Share the post "China, China, China…." The year of China appears to have started. At least that’s what the headlines would have us all think. I feel like I can’t read anything in the financial news in 2016 without stumbling on how awful the Chinese stock market is. But let’s pan way out here and put things in perspective again because we’ve been through this movie already….just 6 months ago! Three things I am tired of: 1) China 2) China 3) China — Cullen Roche (@cullenroche) January 7, 2016 1) China’s stock market is representative of nothing aside from Chinese market dysfunction. The Chinese stock markets are among the worst performing risk adjusted markets in the world. They always have been. They boom and bust with such regularity that it’s hard to decipher anything from all the price noise. None of this should be surprising given how opaque the Chinese economy is. I am not sure why the media focuses so intently on busts in the Chinese stock market when booms go largely unnoticed. For instance, from the middle of 2014 until the middle of 2015 the Shanghai Composite boomed from 2,000 to over 5,000. While this was happening there was virtually no mention of any economic benefits from this boom.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

The year of China appears to have started. At least that’s what the headlines would have us all think. I feel like I can’t read anything in the financial news in 2016 without stumbling on how awful the Chinese stock market is. But let’s pan way out here and put things in perspective again because we’ve been through this movie already….just 6 months ago!

Three things I am tired of:

1) China

2) China

3) China

— Cullen Roche (@cullenroche) January 7, 2016

1) China’s stock market is representative of nothing aside from Chinese market dysfunction. The Chinese stock markets are among the worst performing risk adjusted markets in the world. They always have been. They boom and bust with such regularity that it’s hard to decipher anything from all the price noise. None of this should be surprising given how opaque the Chinese economy is.

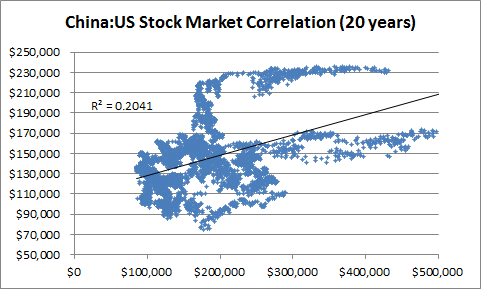

I am not sure why the media focuses so intently on busts in the Chinese stock market when booms go largely unnoticed. For instance, from the middle of 2014 until the middle of 2015 the Shanghai Composite boomed from 2,000 to over 5,000. While this was happening there was virtually no mention of any economic benefits from this boom. But as soon as the Shanghai Composite started to crater the media latched onto the story that China’s stock market decline was somehow a sign of economic fragility….The reality is that China’s stock market has almost no correlation with anything. The Shanghai Composite has no discernible long-term correlation with the S&P 500:

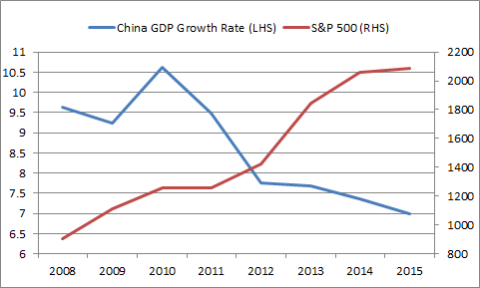

2) The Chinese economy is less impactful than many think. This brings us to another important point. Not only has the slowdown in China been going on for many years, but the Chinese economy appears to have a negative correlation with the S&P 500:

This is due to the fact that China is about 15% of global GDP and the S&P 500 only generates 7% of revenues from the Asia Ex-Japan region of the world. So, China’s slowdown is going to hit some multinationals hard, but on the whole, the Chinese economy isn’t going to sink the US economy or US corporations.

3) Let’s not downplay the impact too much. Okay, China won’t sink the US economy, but its reach extends well beyond the USA. The collapse in commodity prices is consistent with declining global demand and this could cause big problems in certain parts of the world. We’re already seeing the impact in high yield markets and we’re likely to see many high profile bankruptcies in the next 12 months if oil prices remain this low. This will also put extraordinary pressure on many Middle East and Asian governments who rely on oil revenues.

Lastly, the current equity market cycle is consistent with a late cycle market environment. This means the markets are more fragile than they otherwise would be. So this probably isn’t the right time to be excessively optimistic. But I think much of the panic we’re seeing in certain camps is overdone. While China is important, it’s not going to sink the US economic ship.