The Fractal Markets Hypothesis and the Inefficient Markets Hypothesis are two of several attempts to provide a realistic theory of how finance markets actually behave. In this first half of the lecture, I explain what a fractal is, and discuss their basic characteristics.

Read More »IQ Squared Debate: If we populate, we will perish

I took part in an "IQ Squared" debate with that title, on the affirmative side. The title is a play on a favourite saying of Australian politicians back in the country's "White Australia" days, and the immigration surge it caused ironically led to Australia becoming one of the world's most multi-cultural nations. My speech, which focuses on the "Human Ecological Footprint" measure of the impact humanity has on the biosphere, starts at the 40:40 mark. Other speakers are Australian...

Read More »Keen Behavioural Finance 2011 Lecture 04 Actual Finance Markets Behaviour Part 1

The CAPM and EMH stick to the neoclassical script of believing that the economy and finance markets are stable, at or near equilibrium, and on this basis argue that "you can't beat the market". But there is an alternative view, far more aligned with the actual data, that says that markets are chaotic, far from equilibrium systems, and for that reason it's very hard to beat the market.

Read More »Keen Behavioural Finance 2011 Lecture 04 Actual Finance Markets Behaviour Part 2

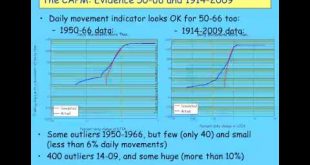

Eugene Fama was an enthusiastic promoter of CAPM and the Efficient Markets Hypothesis, arguing that despite their absurd assumptions, the data supported the theories. But was this a fluke, the result of the narrow data range he used--from 1950 till 1966? He has since disowned the theory in 2004, stating that "the theory has never been an empirical success", and that "most applications of the theory are invalid". But somehow these honest statements don't seem to have made it into the finance...

Read More »Keen Behavioural Finance 2011 Lecture03 Finance Markets Behaviour Part 2

CAPM appeared to fit the statistical evidence for a the period prior to its development, enabling its supporters to champion it and leading to it taking over the profession? But was this just a fluke, resulting from the short time period considered by the statisticians? It has since been challenged by Behavioral Finance, but it seems that this school has also misunderstood John von Neumann's work. Once objective probability is used as he intended, rather than subjective probability, all the...

Read More »Keen Behavioural Finance 2011 Lecture03 Finance Markets Behaviour Part 1

John von Neumann developed Expected Utility theory to wean economists off indifference curve analysis and onto a numerical basis for utility. Instead, they combined indiffiference curves with absurd assumptions about individual behavior in asset markets and a confusion of risk with uncertainty to develop the Capital Assets Pricing Model.

Read More »Keen Behavioural Finance 2011 Lecture 02 Market Behaviour Part 1

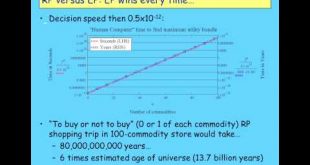

In the last lecture I showed that the Neoclassical model of consumer behavior doesn't work, and is computationally impossible. In this lecture, I show that even if it did work, a market demand curve derived by aggregating the demands of numerous utility-maximizing individuals can have any shape at all. The so-called Sonnenschein-Mantel-Debreu conditions (first discovered in 1953 by Gorman) show that even market demand can't be represented by the demand of a single utility-maximizing...

Read More »Keen Behavioural Finance 2011 Lecture02 Marketbehaviour Part 2

In this half of the lecture, I show that even if there was a downward-sloping demand curve, Neoclassical supply and demand analysis is still invalid because: (a) Equating marginal cost and marginal revenue doesn't maximize profits; and (b) A market supply curve can't be derived independently of the demand curve.

Read More »Keen Behavioural Finance 2011 Lecture01 Economic Behaviour Part 2

In this second half of the first lecture, I explain Sippel's result that most people aren't "rational" as Neoclassical economists define it--because the Neoclassical definition of rational behavior is computationally impossible. The next lecture--which I'll post next week--explains that even if the Neoclassical model of individual behavior was sound (which I've just shown it isn't), the market demand curve derived by aggregating the demand functions of "rational utility maximizing...

Read More »Keen Behavioural Finance 2011 Lecture01 Economic Behaviour Part 1

This is the first of about 20 videos of my lectures in Behavioural Finance at the University of Western Sydney (2 videos per lecture). This first lecture presents the Neoclassical theory of consumer behavior--known as Revealed Preference--and an experiment that invalidated it by the German economist Reinhard Sippel.

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch