This video starts with the "green-room" chatter between myself and Oscar Brisset, who is Co-President of the Oxford Economics Society. The presentation proper starts about two minutes in. Oscar's sound feed is poor, because this was recorded on my PC, but mine is pretty clear. It's an intense one-hour lecture, covering material that should really be done over a dozen or so lectures, so if you'd like to follow up on it, please check this out on my Patreon page...

Read More »Discussing a Modern Debt Jubilee on Macro’n’Cheese

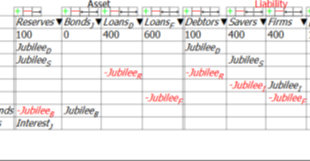

I discuss a Modern Debt Jubilee On Macro’n’Cheese today, and this is a quick explanation of how it could be done. Jubilees were common in antiquity. The Lord’s Prayer did not originally say “And forgive us our sins, as we have forgiven those who sin against us”, but “And forgive us our debts, as we also have forgiven our debtors”. But an old-fashioned Jubilee would reward those who gambled with borrowed money, and thus effectively penalise those who did not. It...

Read More »Economics out of equilibrium–please!

This presentation to students in the EU-sponsored EPOG Masters program (see https://www.epog.eu/) covers the analysis of credit money, financial instability, Modern Monetary Theory, the role of energy in production, and how to model financial and complex systems in my Open Source system dynamics program Minsky (see https://sourceforge.net/projects/minsky/). There was a lively discussion of the way in which capitalism should be modelled--using discrete (NO!) or continuous time, etc.

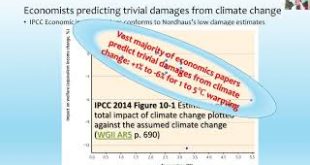

Read More »Talking Climate Change and MMT with students and staff from UMKC

This was a "brown bag" seminar arranged by Masters students at the University of Missouri Kansas City, the home of academic MMT, focusing mainly upon the dreadful Neoclassical economics of climate change, but also covering issues from MMT and macroeconomics.

Read More »A conversation with Michael Hudson about David Graeber

As well as being a great researcher and writer, David was a friend to both myself and Michael. Michael can't take part in the memorial activities for David this Sunday, so we recorded this brief conversation about him and his work instead.

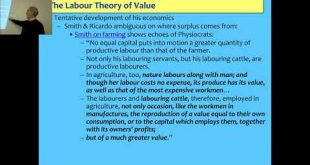

Read More »Keen 2018 Masters Lecture 02 Value Theory For Understanding Capitalism

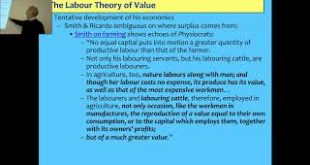

Marx's dialectical philosophy leads to a theory of value that (a) is consistent with the Laws of Thermodynamics; (b) contradicts the Labour Theory of Value; (c) provides a structured means to acknowledge that in the co

Read More »Keen 2018 Masters Lecture 02 Value Theory For Understanding Capitalism

Marx's dialectical philosophy leads to a theory of value that (a) is consistent with the Laws of Thermodynamics; (b) contradicts the Labour Theory of Value; (c) provides a structured means to acknowledge that in the co

Read More »The Minsky Models of Modern Monetary Theory 12 #TMMOMMT

Twelfth of twelve videos showing the construction of models of the monetary aspects of Modern Monetary Theory in Minsky. Download Minsky from https://sourceforge.net/projects/minsky/files/beta%20builds/ and support Minsky's development at https://www.patreon.com/hpcoder/ for as little as $1 a month

Read More »The Minsky Models of Modern Monetary Theory 12 #TMMOMMT

Twelfth of twelve videos showing the construction of models of the monetary aspects of Modern Monetary Theory in Minsky. Download Minsky from https://sourceforge.net/projects/minsky/files/beta%20builds/ and support Minsky's development at https://www.patreon.com/hpcoder/ for as little as $1 a month

Read More »The Minsky Models of Modern Monetary Theory 11 #TMMOMMT

Eleventh of twelve videos showing the construction of models of the monetary aspects of Modern Monetary Theory in Minsky. Download Minsky from https://sourceforge.net/projects/minsky/files/beta%20builds/ and support Minsky's development at https://www.patreon.com/hpcoder/ for as little as $1 a month

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch