Share the post "Say America’s Bankrupt One More Time!" I am beginning to get worried that my future on this planet will consist of something roughly like this: TIME magazine is out with a cover piece saying “Make America Solvent Again”. Here’s the cover for your viewing (dis)pleasure: Regulars know I’ve been over this message too many times in the last, oh, almost decade. Fear sells and I have no doubt this magazine will sell well. But it’s also totally wrong. I’ve spent a few minutes in my life understanding the modern monetary system and trying to explain it to people so here’s the typical rant in case you haven’t heard it from me before: 1 – The United States government spends money by taxing people and then financing the excess spending by selling bonds. 2 – There is a risk that the US government might not be able to finance this spending in the case that private bond buyers don’t want to buy those bonds. However, in this case the US government has something the rest of us don’t have – a bank that can literally finance its spending. So, it should be obvious that the US government literally cannot “run out of money” as it has its own bank willing to lend it money in perpetuity. Therefore, the risk of a solvency crisis is just wrong. 3 – More importantly though, the national debt doesn’t get repaid. This is what’s called a fallacy of composition.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

I am beginning to get worried that my future on this planet will consist of something roughly like this:

TIME magazine is out with a cover piece saying “Make America Solvent Again”. Here’s the cover for your viewing (dis)pleasure:

Regulars know I’ve been over this message too many times in the last, oh, almost decade. Fear sells and I have no doubt this magazine will sell well. But it’s also totally wrong. I’ve spent a few minutes in my life understanding the modern monetary system and trying to explain it to people so here’s the typical rant in case you haven’t heard it from me before:

1 – The United States government spends money by taxing people and then financing the excess spending by selling bonds.

2 – There is a risk that the US government might not be able to finance this spending in the case that private bond buyers don’t want to buy those bonds. However, in this case the US government has something the rest of us don’t have – a bank that can literally finance its spending. So, it should be obvious that the US government literally cannot “run out of money” as it has its own bank willing to lend it money in perpetuity. Therefore, the risk of a solvency crisis is just wrong.

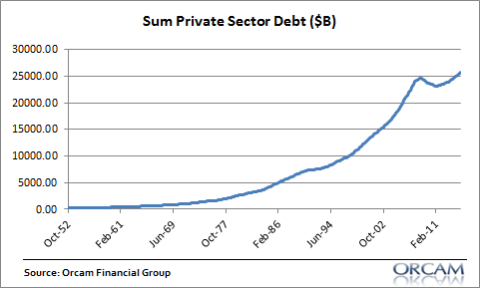

3 – More importantly though, the national debt doesn’t get repaid. This is what’s called a fallacy of composition. For instance, while people individually repay their debt, at the aggregate level the quantity of debt in the private sector and the public sector does not decline over the long-term. In fact, we should expect and actually hope for it to increase as our assets become more valuable relative to our liabilities. There is literally no such thing as repaying the national debt as that would involve the elimination of every good or service presently used to finance public purpose.

4 – The primary problem here is that people don’t look at aggregate balance sheets when they discuss these matters. For instance, the private sector carries a tremendous debt burden:

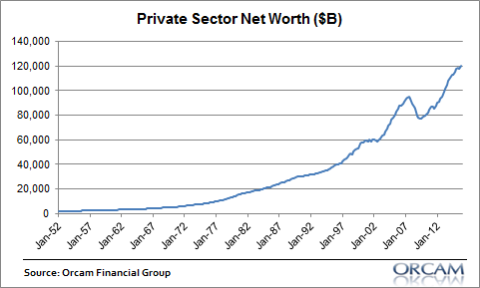

That sure looks scary. But when you look at the whole balance sheet you see that the asset side dwarfs the liability side leading to a massively positive net worth:

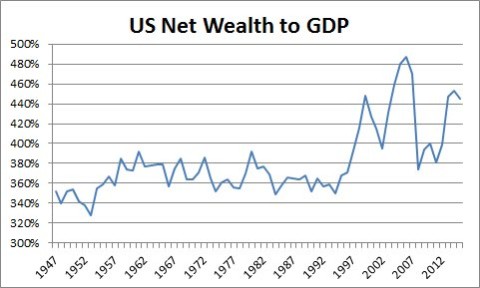

A similar view is net wealth relative to GDP. We hear lots of scary stories about high debt to GDP ratios, but we never hear about the asset side of the balance sheet. And it turns out that net wealth in the USA relative to GDP is very high:

Although the US government doesn’t calculate its assets and balance sheet every quarter like the private sector’s entities do, we do have at least a rough idea of the US government’s balance sheet. In fact, if you calculated just the value of federally owned fossil fuel resources these assets would dwarf the national debt by a margin of 8:1. And that’s not even touching the surface on the trillions in federally owned structures and land. The US government doesn’t have a positive net worth. It is possibly the wealthiest entity on the planet.¹

Of course, none of this means that the USA gets to experience a free lunch. All of this debt issuance could lead to bad outcomes down the road. Although the government won’t experience a standard solvency crisis (as in running out of money) it could spend so much money that it inflates the currency thereby leading to a foreign exchange crisis or an inflation crisis. But that’s a very different type of crisis than a solvency crisis given that the cause of hyperinflations tend to be specifically related to highly unusual exogenous factors.² Further, given the secular economic and technological trends in place I don’t know many people who feel too confidently about their hyperinflation predictions going forward.

So, you can rest easy my friends. Now that you know the US government isn’t bankrupt you don’t have to worry about me busting through your door in a fit of rage over the misguided belief that the USA is on the verge of a solvency crisis. On the other hand, I have no doubt that I will probably be repeating some version of this story until someone kicks down my door and puts me out of my misery.

¹ – See here for more details.

² – See “Hyperinflation – It’s More than Just a Monetary Phenomenon“

Did you have a comment or question about this post, finance, economics or your love life? Feel free to use the discussion forum here to continue the discussion.*

*We take no responsibility for bad relationship advice.