I maintain this site for historical reasons only. If you’re looking for my latest work, please go to https://www.patreon.com/profstevekeen.

Read More »Steve Keen Forum with MMTeens

This was a conversation with a wonderful group of school students who are already very well informed on the weaknesses of mainstream economics and the strength of Post Keynesian Economics and Modern Monetary Theory. They are well ahead of where I was at the same age. Their website is https://mmteens.wordpress.com/, and they have a set of resources on economics at https://linktr.ee/politicswithnick.

Read More »Introducing Ravel, a "Hobbit’s Birthday Present" for my supporters on Patreon

Ravel is a program for the visual analysis and display of data. I have developed it in conjunction with Russell Standish, the programmer behind the Open Source system dynamics program Minsky (see https://sourceforge.net/projects/minsky/). Ravel is a commercial program, which we hope to finish for a first release in 2022. Today, we are releasing the current beta of Ravel to our supporters on Patreon. This video shows how to install and use Ravel. If you'd like to check it out yourself, sign...

Read More »Ravel For Corporate Data

I use Ravel to analyze economic data, but I first designed it to make analyzing corporate data easier. Since then, Pivot Tables have become the norm. This video shows how to use Ravel instead of a Pivot Table to analyze some mock corporate transactional data. I'm releasing the current beta of Ravel to my Patreon supporters on Sunday March 28th, and I would love some of them to use it to analyze their corporate data, and tell us how it goes. There are shortcomings to the current...

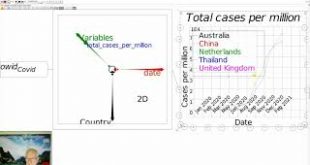

Read More »Using Ravel To Interpret Covid Data

On March 28th--my 68th birthday--I'm giving a free copy of Ravel my supporters on Patreon (at either my site https://www.patreon.com/profstevekeen or Minsky's site https://www.patreon.com/hpcoder/). It's a pre-release version, so there are bugs (some of which turn up in this demonstration) and missing features. But even as it is, Ravel makes it far easier to load and analyse multi-dimensional data than if you used a spreadsheet like Excel, or even a Pivot Table. This quick demonstration...

Read More »Explaining money creation using my Minsky software to Sweden’s Positive Money

This was my second talk to Positiva Pengar, Sweden's version of the UK's Positive Money. Since I'd given a prepared talk just a few weeks before, I did this one in a more extempore fashion, with a lot of it being a dialogue between myself and the organizer Jussi Ora. I used Minsky to lay out the accounting behind money creation--by both banks and governments--and made the general point that, since money is (aside from cash) the liabilities of the banking sector to the non-bank sector, to...

Read More »Talk to the Glasgow Economics Forum 2021

I cover why equilibrium has gone from a modelling compromise for 19th century Neoclassical economists into a near religious belief about the nature of economics amongst 21st century Neoclassicals, how genuine dynamic economic analysis can be derived directly from the structure of the economy, how energy can be incorporated into economic modelling, and why economics remains a pre-scientific discipline.

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch