Share the post "Thinking About the Great Normalization" There’s a lot of talk these days about how bad the economy is and how we seem to be in a state of permanently low growth. But it’s amazing what a macro view of the world will do for you because it shows us that a lot of this could just be recency bias at work. While many other people have referred to this period as the “new normal” or “secular stagnation”, I’ve referred to it as the “Great Normalization”. What I mean by this is that growth does indeed appear to be moderating. But it’s moderating back to a more stable and steady rate. In other words, we’d been in a secular boom for 50+ years and what we’re seeing now is a lower, but more stable form of growth. Here’s a couple of visuals on this. First, here’s the growth rate of world output over the last 2,000 years: And here’s a wonderful chart from Matt Busigin (whose work you should be following if you don’t already) showing what I’ve referred to as “higher risk adjusted growth”. Matt shows that the 5 year rolling volatility in growth is at a historical low: I don’t know about you, but I am fine with lower growth if it means a lot more stability. It’s akin to the balanced investment portfolio that grows 5% per year and doesn’t whipsaw you half as much as the higher growth 10% portfolio does.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

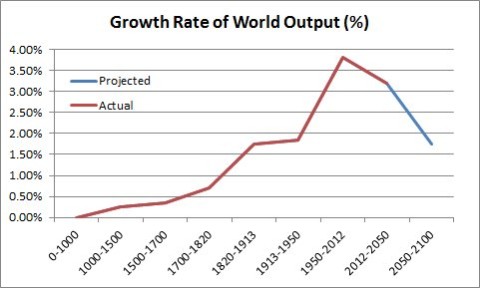

There’s a lot of talk these days about how bad the economy is and how we seem to be in a state of permanently low growth. But it’s amazing what a macro view of the world will do for you because it shows us that a lot of this could just be recency bias at work.

While many other people have referred to this period as the “new normal” or “secular stagnation”, I’ve referred to it as the “Great Normalization”. What I mean by this is that growth does indeed appear to be moderating. But it’s moderating back to a more stable and steady rate. In other words, we’d been in a secular boom for 50+ years and what we’re seeing now is a lower, but more stable form of growth.

Here’s a couple of visuals on this. First, here’s the growth rate of world output over the last 2,000 years:

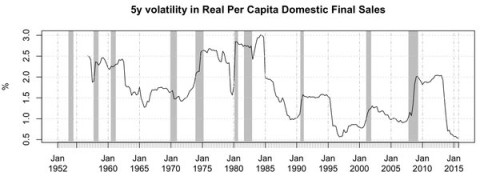

And here’s a wonderful chart from Matt Busigin (whose work you should be following if you don’t already) showing what I’ve referred to as “higher risk adjusted growth”. Matt shows that the 5 year rolling volatility in growth is at a historical low:

I don’t know about you, but I am fine with lower growth if it means a lot more stability. It’s akin to the balanced investment portfolio that grows 5% per year and doesn’t whipsaw you half as much as the higher growth 10% portfolio does. When viewed through this lens we might not necessarily call this growth “better”, but it’s certainly not as bad as some might have us believe.

It’s amazing how a difference in perspective can completely alter your view on something. After all, if the secular stagnationists are right then we’re in the middle of something potentially scary. If, on the other hand, I am right then we’re not really stagnating at all. It’s just that we were booming before. And now we’re experiencing moderating and more stable growth which means that things might not be so bad after all.

Did you have a comment or question about this post, finance, economics or your love life? Feel free to use the discussion forum here to continue the discussion.*

*We take no responsibility for bad relationship advice.