The crypto ecosystem has grown massively in the last three years. Many of those participating in it have made life-changing amounts of money - on paper, or perhaps more accurately on computer. But the problem with paper gains is that they tend to evaporate like the morning mist when the market turns. The crypto market turned towards the end of 2021 and is now firmly in bear territory. Bitcoin has fallen from above $60,000 in November 2021 to barely $16,000 now. For anyone who bought Bitcoin...

Read More »There’s no such thing as a safe stablecoin

Stablecoins aren't stable. So-called algorithmic stablecoins crash and burn when people behave in ways the algorithm didn't expect. And reserved stablecoins fall off their pegs - in either direction. A stablecoin that does not stay on its peg is unstable. Not one of the stablecoins currently in circulation lives up to its name. Don't believe me? Well, here's the evidence. Exhibit 1, USDT since the end of April:Exhibit 2, USDC over the same time period:(charts from Coinmarketcap)Both coins...

Read More »The high price of dollar safety

The world is saving like crazy. Corporations are building up cash mountains that they can’t or won’t invest in expanding their businesses. Individuals are building up pensions and precautionary savings. Governments, especially in developing countries, are building up FX reserves. The “savings glut,” as former Fed chairman Ben Bernanke dubbed it, shows no signs of dissipating. It is sloshing around the world looking for a productive home. But there isn’t one - or at least, not one that...

Read More »The high price of dollar safety

The world is saving like crazy. Corporations are building up cash mountains that they can’t or won’t invest in expanding their businesses. Individuals are building up pensions and precautionary savings. Governments, especially in developing countries, are building up FX reserves. The “savings glut,” as former Fed chairman Ben Bernanke dubbed it, shows no signs of dissipating. It is sloshing around the world looking for a productive home. But there isn’t one - or at least, not one that...

Read More »Currency Wars and the Fall of Empires

This post was first published on Pieria in July 2013. I have re-posted it here on Coppola Comment because it now seems terribly, terribly timely. I have been reading James Rickards' book Currency Wars. In this, Rickards reviews the use of fiat currency over the course of the last century, and concludes that the present global fiat currency system is inherently unstable and on the point of collapse. He calls for return of the gold standard to stabilise firstly the US dollar and, following...

Read More »Lars P. Syll — The money ‘trick’

"Modern money" is state money. Abba Lerner explains the "trick" by which a state creates its money.Imposing taxes and accepting its own liabilities in payment creates demand for the currency. In this sense, state money is "monopoly money" in the truest sense, since modern have a monopoly on the issuance of currency, regardless of whether or how they choose to exercise it. Monopolists are prices setters rather than price takers. Hence, the value of the currency is established based on what...

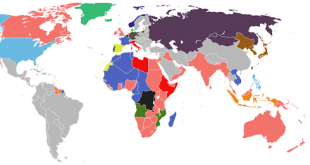

Read More »The myth of monetary sovereignty

How many countries can really claim to have full monetary sovereignty? The simplistic answer is "any country which issues its own currency, has free movement of capital and a floating exchange rate." I have seen this trotted out MANY times, particularly by non-economists of the MMT persuasion. It is, unfortunately, wrong. This is a more complex definition from a prominent MMT economist: 1. Issues its own currency exclusively 2. Requires all taxes and related obligations to be...

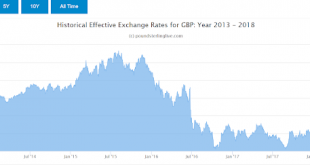

Read More »Patrick Minford’s holidays

Skewering Patrick Minford has become something of an economists' bloodsport. I admit, I have done my fair share of Minford-bashing, though I do try to stay away from trade economics. Others are much better at lampooning Minford's antediluvian approach to trade economics than me.But when Minford starts pontificating on the effect of currency movements on the balance of trade, I can't resist getting out the shotgun. Minford is appallingly bad on anything that involves foreign exchange. He just...

Read More »Peter Cooper — A Simple Modern Money Tale – Buckwell Island Establishes a Currency

Pass it on.heteconomistA Simple Modern Money Tale – Buckwell Island Establishes a CurrencyPeter Cooper

Read More »IPA’s weekly links

Guest post by Jeff Mosenkis of Innovations for Poverty Action. “Economists have now settled down into RCTs as just one tool,” Glennerster told Devex. Among academics, the kind J-PAL works to connect with the world’s policymakers, she said, “the trend toward using RCTs is simply part of this bigger movement in economics to care more about where we can really pin down what is causing what we see.” Any critique I’ve seen of RCTs as a method apply in one way or another to any empirical study...

Read More » Heterodox

Heterodox