My talk at the European Parliament to the conference "Peripheral debts: Causes, consequences and solutions: 2 July 2015". I argue that progressive politicians need a complete alternative to Neoliberal economics, which is basically a First Year Economics textbook re-written as a political manifesto.

Read More »Rethinking Economics London

My 10 minute plenary talk to the Rethinking Economics Weekend in London. I compare the "clever but mad" Ptolemaic model of the universe to Neoclassical DSGE models, and argue that we need a new, genuinely dynamic economics. I also show that my Minsky model can be expressed as three incontrovertibly true identities, and the interaction of them can be shown to generate both a Great Moderation and a Great Recession, using modern complex systems methods

Read More »How rising debt causes inequality and crisis (English & French)

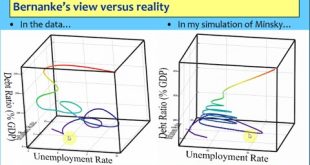

In a (for me!) brief presentation with 7 slides, I explain why rising private debt necessarily causes increased inequality, and leads to an economic crisis when the rate of growth of debt exceeds the rate of decline of wages as a share of national income. Crucially, the actual breakdown is preceded by an apparent period of tranquility--a "Great Moderation". This was a short talk to a public audience at ESCP Europe in Paris, which was presented in English and also translated into French by...

Read More »Greenwich-Kingston PhD students lecture: the logic & maths of modelling Minsky (2)

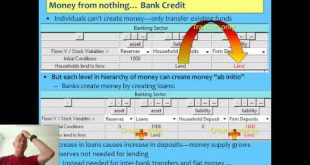

This talk gives a brief technical overview of nonlinear modeling, and explains my Goodwin-Minsky model in some detail, as well as discussing the importance of debt in macroeconomics.

Read More »Greenwich-Kingston PhD students lecture: the logic & maths of modelling Minsky (1)

This talk gives a brief technical overview of nonlinear modeling, and explains my Goodwin-Minsky model in some detail, as well as discussing the importance of debt in macroeconomics.

Read More »What not to learn from conventional finance & macro

If there's one over-arching theme to Neoclassical finance and macroeconomics, it's that leverage doesn't matter. This is so empirically wrong it's almost funny.

Read More »Debt Inequality and Crisis

When the economic history of our epoch is written, three key phenomena will feature: a period of tranquility giving way suddenly to crisis, rising inequality, and rising private debt. Using my model of Minsky's Financial Instability Hypothesis, I show that these three phenomena are all related. There is a direct link between rising debt, rising inequality, and the crisis itself. The key to reducing inequality and ending economic stagnation is to reduce private debt through "Quantitative...

Read More »UK Chartered Financial Advisors Society talk: Why the global economy is stagnating

I gave this invited talk to the UK Chartered Financial Advisors Society about my non-mainstream approach to economics and finance. I cover why conventional macroeconomics that ignores banks and debt is wrong, my monetary alternative based on Hyman Minsky's Financial Instability Hypothesis, and the likely prospects for China.

Read More »Keen 2015 Zagreb Subversive Festival Discussion

The discussion after my talk on "Private Debt and Economic Stagnation" at the 8th Subversive Festival in Zagreb, Croatia, hosted by Dimitrije Birač.

Read More »Private Debt and Economic Stagnation

This is the talk I gave at the 8th Subversive Festival in Zagreb on May 15th 2015. I start with the Queen of England's question "If these things were so large, how come everyone missed them? Why did nobody notice it?" and then show how private debt was the missing ingredient in the models that conventional economists have, which is why they missed the crisis. I finish with the assertion that economic growth will remain low (and inequality will remain high) until the level of private debt is...

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch