Ten years ago today, Chuck Prince, then chief executive of Citigroup, dismissed fears of a financial crisis. “When the music stops, in terms of liquidity, things will be complicated," he said in an interview with the Financial Times in Japan. "But as long as the music is playing, you’ve got to get up and dance. We’re still dancing". He wasn't dancing for long. Less than a month later, the first bank failed. Over the weekend of 27th-29th July, IKB Deutsche Industriebank AG, one of Germany's key "Mittelstand" lenders, was bailed out by a consortium of German banks after credit markets refused to provide it with liquidity. The music had stopped. The reasons for IKB's failure are now all too familiar. Anxious to diversify beyond its traditional core market of German small and

Topics:

Frances Coppola considers the following as important:

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Mike Norman writes The Accursed Tariffs — NeilW

Mike Norman writes IRS has agreed to share migrants’ tax information with ICE

Mike Norman writes Trump’s “Liberation Day”: Another PR Gag, or Global Reorientation Turning Point? — Simplicius

IKB is just one of many banks that set up companies to use this strategy. They're usually off-balance-sheet so that banks don't have to set aside capital to cover the liabilities.Maturity mismatch and no capital - we now know this is a recipe for disaster. But at the time, everyone was doing it. The next bank to fail was Britain's Northern Rock.

Like IKB, Northern Rock had created an SPV, called Granite. Granite's job was to convert Northern Rock mortgages, some of them subprime, into bonds and sell them to international investors, thus raising the funds for more mortgage lending by Northern Rock. It worked well - until the market for subprime mortgage-backed securities started to fail in late 2006. After that, Northern Rock became increasingly dependent on issuing short-term commercial paper, because Granite could not deliver the funding it needed to meet its obligations. Nevertheless, it carried on lending. But in August 2007, credit markets stopped buying its commercial paper, and its liquidity dried up. By September, the bank was in serious trouble. The music had stopped.

Over the next year, there was a slow trickle of bank failures as credit markets refused to provide liquidity against collateral of subprime mortgage assets and their derivatives which were becoming ever less valuable. But after Lehman Brothers failed in September 2008, that trickle became a flood. Markets froze, banks and other financial institutions were refused liquidity by credit markets and were forced to seek support from central banks and, ultimately, from governments. The world's financial system suffered a heart attack. Citigroup survived, but it could not dance as it had before.

Chuck Prince's strategy exploited what I have previously called the "gimmick", or irrational belief, of the "profligacy game": "The money will never run out". He knew perfectly well that the game could not continue for long, but he was making the most of it while it lasted.

He was not the only one. Every bank in the developed world was riding the cheap credit wave - lending ever-larger amounts to poorer quality borrowers, securitising subprime mortgages and other loans to raise funds for more lending, and as the subprime asset market slowed, covering their growing funding gaps with short-term unstable liquidity. Every bank in the developed world was investing in subprime assets, too, to use as collateral for short-term funding, or simply to diversify their balance sheets and deliver a better return to their investors. Banks were on both sides of the subprime trade.

This answers a question I have been asking for some time. Why did securitisation dangerously concentrate and amplify risk, instead of safely dispersing it as it was intended to do? The reason was market concentration. When key market participants are on both sides of the trade, risk is not dispersed, it is concentrated. And when those market participants are also highly leveraged, and generating ever more risk in the mistaken belief that it will not come back to them, the result is a toxic leveraging spiral.

This is how bubbles form. An irrational belief develops that investing in some asset or class of assets will generate high returns with no risk. And because everyone likes a free lunch, everyone piles in. Demand for those assets raises their price far above fundamentals, spurring a supply boom - pace aficionados of Say's Law, in financial bubbles demand generates supply, not vice versa.

When the overpriced assets are used as collateral for borrowing in order to acquire more of the same type of asset, the balance sheets of market participants become hugely distorted with enormous quantities of massively over-valued assets and almost equally enormous quantities of debt backed by those same over-valued assets. Everyone knows the assets are overvalued, but since everyone has a vested interest in ensuring that their value doesn't fall, no-one will say so. Financial bubbles are fine examples of "the emperor has no clothes".

Some market participants. like Chuck Prince, know the party will eventually end, and hope to time their exit. Some go even further, cynically buying up assets to drive up their price, intending to sell as soon as the market shows signs of turning. And some short the assets to profit from the downturn. Banks can be on both sides of this trade, too.

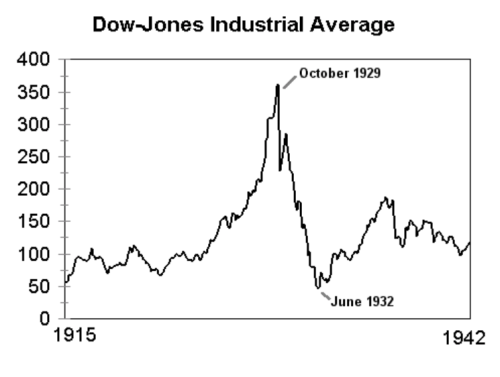

Speculative activity of this kind pumps up the bubble even more. This is the Wall Street Crash of 1929:

The characteristic "sharks-tooth" shape of a financial bubble is very evident here: long slow buildup, noticeable spike at the peak, followed by an abrupt and, in this case, disastrous crash. The spike arises from sharply rising speculation shortly before the bubble bursts.Because speculators are hyper-alert and will run for the exit at the slightest sign of trouble, a financial bubble becomes extremely fragile in its "spike" phase. One relatively small shock, such as a medium-size bank failing, can be enough to burst it. Speculators don't just profit from the bubble bursting, they cause it to burst.

Thus, the financial bubble that grew during the mid-2000s was created by irrational beliefs and herding, its dangerous leverage was caused by market concentration, and its eventual burst was caused in part by speculation and profit-taking.

But hang on. At the INFINITI conference I attended recently, two researchers presented a paper in which they argued that herding that causes price rises is essentially benign. It is simply a matter of market participants all heading for the best grass. The behaviour of the herd shows where the best grass is, and the value of that grass naturally rises as demand for it increases. This is price discovery, and it is essential to all well-functioning markets.

Conversely, the researchers said that when market participants all sell together, there are serious distortions in prices. We can think of this as a stampede: when the entire herd, spooked by a glimpse of a wolf in the woods, gallops down the field at top speed trampling everything, every blade of grass in its path becomes worthless, however green and good it was to start with.

But there, I'm afraid, the analogy ends. Market participants may behave like cattle, but financial assets are nothing like grass. No herd of cattle in the world can create more of the best grass to meet increased demand, and nor can it attract naive new participants from neighbouring fields ("stupid in Dusseldorf", to quote Michael Lewis). And nor can it sell grass derivatives (hay? cattle cake?) to buy yet more grass. In a financial bubble, there is price distortion when people are buying, as well as when they are selling.

So how can we tell whether rising asset values are due to price discovery in a well-functioning market, or price distortion in a dangerously leveraging one? Realistically, this is difficult. Financial bubbles are easy to spot in their final stages, when the spike develops and everyone knows it is only a matter of time till the music stops. But the price distortions actually start long before. And although prices are very obviously distorted when a financial bubble collapses, that is mostly the disorderly unwinding of a long period of price distortion that has gone previously unnoticed, or at least unmentioned.

However, there are some key indicators of a developing asset spiral, apart from fast-rising prices. Over-leveraging of market participants, evident from massively inflated balance sheets and diminishing capital buffers. Persistent attempts to influence or game regulation designed to limit leverage and ensure adequate capital. A focus on building market share rather than profitability, resulting in a buyout spree - larger banks hunting and eating smaller banks and other companies, including those which should be their customers. Promises of excessively high returns to investors and savers. And, of course, market concentration - a small number of core players all linked to each other.

These risk factors can't easily be discerned by market participants. They are part of the herd, so they don't see the market concentrating and prices distorting. In their view, they are laying off risk and pricing fairly - even if they are actively selling insurance products that mean the risk eventually comes back to them. If they could see the whole market, they would know that the risk was not dispersing as it should. But they don't see beyond their own back yard.

When the bubble bursts, of course, prices are typically wildly distorted. Investors rush to dump their holdings of over-priced assets, and those who borrowed against the collateral of those assets are forced to sell at heavily discounted prices to raise the funding they need to meet their obligations. Demand for the assets crashes, causing prices to fall precipitately. Because the fall is short and sharp, prices of other assets are affected too, along with equity valuations of market participants: share prices of even solvent banks crash in a market panic.

But despite the distortions, there is nevertheless price discovery. Eventually the market stops falling, and prices stabilise, though at a much lower level than before. The bursting of the bubble establishes the real value of the assets - which may be nothing.

This leaves a problem. If not only market participants, but large parts of the real economy, depend on over-valued assets - particularly highly inflated house prices - then allowing prices to correct by means of a market panic is enormously destructive. So the temptation is to prevent the bubble bursting fully. This is what central banks and governments did, during and after the 2008 financial crisis. A range of exceptional interventions - including, but not limited to, QE - prevented the feared debt deflationary spiral that would have wiped out the net worth of many Americans and Europeans and wrecked the lives of a whole generation. We have, correctly described, now had ten years of depression. But it has not, except in a few cases, been anything like as deep or as severe as the Depression of the 1930s. Preventing financial bubbles bursting fully does protect the real economy from the fallout.

But propping up asset prices is politically toxic, especially when combined with fiscal austerity that squeezes the incomes of people who are not asset-rich. In the end, it is unsustainable. When the little boy points out that the emperor has no clothes, the emperor and his entourage are overthrown, and there is civil war that lays waste to the country. Whether or not central banks and governments allow the bubble to burst fully, financial crisis on the scale of 2007-8 leads inevitably to political crisis, regime change, and - possibly - war. And, eventually, to a fundamental reordering of society.

Related reading:

A countercyclical credit bubble?

Anatomy of a bank run

Cleaning up the mess

European banks and the global banking glut - Pieria

Image at head of post from WikiMedia Commons. Credit: Bjørn Christian Tørrissen - Own work by uploader, http://bjornfree.com/galleries.html, CC BY-SA 3.0, https://commons.wikimedia.org/w/index.php?curid=22856968

Chart from Culture Of Life News, with thanks.