The Co-Op bank is putting itself up for sale. It announced today that it will offer all of its shares for sale, including the Co-Op Group's 20% stake and the shares currently owned by a consortium of American hedge funds, institutional investors and small investors. The decision follows on from last month's disclosure that it was facing a full-year loss for the third year running and would fail to meet capital requirements set by the Prudential Regulatory Authority (PRA) for some years to come. It has almost certainly been made under pressure from the PRA. The decision to offer the bank for sale was undoubtedly very painful for the Board. But it has been obvious for some time that the Co-Op Bank's recovery plan was heading for the rocks. Both the 2014 and the 2015 reports contained warnings from the directors, endorsed by the auditors, that the bank may not be able to continue as a going concern. There is little doubt that the forthcoming 2016 report, due at the end of March, will contain a similar warning. In fact the Co-Op Bank has been living on borrowed time ever since it ignominiously failed the Bank of England's stress tests in 2015. The capital plan it agreed with the PRA was high risk from the start, relying on very favourable trading conditions and no major shocks.

Topics:

Frances Coppola considers the following as important:

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Mike Norman writes The Accursed Tariffs — NeilW

Mike Norman writes IRS has agreed to share migrants’ tax information with ICE

Mike Norman writes Trump’s “Liberation Day”: Another PR Gag, or Global Reorientation Turning Point? — Simplicius

The Co-Op bank is putting itself up for sale. It announced today that it will offer all of its shares for sale, including the Co-Op Group's 20% stake and the shares currently owned by a consortium of American hedge funds, institutional investors and small investors. The decision follows on from last month's disclosure that it was facing a full-year loss for the third year running and would fail to meet capital requirements set by the Prudential Regulatory Authority (PRA) for some years to come. It has almost certainly been made under pressure from the PRA.

The first is the sheer scale of the repair work needed, which he said was much larger than had been expected. The bank has done a lot of work to clean up its balance sheet, cut its costs and improve the quality of its IT systems. But it still has unacceptably high levels of non-core assets and is struggling either to dispose of them or build the capital to support them. Despite a major cost-cutting and integration drive, its cost/income ratio remains unsustainable at over 100%. And although it has now migrated some of its IT systems to a more robust technical platform, it is still a long way from implementing the resilient, efficient and user-friendly IT infrastructure needed to deliver a strategy based upon a major move to online and mobile banking.

The level of misconduct at the Co-Op Bank may surprise some people. But the truth is that the so-called "ethical bank" has been anything but ethical. Quite why its customers have been so loyal to it is a mystery. The bank systematically ripped them off for years.

There have been suggestions that the TSB might be prepared to take it on - for the right price. The TSB's management probably know better than any other potential buyer just what a mess the Co-Op Bank is in: after all, it was the failure of the Co-Op Bank's attempt to buy the nascent TSB that exposed the awful state of the Co-Op Bank's own balance sheet. They will drive a hard bargain. The sale price of the Co-Op Bank is likely to be extremely low.

There could be some poetic justice in the TSB taking over the bank that tried to buy it - though of course the TSB itself is no longer an independent entity, having been taken over by Spain's Banco Sabadell not longer after its flotation. But it would need to be extremely careful. There have been too many cases of sound banks taking over distressed banks, only to end up in serious trouble themselves: the TSB will no doubt be mindful of the fate of its former parent Lloyds Banking Group, and indeed of the history of the Co-Op Bank itself. Taking on a distressed bank is not to be undertaken lightly. The TSB would no doubt like the Co-Op's customers (if it can keep them) and whatever good quality assets exist on its balance sheet, but it won't be nearly so keen on its costs and its debts. Even at a fire sale price, the Co-Op Bank may be too rotten a morsel to swallow.

If sale of the bank as a going concern fails - as seems distinctly possible, given the scale of the risks for any potential buyer - then it could be broken up. Currently, this seems more likely than an outright sale. The FT reports that challenger banks (including the TSB) and private equity firms are expressing an interest in buying parts of the Co-Op Bank's portfolio.

Breaking up the bank would leave a rump business with its reputation shot to pieces and little in the way of decent assets. It might be better capitalised, but from a business perspective it would have an even bigger mountain to climb than it had before. It would be unlikely to survive for long as an independent entity. However, it would probably be easier for the stripped-down and recapitalised bank to find a buyer.

The FT suggests that the Board might also try to restructure the Co-Op Bank's balance sheet by swapping debt for equity and raising additional capital from new and existing investors. I don't believe it. If that were a viable alternative they would have tried it before putting the business up for sale. I suspect they have already sounded out major shareholders about a rights issue and been firmly told "No". And without a rights issue, a debt for equity swap would still leave the bank desperately short of capital. It is not a solution.

As a last resort, the Co-Op Bank could be wound up by the PRA. In my view this outcome is only likely if a buyer for the whole business still cannot be found after a fire sale of assets.

Whatever the outcome for the bank as a business, the Co-Op Bank brand is likely to disappear. There are a number of reasons for this. Once the Co-Op Group no longer has a stake, it may object to the bank continuing to use its brand name. And if the bank ends up entirely in private sector ownership, the Secretary of State may revoke the bank’s right to describe itself as “cooperative”. If the bank is broken up, the assets will be absorbed into the buyers' own brands: the rump business may retain the Co-Op Bank brand name, but unless by some miracle it manages to rebuild a distinctive franchise with a solid reputation, a future buyer would be unlikely to be interested in paying goodwill for what is by any standards a badly tarnished brand.

This 144-year-old institution seems set to disappear from Britain’s high streets. Many will mourn its passing. But there is a silver lining. The continued existence of a bank that is cooperative in name but not in nature has severely hampered the Cooperative Movement's efforts to promote cooperative banking. Once this albatross has been cast overboard (and regulatory obstacles overcome), they will be free to create new, vibrant cooperative banks. The death of the Co-Op Bank could, perversely, become the source of new life in cooperative banking.

Related reading:

The Co-Op Bank: too high a mountain?

Co-Op Bank Interim Financial Report 2016

The "ethical" Co-Op

A tale of two banks|

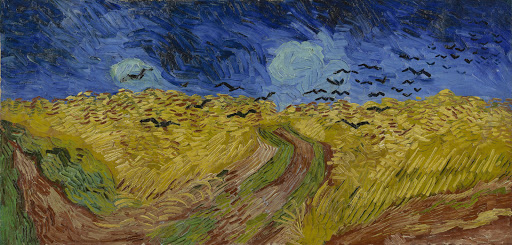

Image: "Wheatfield with Crows", Vincent Van Gogh. Courtesy of the Vincent Van Gogh Museum.