If there is one industry Brexit has stimulated, it is the production of daft ideas for regenerating the UK economy after its exit from the EU. Many of the offerings have been from people who really like the idea of Britain becoming a European version of Singapore. But the left wing is not short of silly schemes either. This one, from businessman and self-styled economist John Mills, is one of the silliest I have seen.John Mills is chairman of John Mills Limited (JML). On his biography, he describes this as “a consumer goods company specialising in selling products requiring audio-visual promotion at the point of sale, based in the UK but with sales throughout the world.” Emphasis is mine, for reasons which will shortly become apparent. John Mills is also a long-standing supporter of

Topics:

Frances Coppola considers the following as important: Brexit, currency, trade

This could be interesting, too:

Frances Coppola writes Trade lunacy is back

Angry Bear writes Policies Shifted Trade from China?

Frances Coppola writes The entire crypto ecosystem is a ponzi

Frances Coppola writes There’s no such thing as a safe stablecoin

If there is one industry Brexit has stimulated, it is the production of daft ideas for regenerating the UK economy after its exit from the EU. Many of the offerings have been from people who really like the idea of Britain becoming a European version of Singapore. But the left wing is not short of silly schemes either. This one, from businessman and self-styled economist John Mills, is one of the silliest I have seen.

John Mills is chairman of John Mills Limited (JML). On his biography, he describes this as “a consumer goods company specialising in selling products requiring audio-visual promotion at the point of sale, based in the UK but with sales throughout the world.” Emphasis is mine, for reasons which will shortly become apparent.

John Mills is also a long-standing supporter of Brexit. Like many left-wing Brexiters, Mills thinks that leaving the EU will create an opportunity to rebalance Britain’s economy away from finance and other service industries and towards manufacturing. Britain’s manufacturing decline long pre-dates the Brexit vote: business investment has been low by comparison with other countries for decades, manufacturing productivity started to fall long before the 2008 financial crisis, and Britain has run a persistent trade deficit since the early 2000s.

For Mills, that trade deficit is the UK’s biggest problem. “We have a major problem in our financial relationship with the other EU countries,” he says, laying out a table showing the UK’s trade position. Indeed, it does look bad: his figures (from the Office of National Statistics, 2016) show the UK running a total trade deficit (goods and services) of £37bn, of which £71bn is with the EU. No, that is not a typo: the UK runs a trade surplus of £34bn with the rest of the world, mainly because of its dominance in services.

Mills blames the trade deficit for increasing foreign ownership of UK-based companies and other assets. He also blames it for the persistent government deficit. Now it is true that these are associated with a trade deficit, but correlation does not imply causation. But more importantly, obsessing about the evils he associates with the trade deficit means he fails to see the very real costs of closing it.

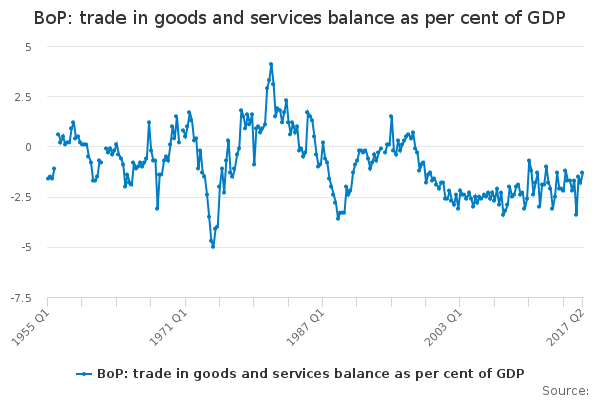

This chart shows the UK’s balance of trade in goods and services since 1953:

(The underlying data can be downloaded here. Incidentally, the dataset shows Mills’ assertion that the last time the UK ran a trade surplus was in 1982 is wrong. This is by no means the only factual error in his piece.)

Now, what is interesting about this chart is not the trade balance itself but its variation. There are three points of interest. The first is that the UK has suffered two “sudden stops”, one in 1975 and the other in 1989. The second is that the post-war trade surplus peaked in 1981. And the third is the gentle slide of the balance of payments into deficit from 1999 onwards.

Mills claims that the cause of the trade deficit is overvaluation of sterling. He believes that sterling has been overvalued for a very long time, and that this is the cause of Britain’s long-term industrial malaise and its stubbornly high trade deficit in goods. He argues for explicit targeting of a significantly lower exchange rate to benefit manufacturing and goods exporters.

There is an obvious legal problem with this. The UK is a founder member of the IMF. Currency manipulation to benefit exporters is explicitly prohibited in Article IV, 1(iii) of the IMF's Articles of Agreement:

[.....each member shall] avoid manipulating exchange rates or the international monetary system in order to prevent effective balance of payments adjustment or to gain an unfair competitive advantage over other members.Nor can the UK afford to ignore the IMF's rules. John Mills's assertion that sterling is not a reserve currency is very wrong. It is not only a major international reserve currency, it is one of only five currencies currently in the IMF's SDR basket. Countries with international reserve currencies all benefit to some extent from "exorbitant privilege" - namely, the ability to borrow externally long-term in their own currency at low interest rates. Giving up this privilege would be costly.

Of course, Mills might argue that losing "exorbitant privilege" would be worth it for a better export performance. So let’s look at the economic case for deliberate sterling devaluation.

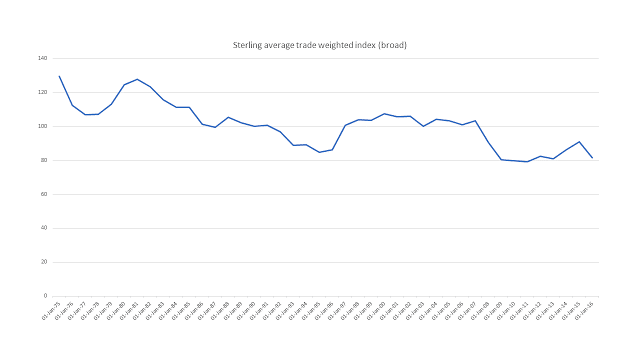

The trade-weighted exchange rate is the right one to use in this case, since we are considering the effect of the exchange rate on broad trade. The chart below shows the sterling trade weighted exchange rate (broad):

There are some caveats around this chart. Firstly, it only goes back to 1975, since that is the limit of Bank of England data. Secondly, in 2006 the valuation basis switches from the 1990 average to 2005. Thirdly, exchange controls were not fully lifted until 1979, and were effectively reimposed between 1985-87, as well as during sterling's brief membership of the ERM: exchange rates during these periods were determined by policy as much as markets.

Nonetheless, it will suffice for my purposes. If the trade deficit is entirely due to the exchange rate, as Mills asserts, we would expect the trade balance and trade-weighted exchange rate charts to be strongly negatively correlated. At first glance, they don’t appear to be, but let’s look more closely. In particular, let’s look at the three points of interest that I identified.

Firstly, the “sudden stops”. A “sudden stop” is usually associated with a collapsing exchange rate as investors pull their funds from the country. Can you can see the two sudden stops that were so evident on the trade balance chart?

You can see the first one, in 1975, followed by the IMF’s intervention in 1976 to stop the pound sliding. Sterling rose sharply after this, recovering its pre-1975 value by 1981.

But the subsequent drop in sterling has nothing to do with the 1989 “sudden stop”. The long fall of sterling from its 1981 height was due to the U.S. dollar, which soared due to the combination of very high interest rates with enormous fiscal stimulus. In 1985, there was an international agreement (known as the Plaza Accord, because it was made at the Plaza Hotel in New York) that central banks would act in concert to dampen the US dollar. Because of the dollar’s dominance in the sterling trade weighted index at this time, the Bank of England’s participation in the Plaza scheme forced sterling’s exchange rate to rise significantly. The 1989 “sudden stop” is present, but it is merely a blip by comparison with Reagan’s tax cuts and the Plaza Accord.

These charts demonstrate a serious problem with the "strong sterling causes trade deficits" idea. 1981 was the peak of the trade surplus. But it was also peak sterling. So the UK not only recovered from a sudden stop in 1975, but delivered its best ever trade performance while sterling was rising to a post-war high. And when sterling fell back in the early 1980s, the UK’s trade surplus shrank. If the exchange rate was determining the balance of trade, as Mills asserts, we would expect the reverse.

The third point of interest is the slow fall of the trade balance into deficit from 1999 onwards. Sterling had been floating since the UK leaving the ERM in 1993: this probably does explain higher volatility in the trade balance. But once again, we see the trade balance improving while sterling was rising. ONS data shows that from 1993 to 1997, the trade balance was in surplus. So what went wrong in 1999?

It would be easy to blame this on the creation of the Euro. But sterling’s exchange rate floats versus the Euro. So how is the Euro to blame?

This could be due to the nature of the Euro. Because by far the largest proportion of the UK’s trade is with the Eurozone, the Euro has replaced the dollar as the dominant currency in the trade weighted basket. But the Euro itself can be regarded as a composite index. The countries whose bilateral trade surpluses with the UK are largely responsible for the UK’s trade deficit are Eurozone countries for whom the Euro’s exchange rate is arguably too low, particularly Germany and the Netherlands. The fact that the Euro is undervalued for Europe’s manufacturing powerhouses could be regarded as unfair advantage, and indeed is so regarded by the Trump administration in the US.

But the Euro is not the only consideration. The Single Market itself encourages cross-border trade and investment: in its capital markets union form, it has encouraged European investors to buy UK-based companies such as privatised utilities and football clubs. The flip side of a current account deficit, of which the trade deficit is part, is a capital account surplus. Extensive inward investment into the UK, encouraged by the dominant financial services industry, necessitates at least a current account deficit and usually a trade deficit as well. But do we really want to reduce inward investment simply for the sake of closing a trade deficit? Surely inward investment benefits the economy even if all the businesses it supports are domestically-focused.

There is also another possible explanation for the UK’s rising trade deficit in goods since 1999, and that is the entry of China to the World Trade Organisation (WTO) and the general opening up of Asian countries to trade. In the US, China’s accession to the WTO is blamed by many for the loss of manufacturing jobs. There is little evidence that UK manufacturing jobs significantly went to Europe – but they have without doubt gone to the Far East. When manufacturers offshore production, the contribution of their goods to the trade balance switches sign. So, for example, ever since James Dyson moved manufacturing to Malaysia, his goods have shown in the UK's trade balance as imports, not exports. His decision, like that of other manufacturers, to move production to cheaper locations, thus contributes to the UK's trade deficit in goods.

In theory, a large depreciation of sterling could improve export competitiveness enough to encourage the likes of Sir James Dyson to bring manufacturing back to the UK. In practice, though, it is not that simple. Dyson now has extensive supply chains in the Far East. Relocating to the UK would be disruptive and costly, not least because unless those supply chains were also relocated to the UK, Dyson's input costs would rise as a direct result of the devaluation of sterling. There are two sides to exchange rate changes, after all: what benefits exporters is harmful to importers, and vice versa. In the UK, most manufacturers import raw materials and components, and all manufacturers are dependent on imported energy (since the UK is not self-sufficient in energy). Sterling devaluation may not benefit manufacturing nearly as much as Mills thinks.

Summing up, therefore:

- Prior to the creation of the Euro and the extension of the Single Market, the trade balance appears to be positively, not negatively, correlated with the trade-weighted exchange rate. Exports expanded with a rising exchange rate. In fact, I suspect there is no direct causation here: a rising sterling exchange rate doesn't benefit exports. Rather, the rising exchange rate is a consequence of rising interest rates, which in turn reflect an improving economy.

- Since the creation of the Euro and the entry of China to the WTO, the trade balance has been negatively correlated with the trade-weighted exchange rate. However, again this does not imply causation. Sterling's 25% fall after the 2008 financial crisis was due to the UK's deep recession, to which the Bank of England responded by cutting short-term interest rates to the floor and embarking on large-scale asset purchases (QE) to depress longer-term interest rates. Exports did not respond to sterling's fall then and they did not respond to a further 10% fall in 2016 either.

But there is a further - and much more serious risk - from Mills's scheme. He blithely asserts that other countries would be happy to accept direct intervention in the sterling exchange rate to benefit British exporters, and cites as evidence the fact that sterling's sharp depreciation when it left the ERM in 1992 and again in 2007-9 due to the financial crisis:

As to recent evidence, the quite major changes in the parity of sterling when the UK left the ERM in 1992 – a trade weighted drop of 12%31 – and the fall in the rate for sterling against the dollar between 2007 and 2009 – about 25%32 – both engendered no retaliation. Both were evidently seen by other countries – the markets and the authorities – as being exchange rate adjustments which were clearly warranted by the state of the UK economy. Against the background of our currently ballooning foreign exchange deficit, there is no reason why the same could not be made to happen again. If the manifest imbalances in the UK economy are clearly associated with an unsustainably high exchange rate, this should also enable us to overcome any objections from our G7 partners, with whom we have jointly agreed not to indulge in unwarranted competitive devaluations.I'm afraid this cannot possibly be true. Mills is comparing apples and pears. Sterling dropped to market value when it left the ERM, not to an artificially created low level. And in 2007-9, the UK was entering the deepest recession since WWII: depreciation was a consequence of the Bank of England's intervention to support the domestic economy, not an explicitly mercantilist exchange rate policy.

Intervention to depress the exchange rate with the explicit intention of benefiting UK manufacturers and exporters at the expense of G7 trading partners would almost certainly be met with retaliation. Indeed, Mills expects retaliation from the Eurozone, and advocates a hard Brexit to ensure that the UK can manipulate its exchange rate without incurring EU wrath. This is, of course, total nonsense. The Eurozone can, and probably would, retaliate against exchange rate manipulation whatever form of Brexit the UK chose.

But the rest of the G7 is not likely to take such action lying down either. In particular, the US is increasingly belligerent towards countries it considers are unfairly manipulating trade, including both Japan and Germany. Deliberately depressing the sterling-dollar exchange rate to benefit UK exporters at the expense of the US would simply result in the UK being added to the miscreants' list. What chance of a UK-US trade deal then?

As I noted at the top of this piece, Mills is a major UK exporter. No wonder he wants a better exchange rate. But I fear that in his desire to benefit his own business he has failed to take into account the terrible political risks associated with using the exchange rate as a source of competitive advantage. The IMF's articles of agreement prohibit exchange rate manipulation precisely because of the risk of tit-for-tat retaliation. Trade wars are costly, and they can lead to real wars. Manufacturing and exports are great, but not at this price. Mills's scheme is a really, really bad idea.

Related reading:

The Amazing Conversion of James Dyson

Tariffs, trade and money illusion

Game Theory in Brexitland

British Lawmaker Advises Investors To Take Their Money Out Of The UK - Forbes

Donald Trump's Chief Trade Advisor Has Accused Germany Of Cheating - But He's Wrong - Forbes

Why President Trump's "Very Big And Exciting" Trade Deal Is Not In The UK's Best Interests - Forbes

Part of the "Rich Old Men Of Brexit" series. Image from CNBC.