approach. It sees capitalism's strengths as how it encourages innovation, which...

Read More »Edinburgh University Talk: financial instability, endogenous money & government budgets

This talk covers all "the usual suspects" for me--the Neoclassical obsession with equilibrium, financial instability, the Loanable Funds myth and the reality of Endogenous Money, and the foolishness of governments trying to run a surplus as if they are households, when the better analogy is that they are banks and should run deficits to create part of the money supply the non-bank private sector needs.[embedded content] Click here to download the Powerpoint file (Minsky files are embedded...

Read More »Edinburgh University Talk: financial instability, endogenous money & government budgets

A talk to the Edinburgh University Society for Economic Pluralism (EUSEP) covering the inherent instability of capitalism, why Loanable Funds is nonsense, and why the government should normally run a deficit.

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch