There’s a lot of scary chatter in the last few years about profit margins. The basic thinking usually goes something like this: “Profit margins are mean reverting and since profit margins are high then that means stocks are risky because they’ll crash when profit margins mean revert” This reminds me a lot of the scary “high valuation” discussions about Tobin’s Q and Shiller’s CAPE which usually go something like this: “Stock valuations are mean reverting and since stock valuations are high then that means stocks are risky because they’ll crash when valuations mean revert” This has been shown to be a bit misleading. After all, these popular valuation metrics have been elevated for decades and have led more than a few permabears to imminent death by “overvalued” bull market. But what about profit margins? Are they telling us anything useful now? Let’s unpack this a bit. First, aggregate profit margins are usually constructed as a percentage of GDP or GNP. So, you might see something like this depending on how you compile the data: Given that the numerator and denominator are highly dynamic inputs the figure will tend to fluctuate (that’s fancy math for ya!). Historically, profit margins have averaged about 6.5% and have tended to mean revert (errr, fluctuate around this historical average).

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

There’s a lot of scary chatter in the last few years about profit margins. The basic thinking usually goes something like this:

“Profit margins are mean reverting and since profit margins are high then that means stocks are risky because they’ll crash when profit margins mean revert”

This reminds me a lot of the scary “high valuation” discussions about Tobin’s Q and Shiller’s CAPE which usually go something like this:

“Stock valuations are mean reverting and since stock valuations are high then that means stocks are risky because they’ll crash when valuations mean revert”

This has been shown to be a bit misleading. After all, these popular valuation metrics have been elevated for decades and have led more than a few permabears to imminent death by “overvalued” bull market. But what about profit margins? Are they telling us anything useful now? Let’s unpack this a bit.

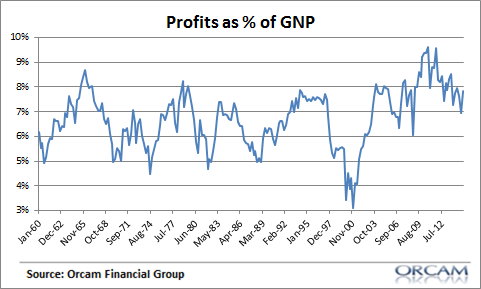

First, aggregate profit margins are usually constructed as a percentage of GDP or GNP. So, you might see something like this depending on how you compile the data:

Given that the numerator and denominator are highly dynamic inputs the figure will tend to fluctuate (that’s fancy math for ya!). Historically, profit margins have averaged about 6.5% and have tended to mean revert (errr, fluctuate around this historical average). So, you can see how the recent experience of elevated profit margins might give the appearance of an excessively risky stock market.

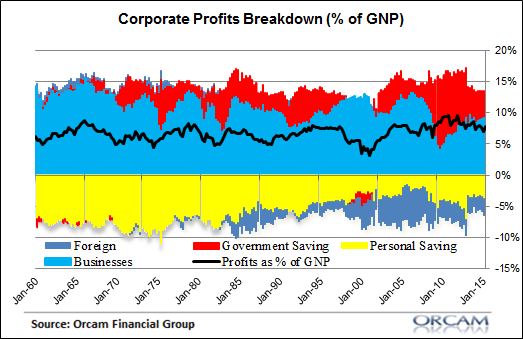

Now for a deep dive into the components. Profit margins are very simple. Margins are nothing more than a function of the source of profits. And we know that the sources of profits are net investment, net exports, consumer expenditures and government deficits (these are the possible sources of aggregate flows in the economy that can contribute to profits). When these components are high relative to GNP margins will also be high, by definition.

As an important aside, labor costs have nothing to do with any of this. This is important because many people assume that lower labor costs mean higher profits. But this is not correct. Lower labor costs mean lower revenues for another company because the fired workers have that much less income to spend. This is a very common fallacy of composition and it’s one I’ve been seeing quite a bit in recent weeks.

So, why have profit margins been so high in the last few decades and why are they falling a bit in the last few years? If we break down the contributing components you’ll get a much clearer picture of what’s going on. That profit margin line (the black line) has shifted upward since 2000 primarily because the US government has run large deficits and household saving has decreased. This just means that corporations are the sector taking in more of the aggregate income in the economy. The main driver of falling profits in the last few years is the reduction in the deficit.

Deciphering the future market direction based on this data is difficult at best. The reason why is because you have lots of moving parts inside of the margin drivers (for instance, when household saving rises you also have to account for the fact that the budget deficit will likely increase). In addition, there’s no reason to believe that that 6.5% figure is going to be the future average. The reason why is because households could be saving less for structural reasons, the budget deficit could be high for structural reasons or any other number of reasons. That 6.5% average isn’t etched in stone, but let’s just assume it is. Does it tell us anything about future stock returns?

Since 1960 the S&P 500 has generated an average compound growth rate of 6.75% per year. But when margins are above 6.5% the S&P 500 averages a 8.75% average compound growth rate. This means that stocks actually experience their highest returns when margins are unusually high. But that doesn’t account for the fact that margins are a coincident indicator. And unfortunately, trying to predict when margins will compress requires a huge amount of guesswork about how the underlying drivers will lead to margin changes. And while I understand these elements fairly well I am not nearly smart enough (or stupid enough?) to try to guess where margins are headed. And that makes predictions about the stock market based on margins a very tricky game and one I would generally advise ignoring.