Summary:

Here is a very familiar financial bubble, in pictorial form: And this is what it looks like, charted: In those days, of course, tulips at least had to be able to flower. But things have changed since then.There are three key stages in the lifecycle of a financial bubble:The "Free Lunch" period. A long, slow buildup of price distortion, during which investors convince themselves that rising prices are entirely justified by fundamentals, even though it is apparent to (rational) observers that they are buying castles built on sand. The "This is nuts, when's the crash?" period. Everyone knows prices are far out of line with fundamentals, but they carry on buying in the irrational belief they can get out before the crash they all know is coming. Speculators pile in, hoping to make a quick

Topics:

Frances Coppola considers the following as important: Bitcoin, bubbles, cryptocurrency, Ethereum, Financial Crisis

This could be interesting, too:

Here is a very familiar financial bubble, in pictorial form:

Here is a very familiar financial bubble, in pictorial form: And this is what it looks like, charted: In those days, of course, tulips at least had to be able to flower. But things have changed since then.There are three key stages in the lifecycle of a financial bubble:The "Free Lunch" period. A long, slow buildup of price distortion, during which investors convince themselves that rising prices are entirely justified by fundamentals, even though it is apparent to (rational) observers that they are buying castles built on sand. The "This is nuts, when's the crash?" period. Everyone knows prices are far out of line with fundamentals, but they carry on buying in the irrational belief they can get out before the crash they all know is coming. Speculators pile in, hoping to make a quick

Topics:

Frances Coppola considers the following as important: Bitcoin, bubbles, cryptocurrency, Ethereum, Financial Crisis

This could be interesting, too:

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Joel Eissenberg writes Crypto capital of the world

merijn knibbe writes The incredible cost of Bitcoin.

Frances Coppola writes The fatal flaws of Celsius Network

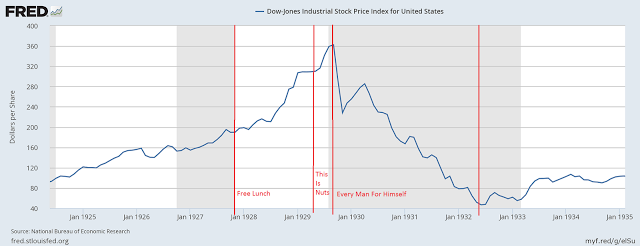

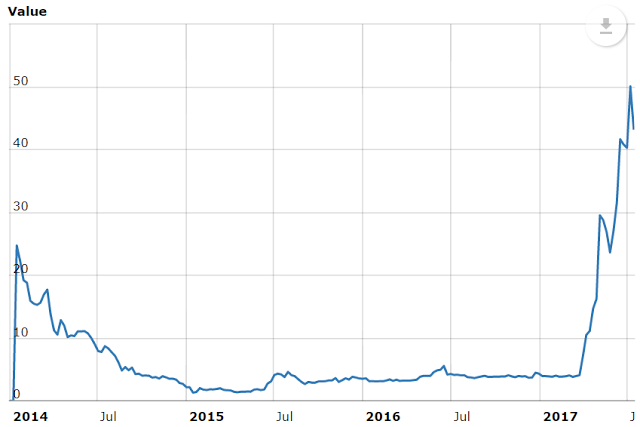

And this is what it looks like, charted:

In those days, of course, tulips at least had to be able to flower. But things have changed since then.

There are three key stages in the lifecycle of a financial bubble:

- The "Free Lunch" period. A long, slow buildup of price distortion, during which investors convince themselves that rising prices are entirely justified by fundamentals, even though it is apparent to (rational) observers that they are buying castles built on sand.

- The "This is nuts, when's the crash?" period. Everyone knows prices are far out of line with fundamentals, but they carry on buying in the irrational belief they can get out before the crash they all know is coming. Speculators pile in, hoping to make a quick profit. Prices spike.

- The "Every man for himself" period (sorry, FT, I couldn't find a reference for this one). Prices crash as everyone runs for the exit. This can happen a number of times, separated by brief periods of stability when everyone congratulates themselves on a lucky escape. But they are wrong. The ship is sinking.

This is what the three stages look like, charted:

The sharp-eyed among you will have noticed that there are no tulips in this chart. That is because financial crashes don't have to involve tulips. This one, of course, is stocks.

So is this one, though not the same kind of stock:

This is the dot-com bubble at the turn of the century. Characteristic shape, again: long slow buildup, noticeable spike, and a crash in several waves. Classic.

I rather like this one, too:

This shows the unsustainable buildup of oil prices from about 2004 onwards, culminating in a simply massive spike and single dramatic crash (no waves) in July 2008. Of course this had no connection whatsoever with the failure of Lehman Brothers in September 2008, did it?

Oh, and in case you were wondering - the second, longer-lasting spike is caused by the Fed pumping up the oil price with QE. The oil price crashed again in 2014 when the Fed ended QE. Tulip mania, central bank style. Don't anyone ever say that QE isn't inflationary.

Now, you are no doubt wondering what all of this has to do with the crypto-title of this post. Well, it just so happens that a fine example of the asymmetric herding I have been talking about is happening right now. Cryptocurrencies are undergoing a massive sell-off.

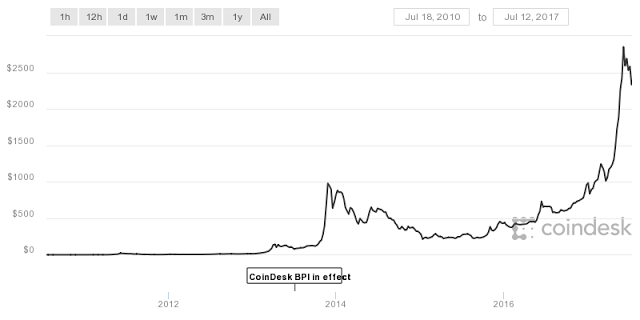

Here is Bitcoin's price chart, today (from Coindesk):

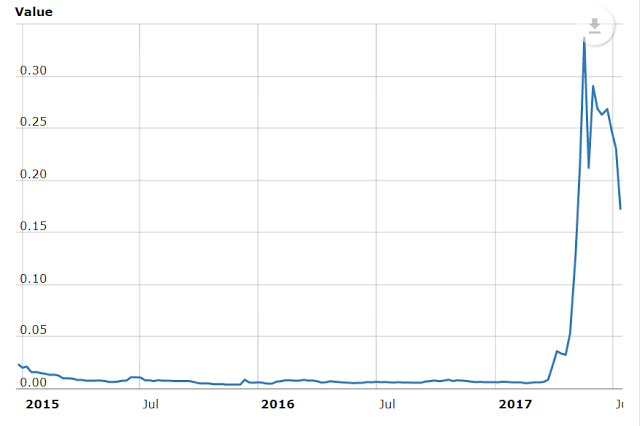

Here is Ethereum:

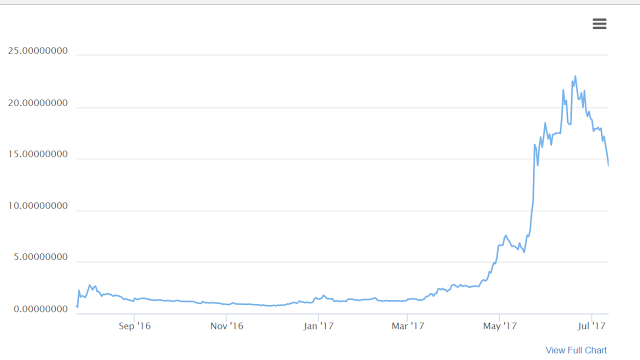

Ethereum Classic (from Coingecko):

Litecoin (this from WorldCoinIndex.com):

Ripple:

In fact, just about every cryptocurrency is selling off - see the list here at CoinMarketCap. And as far as I can see, they all show the characteristic shape of a financial bubble, though some coins are late to this party, so only show the speculative spike typical of the "This is nuts" stage.

And the irrational beliefs underlying financial bubbles are also there. For months, there has been discussion in the financial press about the possibility of Bitcoin and Ethereum being in a bubble: but hardened investors dismissed it all. And are still dismissing it, despite the compelling evidence that not only is this a bubble, it is bursting.

Crypto-tulips are no more valuable than real ones. And crypto-investors are no more rational than any other sort of investor. Pride goeth before a nasty crash.

_________________________________________________________________________________

Image: "Satire on Tulip Mania", Brueghel the Younger - Frans Hals Museum, Haarlem, Netherlands. Public Domain, Wikimedia