A "crash course in capitalism" given at http://sustainabilityconference.org/index.htm in which I explain my approach to economic modeling to a lay audience, using the simulation tools Vissim and QED.

Read More »Keen Behavioural Finance 2011 Lecture 11 Global Economic Crisis

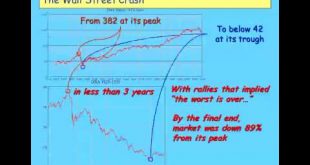

The remarkable thing was not that I and a handful of others saw this crisis coming, but that so many neoclassical economists had no idea it was approaching. I explain why they failed to see it (by ignoring private debt and believing in a fantasy of economic equilibrium), discuss the empirical dimensions of this crisis in comparison with the Great Depression, and present my explicitly monetary macroeconomic model.

Read More »Keen Behavioural Finance 2011 Lecture 10 Financial Instability Hypothesis Part 1

I discuss the economists who influenced Minsky--Marx, Fisher, Schumpeter and Keynes--as a prelude to outlining Minsky's Financial Instability Hypothesis.

Read More »Keen Behavioural Finance 2011 Lecture 10 Financial Instability Hypothesis Part 2

Having outlined Minsky's Financial Instability Hypothesis, I explain the mathematical model I developed of it, on the foundation of Richard Goodwin's "Growth Cycle" model of capitalism.

Read More »Occupy Melbourne & Sydney Shutdowns

The excellent ABC 7.30 Report story on the Occupy Sydney & Occupy Melbourne siblings of Occupy Wall Street, and their shutdown by local authorities. Story by the ABC 7.30 report: http://www.abc.net.au/7.30/content/2011/s3347002.htm

Read More »Keen Occupy Sydney Speech Saturday October 22nd 2011

My speech to the Occupy Sydney Rally begins 10 minutes into this video. The opening includes a Welcome to Country.

Read More »Keen Debunking Economics Oxford 2011 Monbiot Seminar

This seminar led to George Monbiot's Guardian feature (http://www.guardian.co.uk/commentisfree/2011/oct/10/stop-another-great-depression-debt). As well as outlining my critique of Neoclassical macroeconomics, I explain my credit-based analysis. The discussion at the end about the role of aggregate debt is enlightening in that it shows how most economists can't comprehend that the aggregate level of debt matters.

Read More »Keen Behavioural Finance 2011 Lecture 09 Extending Endogenous Money Model Part 2

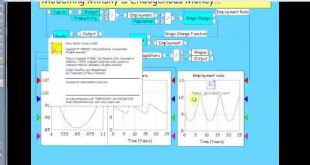

I use the model developed in the first half to show that money is not neutral in a credit-based economy--a higher rate of money creation results in a fall in unemployment--and also model a credit crunch. I also model two government policies to counter a crunch: giving money to the banks (which Obama did) and giving it to the debtors (which the Australian government did). Conventional money multiplier theory argues that the former is more effective; I show that the latter is about three times...

Read More »Keen Behavioural Finance 2011 Lecture 09 Extending Endogenous Money Model Part 1

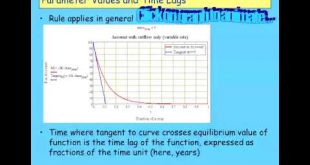

I continue the development of the QED model of a pure credit economy began in the last lecture, including modelling production and developing a pricing equation to produce a combined monetary-physical model. The initial model has a fixed wage, population and labor productivity. To prepare the way for making these variables, I explain what Bill Phillips of "The Phillips Curve" was really trying to do: to drag economists into the modern era by teaching them how to model the economy dynamically.

Read More »Keen Behavioural Finance 2011 Lecture 08 Modelling Endogenous Money Part 1

Explaining the "Monetary Circuit Theory" of capitalism. I show that the dilemmas that hobbled Circuit Theory for so long were simple mistakes in dynamic modelling, which reflect poorly not so much on Circuit theorists themselves, but economists in general, since even non-orthodox economists are locked into the static ways of thinking they were taught by neoclassical lecturers.

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch