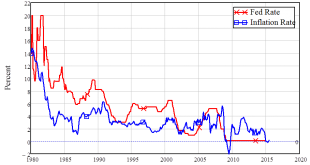

For seven years now, the rate The Fed sets to determine the price banks pay to borrow from it and from each other has been zero, or so close to zero that the difference is immaterial. This is, historically speaking, not normal, and The Fed has a desperate desire to return to what is normal, which is rate a few per cent above the rate of inflation (see Figure 1). Click here to read the rest of this post.

Read More »Why capitalism needs debt jubilees to survive

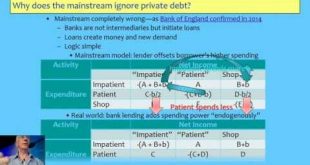

This is a quick 12 minute talk followed by about 18 minutes of discussion at the New Economics Foundation conference in Copenhagen.

Read More »Critical Realism & Mathematics versus Mythematics in Economics

This is the brief talk I gave at a conference celebrating 25 years of the Critical Realist seminar series at Cambridge University. Critical realists argue against the use of mathematics in economics; I argue here that it's the abuse of mathematics by Neoclassical economists--who practice what I have dubbed "Mythematics" rather than Mathematics--and that some phenomena are uncovered by mathematical logic that can't be discovered by verbal logic alone. I give the example of my own model of...

Read More »Critical Realism & Mathematics versus Mythematics in Economics

The Critical Realist movement, developed by Tony Lawson at Cambridge University, argues against the use of mathematics in economics. I argue that their critique is directed at the abuse of mathematics by Neoclassical economists, rather than the proper use of mathematics per se. In this brief talk--where for some reason my webcam was as static as a Neoclassical model--I explain that my 1995 complex systems model of Minsky...

Read More »London Futurists: Why Capitalism Needs a Modern Debt Jubilee to Survive

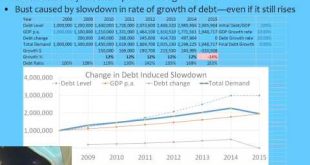

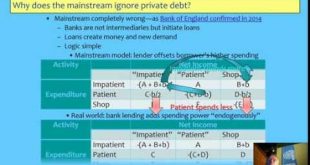

Ordo-liberals like German Finance Minister Wolfgang Schauble insist that enforcing contracts is essential to capitalism, and when applied to financial contracts that means that debt forgiveness is out of the question. They also insist that a prudent government at least runs a balanced budget, and preferably a surplus. However it is easy to show that a pure capitalist economy with neither bankruptcy nor government counter-cyclical spending will collapse into a debt-deflation; and the crisis...

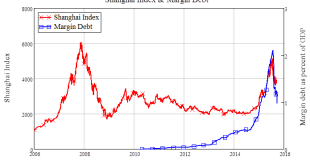

Read More »Why China Had To Crash Part 2

One thing my 28 years as a card-carrying economist have taught me is that conventional economic theory is the best guide to what is likely to happen in the economy. Read whatever it advises or predicts, and then advise or expect the opposite. You (almost) can’t go wrong. Click here to read the rest of this post.

Read More »Why I Support Corbyn For UK Labour Leader

There was a time when most educated people knew that the Earth was the center of the universe. There was a sophisticated “Geocentric” model, known as the “Ptolemaic system”, that predicted to very high accuracy the observed movement of all the objects in the Heavens, as they purportedly orbited the Earth on perfect crystalline spheres. 500 years ago, anyone who proposed an alternative model—in which the Sun was the center and the Earth was just another planet orbiting it—was derided as a...

Read More »The Political implications of a New Economics

Minsky's view that capitalism is fundamentally unstable can be derived from a simple, dynamic view of capitalism: without bankruptcy or government intervention, a pure free market capitalist economy will collapse into a private debt black hole. The political implications of this are (a) that capitalism needs debt write-offs to survive, and (b) that government money creation is needed to avoid economic collapse. This is a huge political shift from today's politics where the rights of...

Read More »Breaking the Bad Habits of Economics: put that “equilibrium” out!

Talk to undergraduate students at Cartanega University in Colombia last week comparies the insistence on equilibrium modelling by economists to the bad habit of smoking.

Read More »Will We Crash Again? FT/Alphaville Talk

This is the talk I gave at the FT/Alphaville conference in London, covering why we crashed in 2008, and why permanent private-debt-induced stagnation is likely to be the rule from now on.

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch