Becoming an Economist is the introductory course on economics for undergraduates at Kingston University. This is the second of 11 lectures in the subject; I’ll post the others as I write them over the next few months. This lecture discusses why the Mainstream approach, starting from the fundamental question Walras posed "Can a system of free markets reach a set of prices that ensures that supply equals demand in all markets?" The answer was "No", but that didn't stop the...

Read More »Becoming An Economist Lecture 2 The Mainstream & why General Equilibrium is unstable

I outline the Mainstream (or "Neoclassical", though the Mainstream has a very narrow definition of what "Neoclassical means) approach, starting from the fundamental question that Walras set as his way to comprehend the economy, "Can a system of free markets reach a set of prices that ensures that supply equals demand in all markets?". The answer to this question happens to be "No". but the Mainstream has continued on as if the answer was "Yes".

Read More »Call for papers for new journal on private debt

The Private Debt Project (this website will become active as of December 2015) invites proposals for articles, papers, and research notes related to the study of private debt and its relationship to economic growth and financial stability. The Project will provide honorarium for all published work. In cases involving papers with original research, it will also consider small research grants to help cover the cost of the research. Commissioned articles, papers, and...

Read More »Fellowship for economic journalism

The Friends Provident Foundation has just established a Fellowship for UK journalism to produce a “a significant work of long form journalism in any medium on the theme of building resilient economies.” I’ve copied the full press release below. For further details, click on this link. The full press release is copied below. Journalist Fellowship 2016 The Foundation’s trustees have created a journalist fellowship to build a better understanding of economics in...

Read More »Lecture 1 in “Becoming an Economist” at Kingston University

Becoming an Economist is the introductory course on economics for undergraduates at Kingston University. This is the first of 11 lectures in the subject; I’ll post the others as I write them over the next few months. This lecture discusses why economists disagree with each other, and draws analogies with astronomy at the time when Galileo discovered craters on the Moon, and moons orbiting Jupiter and Saturn. [embedded content] This is the Powerpoint file for the...

Read More »Why Economists Disagree–Lessons from Astronomy. Kingston University Becoming an Economist Lecture 1

The first lecture in the Kingston University introductory subject Becoming an Economist Economists clearly disagree with each other, in a manner that is quite unlike both the physical sciences and other social sciences. This lecture discusses why this is so, making an analogy to the state of astronomy back at the time of Copernicus and Galileo, where new observations and a new model challenged the view that the Earth was the center of the Universe. I introduce the 8 or so main approaches to...

Read More »Talking Interest Rates with Phil Dobbie

One of the people I miss talking with in Australia is radio journalist and tech and internet expert Phil Dobbie. Fortunately there’s Skype, and we regularly now chat matters economic on his internet radio show Balls Radio. Here’s the latest complete program, including our discussion of why interest rates are so low and are not going to move up until the level of private debt falls dramatically–which is unlikely to happen. [embedded content]

Read More »Discussing the UK with Simon Rose on Share Radio

One of the very enjoyable aspects of being in London is speaking regularly with Simon Rose on the business-oriented internet radio Share Radio. I know I can talk under wet cement; I think Simon could manage to talk after it had set solid. We have a great time bantering about topics economics, and I hope it's of interest to the audience as well. Here's the latest installment, with some earlier ones available here. [embedded content] This blog has been verified by Rise:...

Read More »Discussion of my “Simple Complex Model of Great Moderation & Recession” at EAEPE 2015

The sound quality for the questions isn't too good, given the size of the room, but I hope the questions are clear from the answers I gave to them.

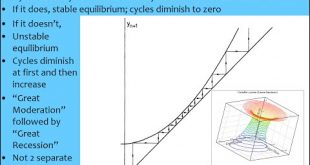

Read More »Keynote Speech to EAEPE 2015: Simple complex systems model of Great Moderation & Great Recession

This is my keynote speech to the 2015 conference of the European Association for Evolutionary Political Economy (EAEPE: http://eaepe.org/). In it I argue that a simple complex systems model captures most of the important economic dynamics of the last 30 years, even with the simplest possible economic relations and linear behavioural relations.

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch