I see this question more and more as indexing grows in popularity. People generally think that more indexing will make the markets function less efficiently . I don’t think this is true at all. Unfortunately, the question and its answers are usually shrouded in misunderstandings about how assets are priced and myths about what it means to invest “passively”. So, let’s think about this from an operational perspective. An index fund is not really an “index”. They are portfolios managed every day trying to track an index. These funds are managed actively and involve hundreds if not thousands of decisions every year. The simplest example is the modern day ETF which is essentially a real-time version of what most people think of as an index fund. When you buy shares in an ETF there is someone who is actively managing the allocation of funds (the same is true for an index mutual fund though it’s less apparent in real-time since the fund is not traded on an exchange). For instance, if the market price of an ETF were to deviate from the intraday indicative value then the market makers would either buy/sell the ETF or buy/sell the underlying securities. So, while there doesn’t appear to be much activity on the surface, the very act of buying an index fund could actually force some active management in the underlying securities markets.

Topics:

Cullen Roche considers the following as important: Most Recent Stories, Myth Busting

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

I see this question more and more as indexing grows in popularity. People generally think that more indexing will make the markets function less efficiently . I don’t think this is true at all. Unfortunately, the question and its answers are usually shrouded in misunderstandings about how assets are priced and myths about what it means to invest “passively”. So, let’s think about this from an operational perspective.

An index fund is not really an “index”. They are portfolios managed every day trying to track an index. These funds are managed actively and involve hundreds if not thousands of decisions every year. The simplest example is the modern day ETF which is essentially a real-time version of what most people think of as an index fund. When you buy shares in an ETF there is someone who is actively managing the allocation of funds (the same is true for an index mutual fund though it’s less apparent in real-time since the fund is not traded on an exchange). For instance, if the market price of an ETF were to deviate from the intraday indicative value then the market makers would either buy/sell the ETF or buy/sell the underlying securities. So, while there doesn’t appear to be much activity on the surface, the very act of buying an index fund could actually force some active management in the underlying securities markets. In other words, your “passive” investment is the other side of the active management of the market maker or fund administrator.¹

It’s not a coincidence that high frequency trading firms and big banks are making huge gobs of money during the rise of passive indexing. After all, passive indexing means that there is a greater need for those alternative forms of what is nothing more than “active” management. Unfortunately, the studies blasting active management usually include mutual fund managers and not the most active managers of them all – market makers and HFT firms. And make no mistake – these “active” operations are hugely profitable because they are essentially making “passive” portfolios available.²

The kicker here is that index funds really aren’t passive at all. When you look at the underlying components of how the funds are actually managed you realize that there’s a lot of activity in all of this. The fact that most index funds and ETFs are more tax and fee efficient than mutual funds does not mean they are necessarily less “active” though. People misuse the term “passive indexing” on a near daily basis now. And it’s the result of this desire to create a black and white view of the world which is usually nothing more than a marketing pitch (something along the lines of, we’re passive so invest with us because the misleading academic studies show that “active” managers are dopes). The reality, however, is that there is really only active management and its varying degrees. Literally no one replicates a pre-fee and pre-tax index. Not a single investor. And your purchase and maintenance of a “passive” strategy will require a good deal of active upkeep.

The bottom line is, most passive investing means there will be greater demand for active managers in the form of market makers and arbitrageurs. The ease of passive investing is made possible thanks to these active underlying elements. And that’s great because it’s a win win. Indexers get a low fee and easy way to access markets. But they also bear the cost of their laziness (in numerous unseen ways) which is why making markets in index funds is hugely profitable. So, if everyone indexed then that much more active market making would be required. End of story.

¹ – Read this fun paper on how ETFs work.

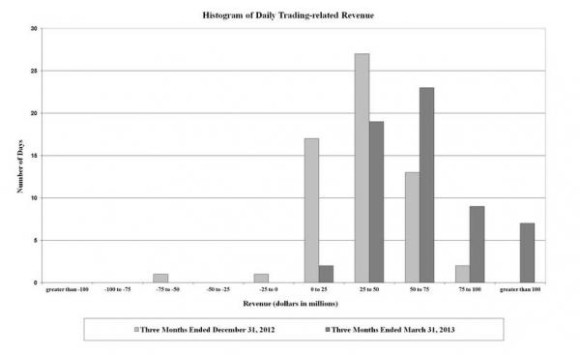

² – Eg, ever wonder how a big bank like Bank of America can be profitable on 100% of its trading days in a quarter? It’s thanks, in part, to passive indexers like me!

“During the three months ended March 31, 2013, positive trading-related revenue was recorded for 100 percent, or 60 trading days, of which 97 percent (58 days) were daily trading gains of over $25 million.”

Related: The Myth of Passive Investing