For over a century now, the world has lacked a genuinely international means of payment. This is partly due to decisions made at the Bretton Woods conference in 1944, when the US dollar was adopted as the principal international settlement currency, rather than John Maynard Keynes's suggestion of an independent global currency that he called "bancor". Although the Bretton Woods gold-backed structure ended in 1971, the US dollar became ever more dominant. In 2008, the dollar's global reach enabled an American financial crisis to spread to the entire world, causing a deep recession and long-lasting malaise. Ever since, there has been a deep longing for a more stable international financial system, one which didn't depend on debt, wasn't dominated by the US and was immune to political

Topics:

Frances Coppola considers the following as important: Bitcoin, Economics, Gold, history

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

For over a century now, the world has lacked a genuinely international means of payment. This is partly due to decisions made at the Bretton Woods conference in 1944, when the US dollar was adopted as the principal international settlement currency, rather than John Maynard Keynes's suggestion of an independent global currency that he called "bancor". Although the Bretton Woods gold-backed structure ended in 1971, the US dollar became ever more dominant.

In 2008, the dollar's global reach enabled an American financial crisis to spread to the entire world, causing a deep recession and long-lasting malaise. Ever since, there has been a deep longing for a more stable international financial system, one which didn't depend on debt, wasn't dominated by the US and was immune to political whims. Some have called for a new Bretton Woods, or even for the return of the classical gold standard.

Bitcoin emerged from the financial crisis as a fledgling international digital currency. Satoshi Nakamoto's white paper presented it as a peer-to-peer electronic cash system, but from the start, its gold-like properties were evident: it was traded like a commodity, it had a restricted supply and it operated seamlessly across borders. Some, including me, thought it could potentially replace gold as the anchor for a new international monetary system similar to Bretton Woods.

Recently, Bitcoin appears to have turned away from its original purpose and become primarily a new class of asset. Other cryptocurrencies are gradually replacing it as international media of exchange. But some argue that this is merely a transitional phase and Bitcoin will nevertheless eventually become the world's premier international currency. Those who see Bitcoin in this way are known as "Bitcoin maximalists".

One of their number, Pierre Rochard, asked me to do a thoughtful review of a new book by Saifedean Ammous, a Lebanese professor of economics who describes himself on Twitter as a "Bitcoin economist and carnivore grill-master". I was immediately attracted by the name of the book - "The Bitcoin Standard". So I asked for a review copy.

I hoped to find a rigorous assessment of the economic costs and benefits of adopting Bitcoin as an international monetary standard. But right from the start, it was clear that the author had another agenda. "The table of contents reads like an Austrian goldbug tome", said one of my friends. It certainly does. Of ten chapters, seven are about money and its history, including an entire chapter on Monetary Metals, and only three about Bitcoin. Quite why Saifedean thought it was necessary to document the entire history of money in order to discuss Bitcoin is not entirely clear. But document it he does, at some length. And not only money, as we shall see. Saifedean has opinions on all sorts of things - education, music, the arts, work, marriage, children, Keynes. And in this book, he freely expresses them.

By far the best part of the book is the last three chapters. On Bitcoin itself, Saifedean clearly knows his subject, and his arguments are generally balanced and nuanced. He sidesteps the "everyone will use Bitcoin" trap, recognising not only that Bitcoin's illiquidity means that most transactions will inevitably be off chain, but also that there will inevitably be competing applications. He also acknowledges that blockchain cannot solve every business problem.

Personally I think he is too quick to dismiss the threat to Bitcoin's supremacy from other cryptocurrencies. He seems to think that everyone will value Bitcoin's deflationary nature and expensive proof-of-work verification as much as he does, but the reality is that people have choices, and they don't always choose the gold-plated solution. The history of computing shows us that often it is the solution with the best marketing that wins the day, not the one that is technically best. Anyone remember CP/M, which lost out to MS-DOS despite being a far better operating system?

I also think he is unwise to downplay the considerable energy cost of Bitcoin mining. He devotes an entire chapter to explaining why natural resources (except for gold) are unlimited, so presumably thinks that the enormous electricity drain can simply be accommodated, since electricity is derived from natural resources. Perhaps in the future there will be abundant cheap electricity from solar and other renewables. But I was concerned by his lack of interest in the environmental costs. Since there is growing international concern about climate change, Bitcoin's environmental issues may put people off using it. Also, Bitcoin miners' energy demand makes Bitcoin vulnerable to censorship. Public grids are already starting to deny access to Bitcoin miners, and state authorities are refusing permission to set up mining rigs. Bitcoin miners may try to develop their own energy sources, but all forms of energy require access to land, and all land is under the control of governments, one way or another. Bitcoin's need for energy may prove to be its Achilles heel.

But apart from these concerns, the chapters on Bitcoin are pretty good. The problem is the rest of the book. Saifedean has framed the narrative as a gold standard apologetic, leading towards Bitcoin replacing gold in a new digital version of the classical gold standard. So you have to wade through seven chapters of Austrian economics and hard-money fetishism before getting to the meat of the book. It's like having to cross a swamp to reach the barbecue.

Saifedean obsesses about "sound money", which for him means either Bitcoin or gold. But he is distinctly cavalier about the soundness of his facts. There are some absolute howlers. This, for example:

There is no better evidence for this than the fact that the rarest metal in the crust of the earth, gold, has been mined for thousands of years and continues to be mined in increasing quantities as technology advances over time, as shown in Chapter 3. If annual production of the rarest metal in the earth’s crust goes up every year, then it makes no sense to talk of any natural element as being limited in its quantity in any practical sense.Gold is not the rarest metal in the crust of the earth. It's rare, yes. But other metals, such as platinum and iridium, are rarer.

Even more problematic are the logical inconsistencies. Here, for example, he says that increasing gold production would make no difference to its price, because gold hoarding would increase to absorb the increase:

For gold, a price spike that causes a doubling of annual production will be insignificant, increasing stockpiles by 3% rather than 1.5%. If the new increased pace of production is maintained, the stockpiles grow faster, making new increases less significant. It remains practically impossible for goldminers to mine quantities of gold large enough to depress the price significantly.But the same apparently does not apply to other metals. On Twitter, I asked him about this, pointing out that sharp rises in gold inflows under a gold standard are known to be inflationary. He argued that because stockpiles of gold are so large, it would be impossible for miners to increase production sufficiently to affect prices. And anyway, he said, gold production has been rising at about 2% per year for decades.

Facepalm. Just because something has been rising at a low stable rate for decades doesn't mean it will continue to do so. Just ask the American construction industry. A sudden large rise in gold production - which could happen if, for example, the present expensive, dangerous and environmentally damaging cyanide extraction process were replaced with cheaper and friendlier starch extraction, or if asteroid mining took off in a big way - would unquestionably depress its price. Even more importantly, so would a sudden inflow of gold on to the world markets if central banks dumped gold in favour of Bitcoin, as he suggests in Chapter 9. Gold isn't so special that the laws of supply & demand don't apply to it.

For me, the most difficult sections of the book are those on monetary history. They are littered with errors, and very poorly referenced. And they are biased. Saifedean's aim seems to be not to give an accurate description of the development of money in all its forms, but to support his hard-money ideology. So we have the obligatory discussion of Yap stones, shells and beads, but no mention of the use of IOUs as money, a practice going back at least 3,000 years. In fact credit-as-money never features in the entire book. For Saifedean, credit simply cannot ever be money. For the rest of us, of course, it is, as the economist Stephen Williamson quipped:

Fortunately, ignoring credit-as-money is not particularly serious in the chapter on Primitive Moneys. The discussion of the debasement of the Roman currency, ending with the shift of the imperial centre to Byzantium and the gradual decline of Rome, is interesting. However, I am unconvinced that the debasement of the currency was the cause of the fall of Rome. Rather, I would suggest, the debasement of the currency was a symptom of its decline. In my view, Saifedean has causation the wrong way round. It is not the presence of a monetary metal in the coinage that preserves its value. It is the robustness of social institutions that makes using a monetary metal possible. The lesson from Rome is that gold standards don't survive economic and social collapse.Just bought some coffee with this stuff that is not money.— Stephen Williamson (@1954swilliamson) 9 April 2018

I am also amused by Saifedean's assertion that today's Islamic dinar, which is derived from the Byzantine bezant, holds its value because it is made of gold. I suspect that the more significant reason is the reverence in which it is held because it is seen as divinely mandated. Religions are far better at preserving institutions over the long term than any other form of social organisation.

Saifedean's problem with causation continues after the fall of Rome:

New generations of Europeans came to the world with no accumulated wealth passed on from their elders, and the absence of a widely accepted sound monetary standard severely restricted the scope for trade, closing societies off from one another and enhancing parochialism as once-prosperous and civilized trading societies fell into the Dark Ages of serfdom, diseases, closed-mindedness, and religious persecution.Umm, can all of this really be blamed on the absence of a "widely accepted sound monetary standard"? Or did social and political fragmentation make a monetary standard impossible?

More importantly, it's not true. Nor is Saifedean's assertion that feudalism followed on from the fall of Rome. Historians are divided on exactly when feudal structures started to emerge, but the earliest estimate seems to be about 800 AD. That is more than three hundred years after the fall of Rome. True, Saxon social organisation did resemble the later Norman French feudal system in important respects. But Viking social organisation did not, and that was at least as important in Europe as Saxon or French.

The untruths continue in the next chapter, where Saifedean describes the rise of the city-states Florence and Venice. According to Saifedean, merchants physically carried the silver and gold coins minted by the city-states. These were accepted all over Europe because of their metal value. "By the

end of the fourteenth century," says Saifedean, "more than 150 European cities and states

had minted coins of the same specifications as the florin, allowing their

citizens the dignity and freedom to accumulate wealth and trade with a

sound money that was highly salable across time and space, and divided

into small coins, allowing for easy divisibility."

No, just no. European cities minted their own coins, yes, but merchants did not carry them from city to city. It was far too dangerous. Trade developed at that time not because of the florin and the ducat, but because of letters of credit and bills of exchange. Saifedean does not even mention the Florentine banks that played such a crucial role in international trade at that time. This is a catastrophic omission.

Saifedean then does even more violence to historical accuracy. He skips straight from the 13th century to the 19th, thereby implying that throughout this time all trade was conducted in gold and silver coinage. Goldsmith receipts, certificates of deposit, the banknotes that were issued first by private banks and later by central banks, the first travellers' cheques, even France's disastrous attempt at a paper currency after the French Revolution - they are all airbrushed out of history. Then he comes up with this absolute gem:

Two particular technological advancements would move Europe and the world away from physical coins and in turn help bring about the demise of silver’s monetary role: the telegraph, first deployed commercially in 1837, and the growing network of trains, allowing transportation across Europe. With these two innovations, it became increasingly feasible for banks to communicate with each other, sending payments efficiently across space when needed and debiting accounts instead of having to send physical payments. This led to the increased use of bills, checks, and paper receipts as monetary media instead of physical gold and silver coins.This is just wrong. Bills, cheques (I prefer the British spelling) and paper receipts long pre-dated trains and wires. In fact the introduction of the telegraph marked the start of the move away from paper and coin as monetary media towards digital money, since it meant payment instructions could be sent by wire between banks, enabling them simply to make the necessary ledger entries without any paper being presented. Even now, international payments are often known as "wire transfers".

Ordinary people, of course, used physical cash for payments, and at that time most of that physical cash was silver and copper coinage. But banknotes were widely used for large transactions. In the 18th and 19th centuries the British guinea (later the gold sovereign) was recognised as the primary unit of account for international trade, just as the US dollar is today. But trade itself mostly involved paper, as it had for centuries. Letters of credit were as ubiquitous in the 19th century as they were in the 14th.

Some of Saifedean's points about the latter half of the 19th century are fair. For example, the demonetisation of silver possibly was at least partly responsible for the decline of India and China. But there are other reasons too. For example, Bengal's cotton weaving industry collapsed during colonial rule because of competition from cheaper British cottons brought in by the East India Company. And the Opium Wars left China scarred and impoverished.

It's also fair to say that the near-universal adoption of a gold standard based on the British pound facilitated international trade to a then unprecedented degree. However, this was the most centralised monetary system in history. European central banks, led by the Bank of England, cooperated to manage the gold price and international money flows. The US, which did not have a central bank at that time, relied on monetary support from the Bank of England to smooth out seasonal fluctuations in its agrarian economy. It is not clear that a decentralised and autonomous form of such a system, with no central banks actively managing specie flows and prices, would necessarily work in the same way - or be as effective at facilitating trade.

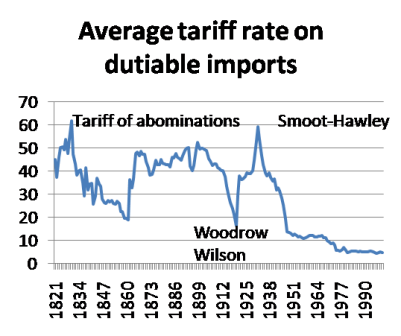

The international trade boom facilitated by the gold standard was even more remarkable when you consider that trade in the latter half of the 19th century was anything but free. True, the British Empire was at its height then, covering a third of the globe, and countries that were part of the Empire had what amounted to "free trade" with Britain. And Britain itself famously adopted unilateral free trade in 1846 when it repealed the Corn Laws. But the US's import tariffs in the second half of the 19th century averaged 40-50%:

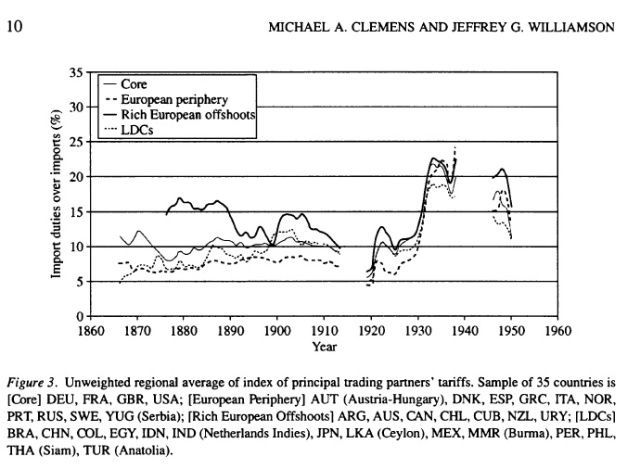

And although tariffs in the rest of the world were significantly lower, they rose gradually during the last two decades of the 19th Century in response to the US's very high tariffs and its growing dominance of global agriculture:

Saifedean's assertion that the classical gold standard period was a time of "global free trade" is yet another gross error. In fact the world is much closer to global free trade now, under the "unsound money" system that Saifedean hates, than it was under the classical gold standard. The last three decades have seen globalisation on an unprecedented scale, and an equally unprecedented fall in global poverty. We should think very hard before throwing that away in pursuit of a golden chimera.

After this, Saifedean's narrative goes horribly wrong. His discussion of the twentieth century opens with this howler:

The twentieth century began with governments bringing their citizens’ gold under their control through the invention of the modern central bank on the gold standard.The only central bank that was invented at the beginning of the twentieth century was the Federal Reserve, which was created in 1913. All the European central banks had existed for at least the previous two centuries, and many for much longer - the Bank of England, for example, was founded in 1694, and Sweden's Riksbank in 1668.

He continues:

As World War I started, the centralization of these reserves allowed these governments to expand the money supply beyond their gold reserves, reducing the value of their currency. Yet central banks continued to confiscate and accumulate more gold until the 1960s, where the move toward a U.S. dollar global standard began to shape up,I genuinely don't know where to start with this. He seems to be talking about all central banks as if they were the Fed. The Fed did indeed accumulate gold from World War I onwards (though so did the Bank of France), but it did so at the expense of other central banks, not ordinary citizens.

But there is worse to come. Saifedean thinks he knows why World War I lasted as long as it did:

In retrospect, the major difference between World War I and the previous limited wars was neither geopolitical nor strategic, but rather, it was monetary.So nothing to do with the fact that four great European Empires were fighting for supremacy? Nor that because of their colonial possessions, they were able to bring in fighters from all over the world? Nor that the British were eventually able to call on their historic alliance with the USA? Seriously, none of that matters?

Nope:

Had European nations remained on the gold standard, or had the people of Europe held their own gold in their own hands, forcing government to resort to taxation instead of inflation, history might have been different. It is likely that World War I would have been settled militarily within a few months of conflict, as one of the allied factions started running out of financing and faced difficulties in extracting wealth from a population that was not willing to part with its wealth to defend their regime’s survival. But with the suspension of the gold standard, running out of financing was not enough to end the war; a sovereign had to run out of its people’s accumulated wealth expropriated through inflation.Good lord. The European powers did run out of money. They borrowed heavily from the USA. That's how the Fed acquired all that gold. That's why they had to abandon the gold standard. If Saifedean paid any attention to debt dynamics, he would see this. But because he totally ignores the role of debt in the monetary system, his causation problem has gone into overload.

World War I eventually ended in 1918. Unsurprisingly, the currencies of the losing team (Germany and Austria) devalued far more than those of the winners. Saifedean does not connect that devaluation with the Treaty of Versailles, in which Germany was forced to relinquish much of its productive capacity to France and Poland, and was additionally saddled with enormous reparation bills. This is what Saifedean thinks was the effect of World War I:

The geographic changes brought about by the war were hardly worth the carnage, as most nations gained or lost marginal lands and no victor could claim to have captured large territories worth the sacrifice. The Austro-Hungarian Empire was broken up into smaller nations, but these remained ruled by their own people, and not the winners of the war. The major adjustment of the war was the removal of many European monarchies and their replacement with republican regimes.The Treaty of Versailles set up both the Weimar hyperinflation and the rise of Hitler. It was one of the most disastrous decisions ever made. And it doesn't even warrant a mention?

It does get a brief mention a little later, in a paragraph discussing return to the gold standard:

Germany suffered from hyperinflation after the Treaty of Versailles had imposed large reparations on it and it sought to repay them using inflation.Eh, what??? The reparations had to be paid in gold or in kind. Germany couldn't "use inflation to pay them". Inflation actually made paying them impossible.

Drawing a veil over this unfortunate episode, we move swiftly on to the Wall Street Crash and the Depression. Dismissing Liaquat Ahamed's book Lords of Finance on the grounds that it is "Keynesian", Saifedean accepts without question Murray Rothbard's partisan analysis. Rothbard blames the credit bubble that burst so disastrously in 1929 on the UK, which returned to the gold standard at too high a parity in 1925 then leant on the US to loosen monetary policy to ease its gold shortage. Well, I agree that the UK's tight money policy was foolish. So did Keynes, who warned about it at the time. But really, Saifedean - don't American banks bear any responsibility for their excessive lending?

Saifedean then goes on to criticise US economic policy in the Depression. Again, there are things I agree with: the US could simply have devalued the dollar versus gold, rather than leaving the gold standard completely, and attempting to maintain producer prices and wages in a debt deflationary depression was crazy. So too was running fiscal surpluses, as Hoover did. But who does Saifedean blame for the mismanagement of the US economy? Not Hoover, or Mellon, or Roosevelt. No, he blames John Maynard Keynes:

Having never studied economics or researched it professionally, Keynes captured the zeitgeist of omnipotent government to come up with the definitive track that gave governments what they wanted to hear. Gone were all the foundations of economic knowledge acquired over centuries of scholarship around the world, to be replaced with the new faith with the ever-so-convenient conclusions that suited high time-preference politicians and totalitarian governments: the state of the economy is determined by the lever of aggregate spending, and any rise in unemployment or slowdown in production had no underlying causes in the structure of production or in the distortion of markets by central planners; rather it was all a shortage of spending, and the remedy is the debauching of the currency and the increase of government spending. Saving reduces spending and because spending is all that matters, government must do all it can to deter its citizens from saving. Imports drive workers out of work, so spending increases must go on domestic goods.This is the first of several attacks on Keynes in this book. Anyone who has actually read the General Theory, or anything else by Keynes for that matter, will know that this is a gross distortion of his ideas. But Saifedean is not writing for an informed audience. His book is polemical, not scholarly. Hence the historical distortions, the lack of credible academic citations, the presentation of opinions as facts, and the demonization of people he doesn't agree with, particularly (but not exclusively) Keynes.

Saifedean then launches a diatribe against economic education, alleging that it has become a vehicle for enforcing government management of the economy, and blaming what he calls the "Keynesian deluge" for, among other things, murder of "classical liberal" economists in Russia, Italy, Germany and Austria. How on earth Keynes is responsible for the treatment of academics by Hitler, Mussolini and Stalin is beyond me, but that is the clear implication. I suppose if you want to demonize someone, finding a way of linking them with this trio is a sure-fire way of achieving it.

He goes on to dismiss all research into the role of the gold standard in the Great Depression on the grounds that it relies on "Keynesian animal spirits" - another gross distortion, this time of the work of Friedman, Bernanke, Eichengreen, Delong and many others. According to Saifedean, leaving the gold standard didn't result in recovery:

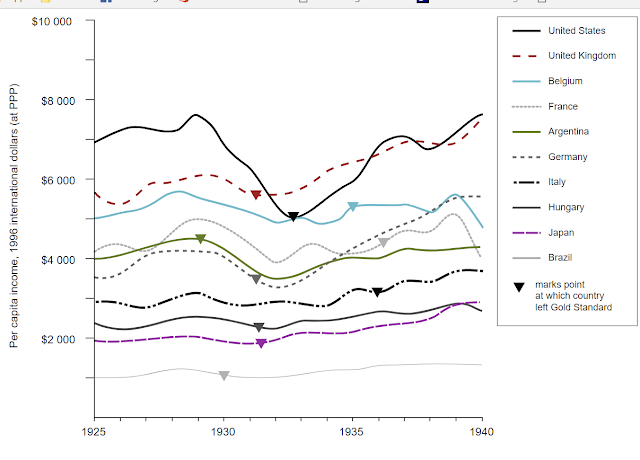

if the problem was indeed the gold standard, then its suspension should have caused the beginning of recovery. Instead, it took more than a decade after its suspension for growth to resume..."This is empirically untrue. Not only in the US, but internationally:

Having blithely dismissed the evidence that leaving the gold standard kickstarted recovery from the Depression, he then comes out with this extraordinary statement:

The nations that had prospered together 40 years earlier, trading under one universal gold standard, now had large monetary and trade barriers between them, loud populist leaders who blamed all their failures on other nations, and a rising tide of hateful nationalism that was soon to fulfill Otto Mallery’s prophecy: “If soldiers are not to cross international boundaries, goods must do so. Unless the Shackles can be dropped from trade, bombs will be dropped from the sky.”So the ending of the gold standard not only didn't restore growth, it caused the rise to power of Hitler and Mussolini. You couldn't make it up.

You couldn't make this up, either:

From the sky the bombs did drop, along with countless heretofore unimaginable forms of murder and horror. The war machines that the government-directed economies built were far more advanced than any the world had ever seen, thanks to the popularity of the most dangerous and absurd of all Keynesian fallacies, the notion that government spending on military effort would aid economic recovery.Apparently the Western powers were so desperate for economic growth that they started the most devastating war in history. I thought for a moment I was imagining this, but there is no doubt what he means:

As an increasing number of people went hungry during the depression, all major governments spent generously on arming themselves, and the result was a return to the senseless destruction of three decades earlier.I have never before encountered such outrageous historical revisionism. The only European government that seriously tried to kickstart growth through rearmament was Germany's. And even there, economic growth was far from the main objective. Hitler's primary aim was conquest. Outside Europe, the only country that undertook significant rearmament during the 1930s was Japan, but again that had nothing to do with economic growth. The US did not start rearming until 1939.

The fact that European countries had not rearmed was in large measure the reason for Hitler's early successes. They did not have the firepower to counter the Anschluss or the invasion of Czechoslovakia, so they opted for appeasement. Only when Poland was invaded did the British act, even though they lacked the forces to mount a credible opposition to Hitler's war machine. And the rest of the Europe was unable to resist Hitler's advance. Even the mighty Soviet Union struggled, before the US intervention in 1941.

Saifedean's allegation is poisonous nonsense. And terrifying. We must not forget what the real causes of World War II were - the asset-stripping of Germany and Austria after World War I, the racism and anti-Semitism of the Nazis, the doctrine of "lebensraum" that underpinned Hitler's imperialist ambitions. Neither must we forget that eugenics, which the Nazis used to justify systematic murder of millions of "inferior" human beings, had widespread support in other Western countries too. Leaving the gold standard and restoring economic growth had nothing to do with World War II. And although I find Keynes's support of eugenics repellent, I don't think his economic ideas had any influence on World War II. Mein Kampf was written in 1924, twelve years before the General Theory. And Hitler was using scrip currency to reflate the German economy and pay for arms long before the General Theory was translated into German.

After the war, the world established a new monetary system, in which the US dollar was pegged to gold at $35 per ounce, and other currencies were pegged to the US dollar. Saifedean claims that to support this, other central banks provided gold to the US. I think this is a misunderstanding of the role of gold reserves at other central banks, but it may also reflect the fact that heavy borrowing by European powers from the US drained their gold reserves not only during the war, but for some time afterwards. Once again, ignoring the role of debt leads Saifedean to unfortunate conclusions.

The fixed gold price was maintained, with extreme difficulty, until 1968 when the London Gold Pool was forced to close. Pegging currencies to gold does not prevent inflation; rather, when inflation takes off, the peg becomes impossible to hold. The US unpegged the dollar from gold in 1971. However, it did not completely abandon its anchor: in 1974, the US entered into an agreement with OPEC to price oil in dollars. Although the price was not fixed, the importance of oil in the international economy, and OPEC's recycling of petrodollars into US investments, helped to ensure the global dominance of the US dollar and dollar-denominated assets. Saifedean doesn't mention any of this. Nor does he mention the repeated attempts to manage the dollar exchange rate during the 1970s and 80s. He mentions the high inflation of that time, but simply says "things got better after 1990". Well I never. Just about the time that central banks gave up trying to manage exchange rates and started targeting inflation instead. The period between 1992 and the 2008 financial crisis is known as the Great Moderation, because inflation remained low and stable in all Western countries. It also happens to be the period of the greatest expansion in global trade in history. You don't need a gold standard to have both expanding trade and low inflation.

There now follow two chapters extolling the virtues of the gold standard and the awfulness of the present monetary system. Apparently all of the ills of society are due to the lack of "sound money", while all the beneficial inventions that have ever been made happened under the classical gold standard. I agree that monetary instability is socially damaging: I lived through the 1970s and 1980s, and I remember the unemployment and social misery caused by both inflation and the high interest rates used to bring inflation under control. But inequality is also socially damaging, and a deflationary currency such as a strict gold standard tends to increase inequality, because its rising price makes it increasingly inaccessible to late adopters while encouraging hoarding among those who bought in early. Subdividing the currency may make it more usable for transactions, but it doesn't stop people hoarding. Anyway, gold standards don't prevent monetary instability (see Rome), and fiat currency can be extremely stable (see Japan). Once again, Saifedean has causation the wrong way round. A stable, prosperous society with strong institutions is likely to have sound money, whether it is a fiat currency or a gold standard.

There are also repeated attacks on Keynes. Not only his ideas, but also his personal lifestyle are severely criticised. This, for example:

It is no coincidence that the breakdown of the family has come about through the implementation of the economic teachings of a man who never had any interest in the long term. A son of a rich family that had accumulated significant capital over generations, Keynes was a libertine hedonist who wasted most his adult life engaging in sexual relationships with children, including traveling around the Mediterranean to visit children’s brothels.Keynes was undoubtedly a flawed man, but he was married, and he and his wife grieved over the loss of their child.

More importantly, though, this is more historical revisionism. The heyday of Keynesian ideas was the post-World War II period. This was also the period of the biggest baby boom in history. Birth rates only started to fall when abortion and contraception became widely available in the late 1960s. Marriage rates have also fallen significantly since then, and divorce rates have risen. Is this all because of Keynes' lifestyle? Hardly. It is more likely due to women becoming economically active and therefore no longer dependent on men. It might also have something to do with the decline of religion and the fading of social norms derived from religion. And it might also have something to do with divorce becoming much easier and marriage much more expensive. And yes, it might also have something to do with social safety nets (which Saifedean appears to hate).

Having blamed Keynes for family breakdown, and attributed the invention of hot and cold running water to the gold standard (nothing to do with cholera, then?), Saifedean then launches into an extraordinary diatribe against modern music and art. He claims, for example, that modern musicians and artists do not work at their art. He calls them talentless and lazy. His attack on artists, in particular, is so virulent that I wonder if he was rejected from an art college. "A stroll through a modern art gallery shows artistic works whose production requires no more effort or talent than can be mustered by a bored 6-year-old," he proclaims. My art student daughter gently pointed out on Twitter that art projects can take years to complete. "Stick to your lane, grill-master", she said.

Saifedean blames what he regards as the degeneracy of music and art on the absence of a gold standard and the interference of government in the economy:

As government money has replaced sound money, patrons with low time preference and refined tastes have been replaced by government bureaucrats with political agendas as crude as their artistic taste. Naturally, then, neither beauty nor longevity matters anymore, replaced with political prattling and the ability to impress bureaucrats who control the major funding sources to the large galleries and museums, which have become a government-protected monopoly on artistic taste and standards for artistic education. Free competition between artists and donors is now replaced with central planning by unaccountable bureaucrats, with predictably disastrous results. In free markets, the winners are always the ones who provide the goods deemed best by the public. When government is in charge of deciding winners and losers, the sort of people who have nothing better to do with their life than work as government bureaucrats are the arbiters of taste and beauty.Ok, so the X factor is a better arbiter of taste and beauty than the Arts Council?

Ah, no. It's all about being the right kind of people:

Instead of art’s success being determined by the people who have succeeded in attaining wealth through several generations of intelligence and low time preference, it is instead determined by the people with the opportunism to rise in the political and bureaucratic system best. A passing familiarity with this kind of people is enough to explain to anyone how we can end up with the monstrosities of today’s art.So people who have inherited wealth are the best arbiters of taste and beauty. Paris Hilton is a better judge of music than someone from a poor background who studied at the Royal College of Music. I am stunned.

Saifedean is also embarrassingly ignorant of how the creative arts have historically been funded. Patronage has always been the prerogative of government. Handel, for example, wrote numerous commissions for British kings, including the Music for the Royal Fireworks, the Coronation Odes and the Water Music. Purcell wrote Queen Mary's funeral music. The composers Lully, Rameau and later Gluck worked at the court of the French King. Bach wrote the Brandenburg Concertos in the hope of getting a job at the court of the Margrave of Brandenburg. And by far the greatest age of government musical and artistic patronage was the period of the classical gold standard.

I found Saifedean's attack on musicians and artists chilling. "Degenerate art" has a bad history. Saifedean lambasts Russia, Italy, Germany and Austria for murdering and exiling his favourite economists, but conveniently forgets about the musicians and artists who were murdered and exiled for producing the wrong sort of art, or for being the wrong kind of people.

But I'm not going to waste any more time on this lunacy, worrying though it is. The big question for me is what I asked at the start of this post. Could Bitcoin be the anchor for a global system of currencies in the digital age?

Sadly, if this book is anything to go by, there is little chance of this. The Bitcoin community is in thrall to Austrian economic cranks and historical revisionists. "Sound money" has become something of a religion, and hoarding a religious duty. Saifedean talks about a "pool of loanable funds" (yes, I know, this is wrong, loans create deposits etc.). But this implies that there must be people willing to lend their money, rather than simply HODLing it. In Bitcoin, saving means hoarding, not investing. It means building up a hoard of something akin to gold, then sitting on it waiting for the price to rise - as it inevitably will, if enough people do this. Investment? I don't see any.

That said, there is investment in the cryptocurrency ecosystem. Lots of it. There is also money creation. Lots of it. That's what ICOs are about. Creating money and investing it. But the connection between saving and investment is broken: HODLers sit on their hoards, while ICOs create ever more "money". Loanable funds? I don't see any.

Until the Bitcoin community ditches the cranks and adopts a sensible monetary policy that properly recognises both the need for savings to be intermediated into productive investment and the need for money to flow, Bitcoin cannot possibly operate as the anchor of the cryptocurrency ecosystem. And in part because of Bitcoin's failure, the ecosystem itself is hyperinflating. Sound money? I don't see much of that.

Saifedean spent some time in his book discussing hyperinflation in fiat currencies. He should have a good look at what is going on in the crypto world, right now. That would be a much better use of his economic skills than writing this silly book. Stick to your lane, "Bitcoin economist".

Update: David Gerard is less positive than me about the Bitcoin part of the book. His review is here.

Related reading:

The Bitcoin Standard: A Decentralized Alternative to Central Banking - Saifedean Ammous

Currency Wars - James Rickards

Lords of Finance: the Bankers who Broke the World - Liaquat Ahamed

Currency Wars and the Fall of Empires - Pieria

Economic Consequences of the Peace - JM Keynes

Essays in Persuasion - JM Keynes

When Money Dies - Adam Fergusson

The Course of Rearmament before the Second World War - Snell

The Rise and Fall of the Third Reich - Shirer

The necessary arrogance of elites

Mein Kampf - Adolf Hitler

Dragon image from Paul Demaret via Wikipedia.