Extending the model developed in the first half of the lecture to include payment of wages and consumption. The resulting model "works" in that it is possible for capitalists to borrow money, produce output, and make a profit.

Read More »Debunking Economics 2 Launch October 4th 2011

My speech and Ann Pettifor's speech at the launch of the 2nd edition of Debunking Economics, at the University College London on October 4 2011. I give an overview of the new edition, which focuses on the absurd state of neoclassical macroeconomic theory and the reasons that conventional economists were the last people on the planet to realize that a serious economic crisis was about to occur. I also outline my "Monetary Circuit Theory" approach that let me anticipate the crisis. Ann...

Read More »Keen’s Minsky model covered in SMH 20110926

A video of the inspiration behind the Minsky program, whose development is being funded by the Institute for New Economic Thinking.

Read More »Keen Faces of Liberal Capitalism Conference

The fact that Australia didn't experience a bad recession during the GFC is sometimes attributed to its better regulatory system. It would be a miracle were that true, since the Wallis Committee and all government interventions up until 2008 were done to reduce regulation, not strengthen it.

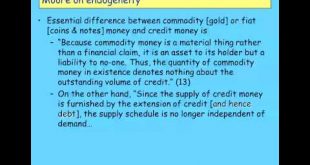

Read More »Keen Behavioural Finance 2011 Lecture 07 Endogenous Money Part 1

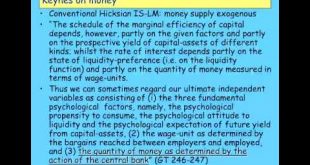

Endogenous money is an established empirical fact, but a seriously underdeveloped concept in economics. In this lecture I cover some of the foundational disputes that marked the development of the concept, and then introduce Graziani's brilliant concept of the Monetary Circuit as a foundation for a monetary model of capitalism.

Read More »Keen Behavioural Finance 2011 Lecture 07 Endogenous Money Part 2

Though the basic ideas of the Monetary Circuit are brilliant, when it came to turning these into a model of the monetary circuit, the Circuitists made numerous errors that were the result of them not knowing how to model a dynamic process. I outline these errors and then introduce the basic tool of dynamic modelling, the differential equation.

Read More »Keen Switzer Sky Business News 20110913

Excellent wide-ranging interview by Peter Switzer (www.switzer.com.au) on Sky Business News about the financial crisis, who predicted it and how, and what the prospects are for the global and Australian economies and the Australian housing market.

Read More »Keen Behavioural Finance 2011 Lecture 06 Part 2 Statistics

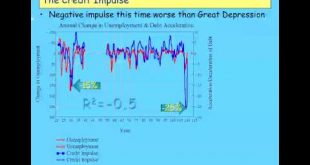

Given how appallingly bad neoclassical economics is, an alternative economics that is at least roughly capable of reproducing the actual performance of the economy is badly needed. One of the best studies of the empirical data about the economy was ironically undertaken by the two neoclassical economists who developed Real Business Cycle theory, Kydland and Prescott. This lecture reports their findings, focusing on the conclusion that "credit should play a larger role" in future analysis of...

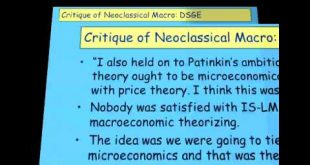

Read More »Keen Behavioural Finance 2011 Lecture 06 Part 1: State of Macroeconomics

One year after the start of the greatest economic crisis since the Great Depression, the editor of the American Economic Review: Macroeconomics claimed that "the state of macro [theory] is good". How could be be so deluded? Macroeconomics has been distorted by appalling scholarship and a misguided belief that macroeconomics and microeconomics should be consistent. The best critics of this, ironically, are given by the authors most responsible for the state of macroeconomics, John Hicks and...

Read More »Keen Behavioural Finance 2011 Lecture 05 Fractal Finance Markets Part 2

In this second half of the lecture, I outline the Fractal Markets Hypothesis and the Inefficient Markets Hypothesis (IEH). The IEH suggests precisely the opposite investment strategy to the EMH on how to maximize returns on the stock market: invest in low volatility, high Book to Market stocks.

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch