When it comes to the recent market turmoil people are quick to make two comparisons – 1998 or 2008. Both were “crisis” type events that led to big stock market declines and substantial economic turmoil, but 2008 was far more traumatic. There are some important distinctions between the two environments so let’s look at the macro picture and see if we can’t better understand where we are and where we might be headed. I should start by pointing out that the only reason this website even exists is because of 2008. For those who have been reading me for the last 5 years thinking I am a permabull I can assure you that’s wrong. I was often called a permabear from 2008 through early 2010 (yes, I was late to the recovery). My first posts here (see here, here and here for example) were anonymous thoughts I was hashing out at the time (mostly for my client letters). As someone who was fairly immersed in the mechanics of banking and endogenous money I was extremely worried about a debt deflation style event that was occurring due to the housing market collapse. And while I was worried I have to admit that things turned out even worse than I expected. The contagion was far worse than I knew. Still, given my understandings of the monetary and financial system I had a pretty darn good grasp on what was going on at the time.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

When it comes to the recent market turmoil people are quick to make two comparisons – 1998 or 2008. Both were “crisis” type events that led to big stock market declines and substantial economic turmoil, but 2008 was far more traumatic. There are some important distinctions between the two environments so let’s look at the macro picture and see if we can’t better understand where we are and where we might be headed.

I should start by pointing out that the only reason this website even exists is because of 2008. For those who have been reading me for the last 5 years thinking I am a permabull I can assure you that’s wrong. I was often called a permabear from 2008 through early 2010 (yes, I was late to the recovery). My first posts here (see here, here and here for example) were anonymous thoughts I was hashing out at the time (mostly for my client letters). As someone who was fairly immersed in the mechanics of banking and endogenous money I was extremely worried about a debt deflation style event that was occurring due to the housing market collapse. And while I was worried I have to admit that things turned out even worse than I expected. The contagion was far worse than I knew. Still, given my understandings of the monetary and financial system I had a pretty darn good grasp on what was going on at the time. And let me be very clear – what we’re seeing today is NOT 2008.

Credit Markets Are Far Healthier

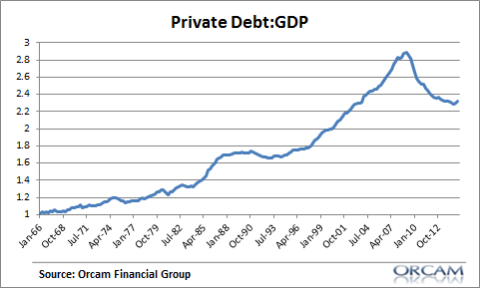

The first big difference between today and the 2008 period before the financial crisis is that private sector balance sheets are far healthier. 2008 wasn’t a banking crisis or a “financial” crisis. It was a credit crisis. This distinction is important because it was the surge in private credit that led directly to overpriced homes which led to Wall Street securitizing those debts. In essence, we had leverage on top of leverage. And when the product supporting all that leverage (housing) collapsed it led to a domino effect. The credit markets today are far healthier than they were in 2008 and not directly attached to an uncontrollable bull market in the most important item in the private sector balance sheet (houses).

Private debt to GDP has come way down in recent years:

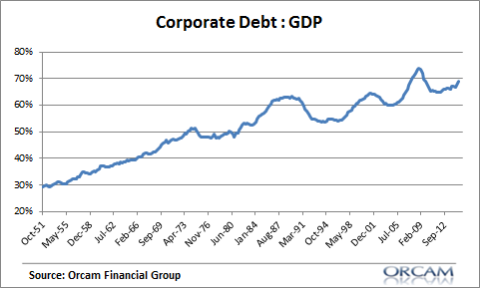

Corporate debt has jumped in recent years, but as a percentage of GDP it has also declined since 2007:

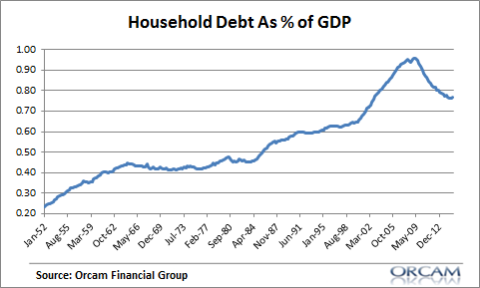

Household debt as a percentage of GDP has dropped pretty dramatically:

Of course, government debt has surged and offset much of this deleveraging, but regular readers know that we don’t have to worry too much about the potential for the US government to go bankrupt. So that quantity of debt is far less worrisome and destabilizing than the private sector’s debts.

Labor Markets Are Far Healthier

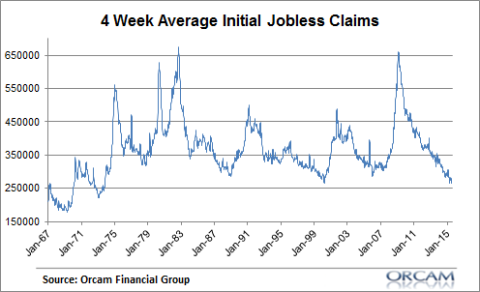

Despite the turmoil abroad the US economy appears to keep chugging along. Yes, growth isn’t great and I still think we’re “muddling through” from the financial crisis, but it’s still not as bad as some make it out to be. In 2008 the key domino was housing. Once the housing domino tipped it led to widespread job cuts. You might not remember, but the labor market in 2008 was very bad. In fact, the unemployment rate had been rising since 2006. The credit crisis was like a slow motion train wreck that actually unfolded over the course of several years. This does not remotely resemble today’s labor market.

Jobless claims are near all-time lows:

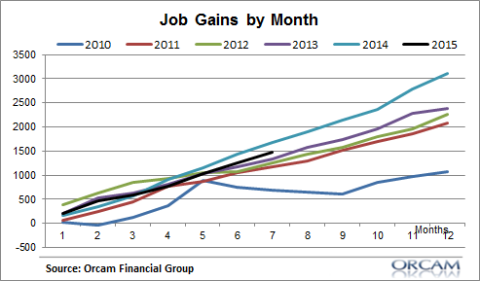

In 2008 we were 8 months deep in consecutive job losses. We’d lost an average of almost 75K jobs per month when the financial crisis struck in August 2008. This time around we have yet to see a negative month. In fact, 2015 is shaping up to be one of the better employment years of the recovery.

The Banking System is Far Healthier

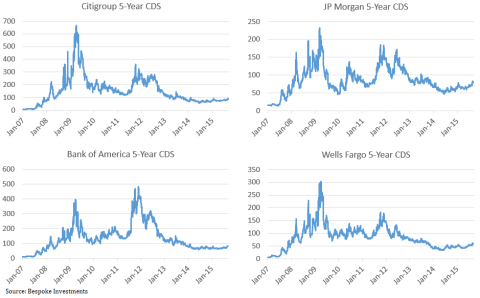

By late 2007 and mid 2008 bank Credit Default Swaps were surging and many had already blown out to record highs. The largest banks in the USA were all seeing substantial moves in CDS well before the panic struck in 2008. Today, there has been virtually no change:

It’s also worth noting that the regulations that were put in place following the crisis have led to much higher capital ratios. US banks have a much bigger cushion for downside than they did in 2008.

More 1998 than 2008

What this environment does look like is 1998. 1998 was an emerging market crisis that slammed foreign stocks, commodities and currencies. But the issues were relatively contained. In fact, the USA boomed in 1999. So much so that stocks surged irrationally on the platform of fear that 1998 created and led directly to the blow off top in the Tech Bubble. Even emerging market stocks made a huge comeback in 1999 as markets realized the panic might be overblown.

Of course, the unknown here is China. And I don’t know if anyone fully understands what’s going on with the Chinese economy. But one thing is clear. If China is the slow motion credit train wreck analogous to 2008 then this too should be relatively contained to China and its most interconnected economic partners. And the biggest reason why this is likely to be contained is because China’s banking system is mostly state owned. Remember, the 2008 crisis didn’t really end until the US government put its full faith and credit behind the US banking system. But China already has this in place. China’s biggest banks won’t be allowed to default or even come close. In essence, the AIG plan for China has always been in place. China’s biggest banks aren’t just too big to fail. They are infallible.

Interestingly, if you look at GDP and labor market trends in 1998 they look eerily similar to today’s environment. While the 1998 emerging market crisis unfolded US GDP hardly budged. And the unemployment rate continued to drive lower into late 1999. At the macro level the emerging market crisis didn’t have much impact on the world’s most important economy.

It’s Always Different This Time

Of course, it’s always different this time. No two environments are exactly alike. And I shouldn’t downplay some of the potential risks in the USA at present. There has been a lot of margined buying of equities, a buyback fueled bull market, weak economic growth, etc. So there are risks out there that could create the potential for stock market instability. The fact that stocks fall seems to surprise a lot of people who have become used to the recent stability, but what we’ve seen so far is little more than benign market action.

Now, I am certainly no soothsayer. I simply look at the world we have, assess probable outcomes and position myself accordingly. And when I look at the macro picture I see this environment as being one that looks a lot more like 1998 than 2008. And while that doesn’t mean we shouldn’t fear some downside in financial markets and the economy it also doesn’t mean we should be building bunkers and piling into gold.