Read More »

APE2012Lecture01B

APE2012Lecture01A

MarkThomasModernDebtJubilee

Keen 2012 Google Talks

Don't Trust an Economist

Read More »Keen Cambridge Lecture 2011 plus questions

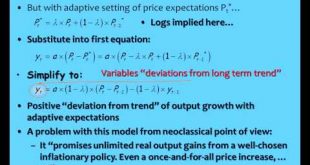

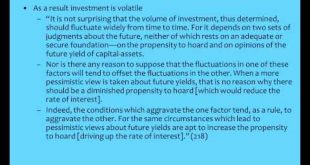

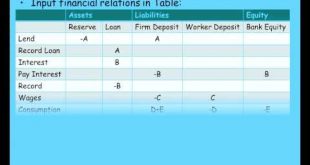

This longer video includes the same topics as my other Cambridge lecture (description reproduced below) plus the Q&A session with the audience. The lecture covers the failure of neoclassical macroeconomics to foresee the crisis (and the attempt by neoclassicals to avoid the consequences of this failure), the key reason why they are wrong about its persistence (the endogeneity of money), Minsky's "Financial Instability Hypothesis", my initial models of that Hypothesis, the development of a...

Read More »Keen Cambridge Lecture 2011

This is a reasonably comprehensive lecture covering the failure of neoclassical macroeconomics to foresee the crisis (and the attempt by neoclassicals to avoid the consequences of this failure), the key reason why they are wrong about its persistence (the endogeneity of money), Minsky's "Financial Instability Hypothesis", my initial models of that Hypothesis, the development of a method to produce strictly monetary models of capitalism, and an overview of my multi-sectoral monetary model of...

Read More »Keen Debunking Economics Uni of Buenos Aires 2011

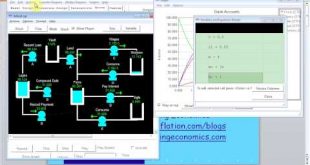

This lecture explains why neoclassical DSGE models are inherently incapable of modeling the macroeconomy, outlines my model of Minsky's "Financial Instability Hypothesis, and shows how to build a basic model of a credit economy using QED. It concludes with a lengthy Q&A session where the questions are mainly in Spanish, since this lecture was given at the University of Buenos Aires.

Read More »Keen Crash Course Part 1

A "crash course in capitalism" given at http://sustainabilityconference.org/index.htm in which I explain my approach to economic modeling to a lay audience, using the simulation tools Vissim and QED.

Read More »Keen Crash Course Part 2

A "crash course in capitalism" given at http://sustainabilityconference.org/index.htm in which I explain my approach to economic modeling to a lay audience, using the simulation tools Vissim and QED.

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch